- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

August 4

August 42016

EUR/USD Falls After BoE Meeting, Bounces Later

EUR/USD was falling today and accelerated its decline after the Bank of England had announced a massive stimulus package. (Event A on the chart.) Yet the currency pair has reversed its movement later and is now trading not far from the opening level. Initial jobless claims rose a bit from 266k to 269k last week. Analysts had anticipated them to stay little changed at 265k. (Event B on the chart.) Factory […]

Read more August 3

August 32016

EUR/USD Drops After ADP Report

EUR/USD was moving down today, and extended its decline after rather positive ADP employment data. Now, traders eye Friday’s nonfarm payrolls, which are expected to show about the same growth as in the ADP report. Meanwhile, speculations about future steps of the Federal Reserve continue to dominate the Forex market as speculators are arguing whether the US central bank is ready to resume its monetary tightening. ADP employment […]

Read more August 2

August 22016

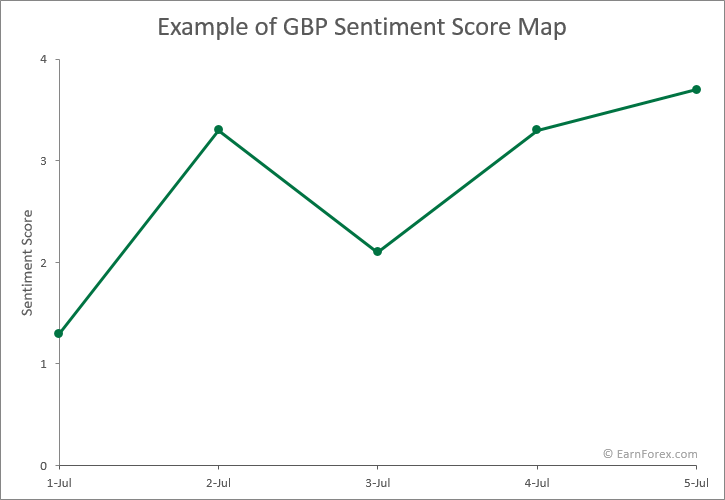

How Good Is Sentiment Analysis in Forex?

As per efficient market hypothesis, it is almost impossible to outperform the market. The reason is that marketâs efficiency ensures that relevant details of an asset are incorporated in the prevailing trading price. It means that, theoretically, there is no possibility of buying and selling an asset low and high respectively. Thus, a trader can outperform the market only through the purchase of riskier assets. However, practically, it is not always […]

Read more August 1

August 12016

EUR/USD Slips, Losses Minimal

While EUR/USD fell a little during Monday’s trading, the drop was very small and not nearly enough to compensate the Friday’s jump due to the poor GDP report. Now, traders are bracing themselves for nonfarm payrolls released on August 5 and potential impact of the employment data on markets. Markit manufacturing PMI was at 52.9 in July, up from 51.3 in the preceding month, according to the revised estimate. The actual reading was the same as the preliminary […]

Read more August 1

August 12016

How Do You Prefer Your MetaTrader Input Parameters?

As an MQL4 and MQL5 developer, I often wonder — what is the best way of presenting the input parameters to control the behavior of the indicators and expert advisors I create? Input parameters are vitally important — Forex traders should easily understand which one does what. If you make input parameters too complex — users will flood you with questions. However, the MetaTrader platform has its own limits for the inputs’ descriptions. Moreover, […]

Read more July 31

July 312016

Forex Brokers Update — July 31st, 2016

Not many changes to report on this week: FIBOGroup opened an office in China. Xtrade is now regulated by Russian NAFD. Direct FX now accepts Australian dollar and euro for deposits. Raised minimum account size to $500, position size — to 0.1 lot. Maximum leverage is now 1:100 instead of 1:400. Trading in binary options and stocks has been added. Alpari increased maximum leverage for pro.ecn.mt4 accounts from 1:100 […]

Read more July 30

July 302016

Weekly Forex Technical Analysis (Aug 1 — Aug 5)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0739 1.0835 1.1005 1.1101 1.1271 1.1367 1.1536 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.0854 1.1041 1.1119 1.1307 1.1385 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more July 29

July 292016

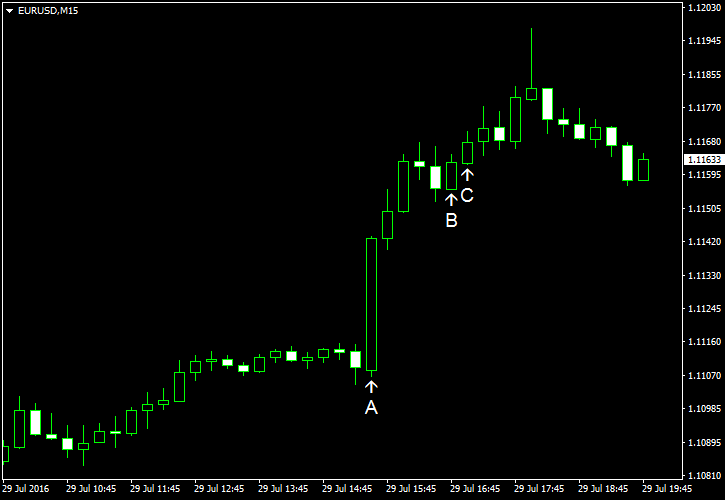

EUR/USD Rallies After Abysmal US GDP Report

EUR/USD surged up following disastrous US GDP data that will probably prevent the Federal Reserve from raising its target funds rate this year. The currency pair pared some of its gains by now, but still trades significantly above opening level. US real gross domestic product increased by mere 1.2% in the second quarter of 2016 according to the advance estimate report. The growth followed 0.8% increase […]

Read more July 27

July 272016

EUR/USD Shaken by FOMC Decision

The euro slid against the US dollar following the Fed’s announcement of its interest rate decision today. Even before the news, EUR/USD has been trading with a bearish bias. After the release, the currency pair plummeted. Durable goods orders fell sharply by 4% in June, following 2.8% decline in May (revised negatively from 2.2% drop). The median forecast was pointing at 1.4% decline. (Event A on the chart.) Pending home sales […]

Read more July 26

July 262016

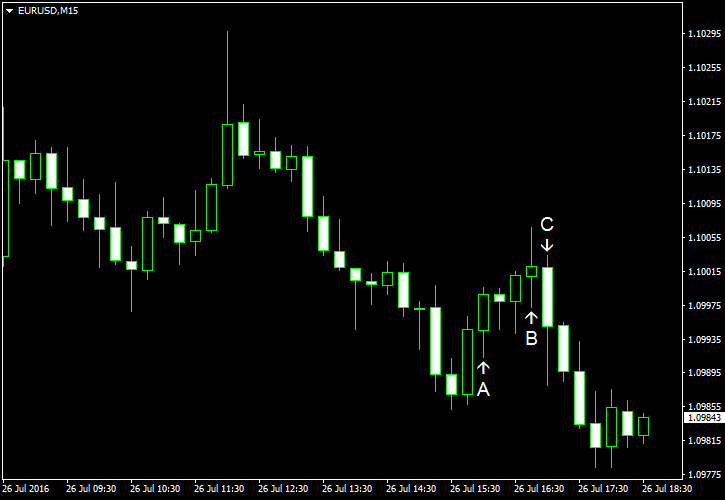

EUR/USD Resumes Decline After Good New Home Sales Data

The EUR/USD currency pair has been falling during the day with some minor technical corrections along the way today. The US dollar continued to rise versus the euro following particularly good figures coming out on the US new home sales. The general trend remains pretty clear in EUR/USD these days. S&P/Case-Shiller home price index for the top 20 US cities rose by 5.2% on a yearly basis in May. The growth followed […]

Read more