- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

February 7

February 72017

EUR/USD Drops for Another Day, Driven Down by Multiple Factors

EUR/ USD fell today for the second consecutive day, and it was the fourth daily decline in five sessions. There were plenty of reasons for the drop, including yesterday’s dovish remarks from European Central Bank President Mario Draghi, today’s report that showed unexpected contraction of German industrial production (event A on the chart), and political uncertainty associated with this year’s elections in various European countries (France in particular as it may […]

Read more February 3

February 32017

EUR/USD Edged Higher After Wage Inflation Misses Expectations

EUR/USD was swinging widely immediately after the release of nonfarm payrolls but decided to go higher after all. Apparently, markets preferred to pay more attention to lower-than-expected wage growth rather than to solid employment growth that was above expectations. With factory orders and the ISM non-manufacturing indicator also trailing forecasts, the currency pair went even higher. Nonfarm payrolls rose by 227k last week in January. That […]

Read more February 2

February 22017

Dollar Retreats vs. Euro in Day Following FOMC Meeting

The dollar retreated versus the euro today following yesterday’s meeting of the Federal Reserve as markets continued to digest the policy statement from the Fed. Uncertainty associated with Donald Trump also weighed on the greenback as the US President had reportedly heated debate with the Australian Prime Minister, which ended with Trump hanging up the phone, and also criticized Iran for firing a ballistic missile. While increasing geopolitical risks will undoubtedly be […]

Read more February 1

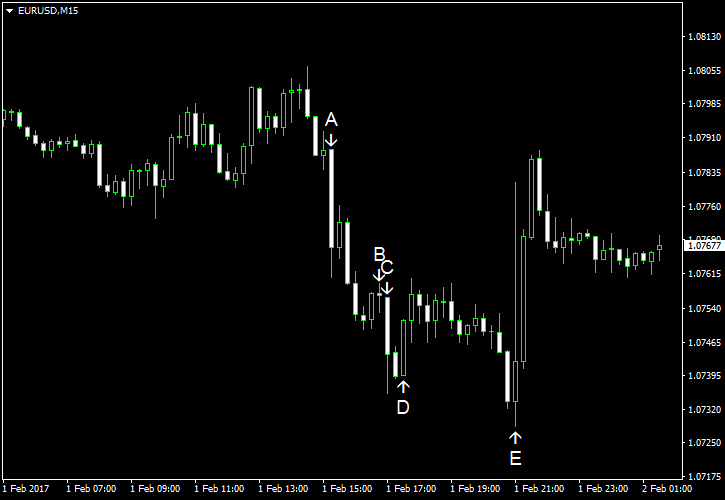

February 12017

USD Rises vs. EUR, Loses Part of Gains After FOMC

The dollar rose versus the euro today as most of US economic indicators were good (with the exception of construction spending), including employment that showed unexpectedly strong growth. The dollar trimmed its gains after the Federal Open Market Committee left its monetary policy without change and issued cautious statement. The March meeting should be more important as it will be accompanied by economic projections and a press conference. ADP […]

Read more January 31

January 312017

EUR/USD Jumps After Remarks About Euro’s Weakness

EUR/USD rallied strongly today after remarks from Peter Navarro, the head of Donald Trumpâs new National Trade Council, who claimed that Germany uses the weakness of the euro as an advantage against its main trading partners. Economic data was beneficial to the currency pair as well. Eurozone inflation beat expectations (event A on the chart), while the US consumer confidence and the Chicago PMI trailed forecasts. S&P/Case-Shiller home price index rose […]

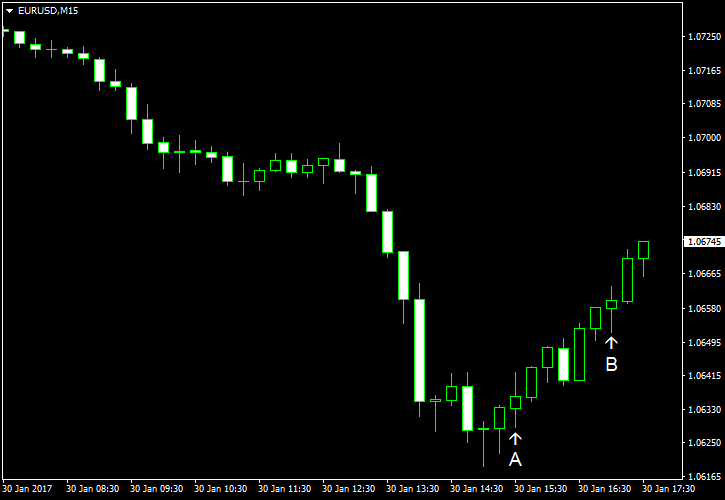

Read more January 30

January 302017

Euro Attempts to Bounce vs. Dollar

The dollar gained on the euro today even though the US currency was generally weak during the current trading session. With that said, EUR/USD is attempting to rebound as of now, and it has already erased about a half of today’s losses. US economic data released today was generally solid, while German inflation missed expectations, causing the decline of the currency pair. Personal income and spending rose in December. Income was […]

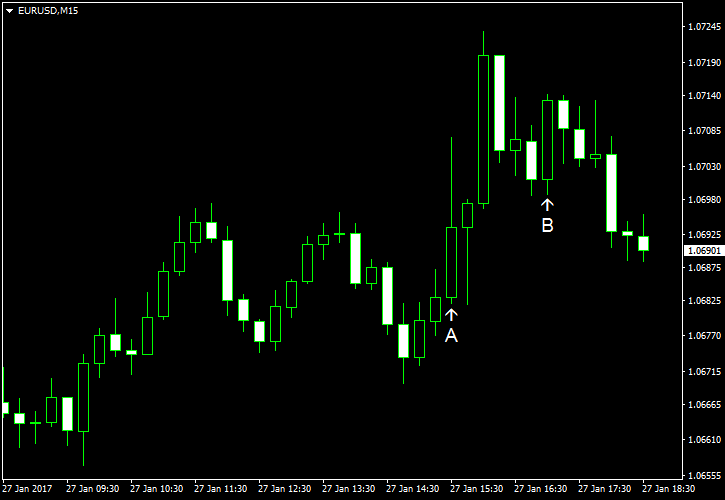

Read more January 27

January 272017

EUR/USD Up After Disappointing Set of Data from USA

EUR/USD rose a little today after US reports about gross domestic product and durable goods orders disappointed traders (at least those who want to be bullish on the dollar). The US currency was attempting to regain its footing, getting help from the better-than-expected consumer sentiment, but still trades below the opening level against the euro by now. US GDP demonstrated growth of 1.9% in Q4 2016 according to the advance report, […]

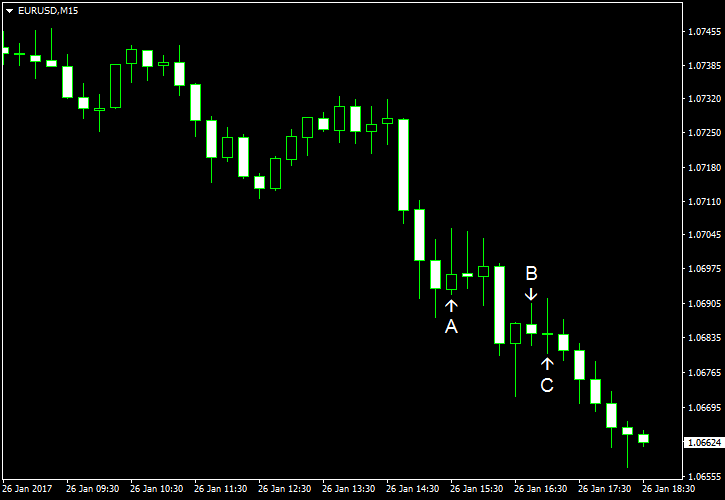

Read more January 26

January 262017

EUR/USD Slides amid Trump Worries

EUR/USD slid today even though economic indicators released from the United States were mixed and traders were cautious about potential policies of the new US President, Donald Trump. Initial jobless claims climbed from 237k to 259k last week, exceeding the analysts’ median forecast of 247k. (Event A on the chart.) Flash Markit services PMI advanced from 53.9 in December to 55.1 in January, above the consensus forecast value of 54.4. […]

Read more January 24

January 242017

EUR/USD Ends Three-Day Rally

The eurozone released a bunch of Purchasing Managers’ Indexes today, which were decent for the most part. Yet that did not prevent EUR/USD from falling on Tuesday, halting the three-day rally. As for US data, manufacturing indicators were very good, while the existing home sales report was disappointing. Markit manufacturing PMI rose from 54.3 in December to 55.1 in January. Analysts had predicted just a small increase to 54.6. (Event […]

Read more January 19

January 192017

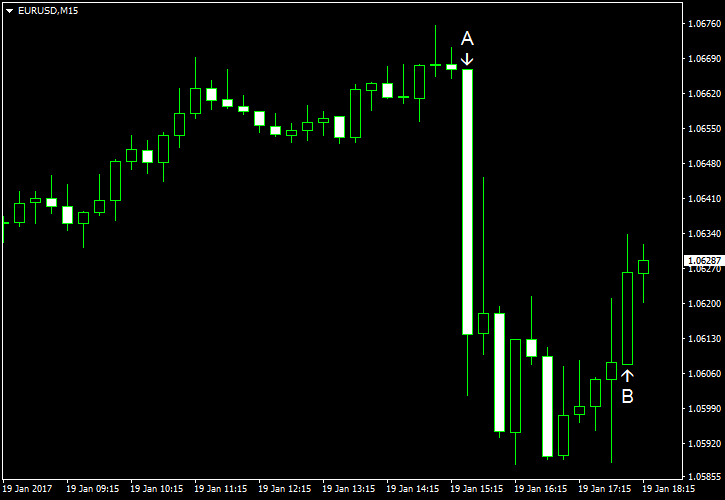

EUR/USD Fails to Rally, Dragged Down by ECB

EUR/USD was trying to rally during the current trading session but slid below the opening level after the European Central Bank policy meeting. The ECB did not announce any change to its extremely loose policy, and ECB President Mario Draghi said that the central bank needs to keep stimulating measures in place and is ready to make policy even more accommodative in case of necessity. (Event A on the chart.) As for economic data […]

Read more