- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

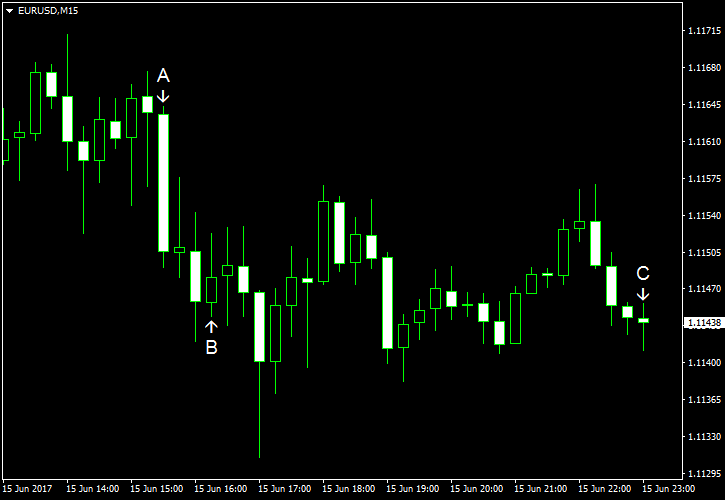

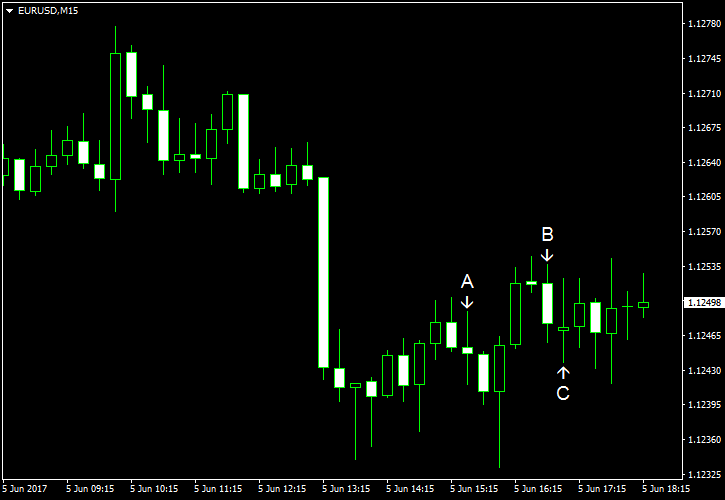

June 15

June 152017

EUR/USD Drops on US Data, Fed Interest Rate Hike

EUR/USD dropped today following yesterday’s interest rate hike from the Federal Reserve. Today’s economic reports released in the United States were mixed, but those that were good were sufficient to drive the dollar higher. Initial jobless claims slipped from 245k to 237k last week. That is compared to the forecast value of 241k. (Event A on the chart.) NY Empire State Index surged from -1.0 to 19.8 in June — […]

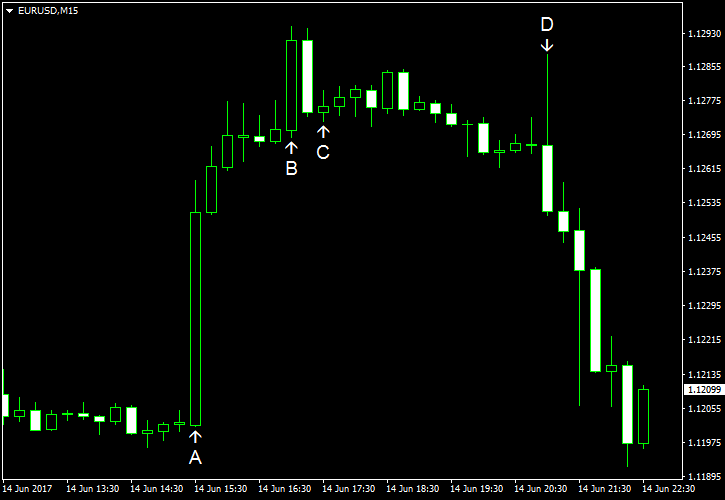

Read more June 14

June 142017

EUR/USD Halts Rally After FOMC Interest Rate Hike

EUR/USD rallied today as data about inflation and retail sales came out unexpectedly bad. The Federal Open Market Committee raised the main interest rate and predicted one more hike in 2017, staying in line with the previous forecasts. Considering that many market participants were expecting FOMC to revise the projected dot path down, the announcement looked very bullish to the dollar. The EUR/USD currency pair halted the rally after the news, […]

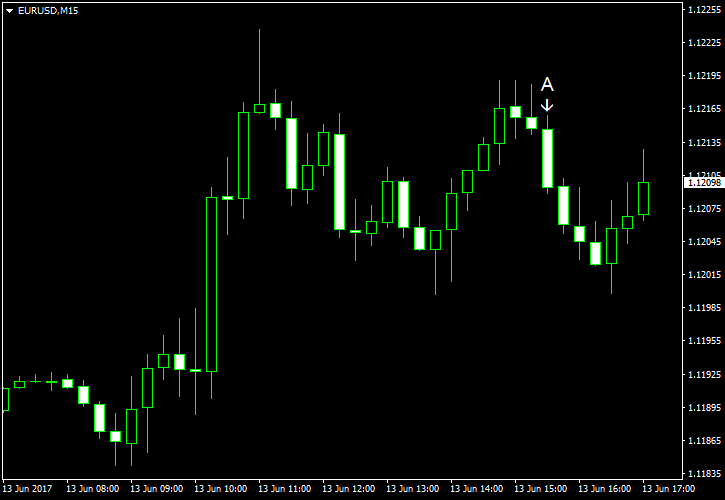

Read more June 13

June 132017

EUR/USD Little Changed Ahead of FOMC Meeting

EUR/USD was little changed today as traders were lying in wait ahead of tomorrow’s policy announcement from the Federal Open Market Committee. The first two trading days of the week were light on economic data. This will change tomorrow as several important reports will be released, including the Consumer Price Index and retail sales data. PPI showed no change in May, exactly as analysts predicted. The index was up […]

Read more June 9

June 92017

EUR/USD Maintains Decline on Friday After Thursday’s Testimony of James Comey

EUR/USD dropped today, extending yesterday’s decline. The currency pair fell on Thursday after the long-awaited testimony of former FBI chief James Comey to the Senate did not bring any significant revelations, causing the US dollar to gain on other currencies. Yesterday’s policy announcement from the European Central Bank also caused a drop of the euro versus the dollar. As for economic data from the United States, the previous and the current trading sessions was very […]

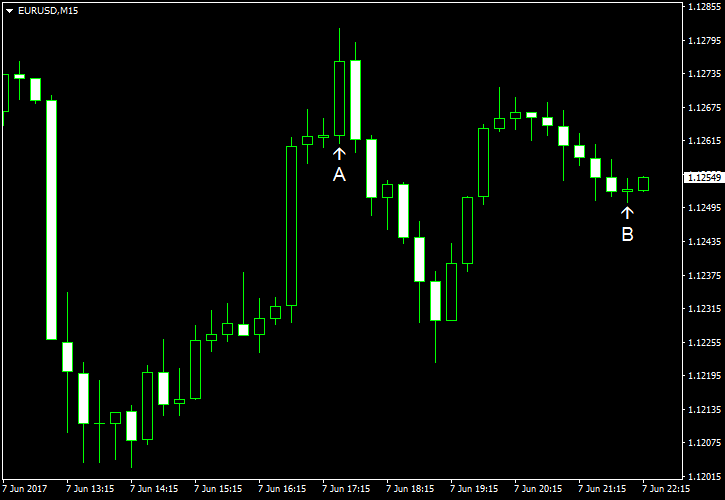

Read more June 7

June 72017

EUR/USD Attempts to Bounce After Drop on ECB Rumor

EUR/USD dropped today due to the rumor that the European Central Bank will lower its inflation forecast at the next policy meeting. The ECB will meet tomorrow, and markets were hoping for a hawkish policy statement after the gathering. Yet if the rumor proves true, the central bank will likely maintain its dovish stance. The currency has bounced by now and is attempting to reverse the decline on the back of the disappointing US consumer credit […]

Read more June 5

June 52017

EUR/USD Drops Even as US Services Sector Fails to Meet Expectations

EUR/USD dropped today even as growth of the US services sector slowed, and other economic indicators were also unimpressive. Traders focus on the policy decision of the European Central Bank scheduled for June 8. No changes to the existing policy are expected, but market participants count on a more hawkish statement from the ECB. Nonfarm productivity showed no change in the first quarter of 2017 while experts had predicted the same 0.6% drop […]

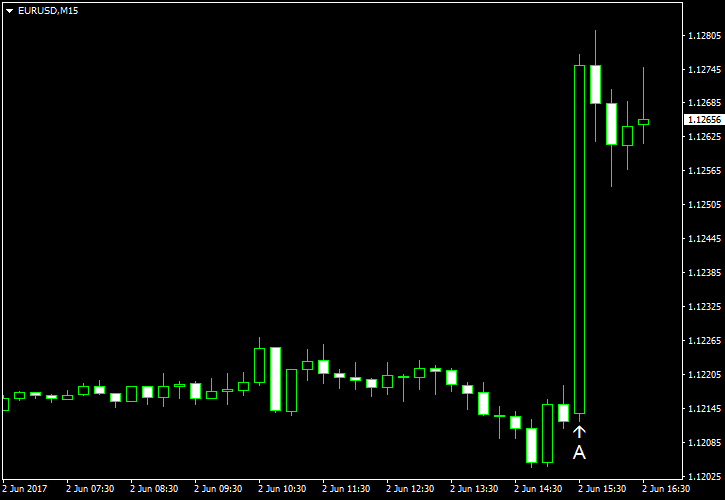

Read more June 2

June 22017

Nonfarm Payrolls Miss Expectations, Reviving EUR/USD

EUR/USD was moving gradually down today but jumped sharply after the release of nonfarm payrolls. Market participants were expecting a robust growth of US employment, but the reality turned out to be rather different. The actual figure was not disastrous, but it was far below expectations. The trade balance report was not good either, adding to the reasons for the dollar to go down versus the euro. Nonfarm payrolls […]

Read more June 1

June 12017

US Employment Shows Strong Growth, EUR/USD Falls

EUR/USD was falling today and the decline accelerated after US employment showed a very robust growth. Other reports from the United States were either neutral (manufacturing) or bad (jobless claims and construction spending), but it looks like markets focused singularly on the employment data. Hawkish comments from John Williams, President of the San Francisco Federal Reserve Bank, were also driving the currency pair down. ADP employment […]

Read more May 31

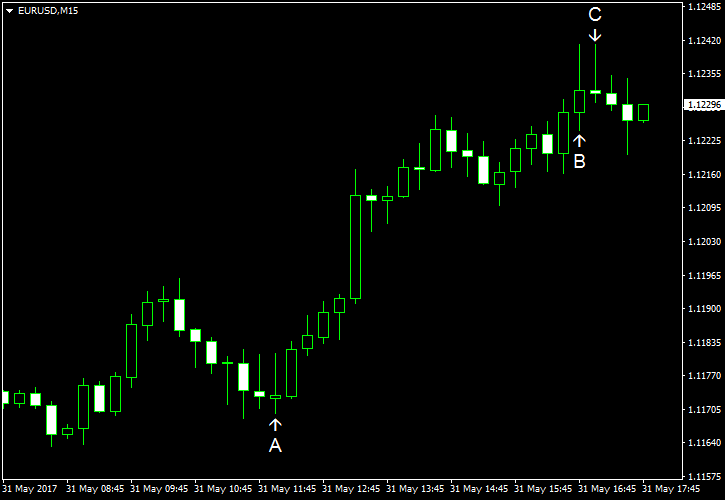

May 312017

EUR/USD Pays No Heed to Slowing Eurozone Inflation

EUR/USD rallied today even though the report released during the trading session showed that eurozone inflation slowed, missing analysts’ expectations. (Event A on the chart.) Experts explained the euro’s good performance by expectations of discussion about stimulus exit at the next week’s policy meeting of the European Central Bank. Additionally, US macroeconomic data released over the current session was disappointing, helping the euro to solidify its gains versus the dollar. Chicago […]

Read more May 30

May 302017

EUR/USD Bounces Off Day’s Lows Despite Unfavorable Data

EUR/USD rebounded today after falling intraday even though eurozone macroeconomic data was less than impressive. US economic reports, on the other hand, were decent, with the exception of the consumer sentiment that worsened unexpectedly. One of the possible reasons for the rally of the currency pair were speculations that the European Central Bank may discuss removal of monetary stimulus at the June policy meeting. Both personal income and spending rose 0.4% […]

Read more