- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

March 15

March 152018

EUR/USD Drops on US Data, Fed Policy Outlook

EUR/USD dropped for the second day today, basically erasing gains caused by the previous two-day rally. One of the reasons for the drop was good US data. Another one was the fact that traders considered an interest rate hike from the Federal Reserve next week almost guaranteed. NY Empire State Index jumped from 13.1 to 22.5 in March, far above the projected figure of 14.9. (Event A on the chart.) Philadelphia Fed manufacturing […]

Read more March 14

March 142018

EUR/USD Falls After US Data, US Politics Make Future Uncertain

The dollar gained on the euro on Wednesday, but the outlook for the greenback remained uncertain amid political upheaval in the United States. US macroeconomic data released over the trading session was mixed, but traders paid more attention to the good part of it. PPI rose 0.2% in February. That is compared to the predicted increase by 0.1% and the January gain by 0.4%. (Event A on the chart.) Retail sales fell 0.1% in February, the same as the revised January reading […]

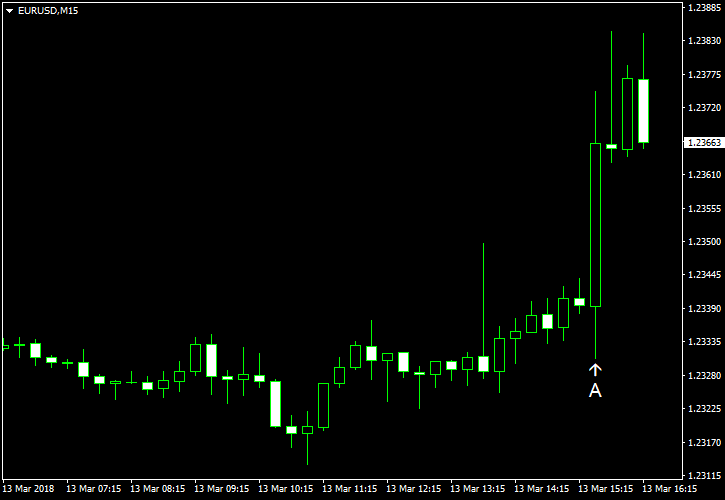

Read more March 13

March 132018

EUR/USD Jumps After CPI Report

EUR/USD traded in a range for the most part of the current trading session but jumped after the release of the US inflation report. While the CPI data was in line with expectations, analysts argued that it did not provide incentive for the Federal Reserve to hike interest rates with faster pace. And that disappointed those dollar bulls who were betting on more aggressive monetary tightening from the Fed. CPI rose 0.2% […]

Read more March 9

March 92018

NFP Causes EUR/USD Confusion and Brief Rally

The US dollar had been strengthening against the euro during today’s trading session right until the monthly employment report was released by the US Bureau of Labor Statistics. A set of mixed data caused the turmoil in the currency market and created a notable spike in the EUR/USD chart. Then, the currency pair switched to a rally, though a short-lived one. Nonfarm payrolls added astonishing 313k jobs in February. Not only it was much better […]

Read more March 7

March 72018

EUR/USD Trading Ignores US Macros

The euro fell against the US dollar somewhat during today’s trading session. Still, the currency pair seemed to be unmoved by the fundamental indicators that have been released in the USA today. Although they were mixed, some of them deviated from the forecast values quite significantly. ADP employment rose by 235k jobs in February following 244k increase in January and well above the median forecast of 200k. (Event A on the chart.) Nonfarm productivity […]

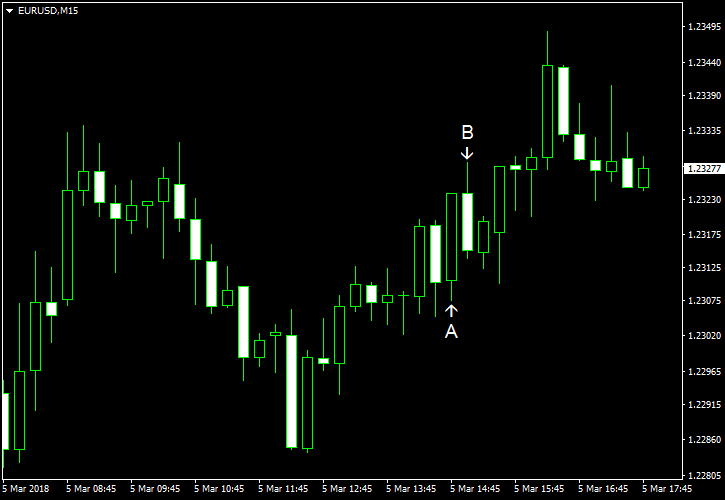

Read more March 5

March 52018

EUR/USD Recovers from Intraday Drop

EUR/USD dropped today but has almost recovered by now as the dollar remained under pressure from concerns about the planned US tariffs on steel and aluminum imports. The recovery paused for a short while following the release of decent reports about the US services sector but resumed fairly quickly. Markit services PMI climbed from 53.3 in January to 55.9 in February according to the final estimate. It was unrevised from the preliminary reading […]

Read more March 1

March 12018

EUR/USD Bounces from Daily Lows After Powell’s Second Testimony

EUR/USD was moving down earlier today but bounced later and is now trading above the opening level. There were plenty of economic releases in the United States during the current trading session, but most of them were either within or better than expectations, with just a couple of missteps. That means the economic data is unlikely to be a source of the rebound. Whether the currency pair bounced sharply due to the disappointment […]

Read more February 28

February 282018

EUR/USD Extends Decline Despite Poor US Data

EUR/USD extended yesterday’s decline as markets welcomed the testimony of the new Federal Reserve chief Jerome Powell. The currency pair fell even as today’s macroeconomic data in the United States was not that hot, though the decline was limited and the pair is trying to rebound right now. US GDP rose by 2.5% in Q4 2017 according to the preliminary (second) estimate, slowing from the growth of 3.2% in Q3. The actual reading was in line […]

Read more February 27

February 272018

EUR/USD Drops After Powell’s Testimony, Positive US Data

EUR/USD dropped today following the testimony of the new Federal Reserve Chairman — Jerome Powell. He signaled that the Federal Reserve will proceed with monetary tightening, though he did not mention more aggressive pace of tightening. As for US economic data, it was mixed. Nevertheless, the currency pair accelerated its decline after the release of positive indicators, namely the consumer confidence and the Richmond Fed manufacturing index. Durable goods […]

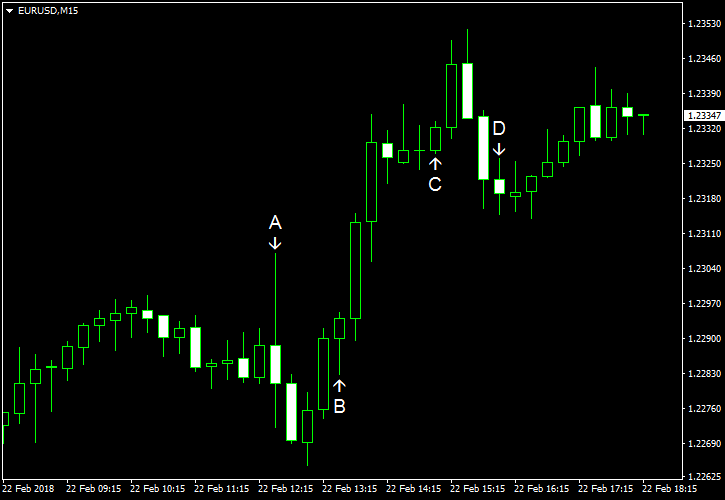

Read more February 22

February 222018

EUR/USD Rises Following Dovish ECB Minutes

EUR/USD bounced today after losing yesterday’s gains by the end of the previous trading session. The currency pair displayed a significant volatility following the release of the European Central Bank policy minutes before deciding to rally. That was a surprising outcome as the ECB minutes showed that the central bank is not in a hurry to normalize accommodative monetary policy, saying that “changes in communication were generally seen to be premature at this juncture, as inflation […]

Read more