- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

June 6

June 62016

What to Expect from FOMC June 2016 Meeting?

Contents 1 Market sentiment 2 Speeches 3 Economic data 4 Nowcasts of GDP 5 Projections 6 Conclusion Following the dovish remarks of the FOMC’s decision to keep interest rates unchanged in March and an even less optimistic statement in April, markets had lowered their expectations for interest rate hikes this year. By mid-May, the outlook has changed significantly. What is influencing the traders’ perception of the interest rates’ future and how […]

Read more June 5

June 52016

Forex Brokers Update — June 5th, 2016

There were only some small updates to the brokers this week: Mayzus added STP-Platinum account type $20,000 minimum. Minimum account size for STP-Mini is now $100 vs. $25 earlier. Maximum Forex leverage for STP-Mini and STP-Classic is now 1:1000. Hadwins discontinued support of its Russian website. Grand Capital added Arabic, Polish, and Indonesian versions of its website. Investors Europe has been delisted as they […]

Read more June 4

June 42016

Weekly Forex Technical Analysis (Jun 6 — Jun 10)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0864 1.0968 1.1167 1.1270 1.1469 1.1573 1.1772 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.0992 1.1215 1.1294 1.1517 1.1597 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more June 3

June 32016

EUR/USD Up 1.6% After NFP Shock Market

EUR/USD surged today after the release of US nonfarm payrolls. The data was not just worse than expected, it was simply awful, showing the smallest employment growth since the late 2010. Most other indicators released during the trading session were not that bad, but they were overshadowed by the abysmal report. As a result of that, the dollar was weak not just against the euro but versus other […]

Read more June 2

June 22016

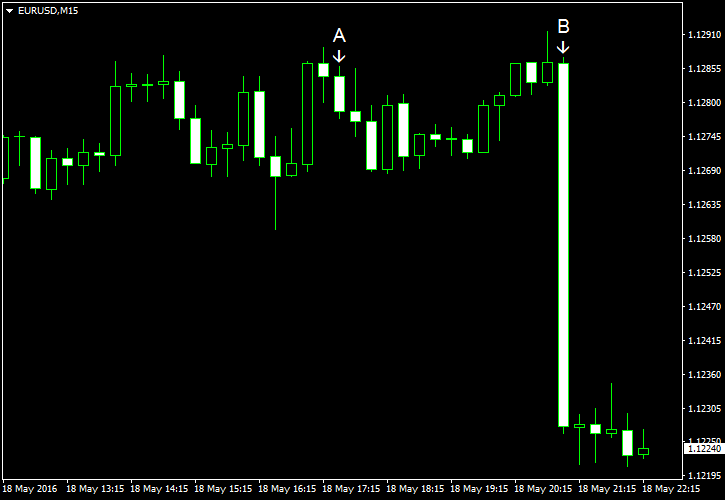

EUR/USD Goes Down After ECB

EUR/USD dropped after the European Central Bank conducted a policy meeting today. ECB President Mario Draghi tried to avoid any shocks, making rather neutral comments. (Event B on the chart.) Yet the outlook for the European economy remained fairly pessimistic, giving incentive for traders to sell the euro. As for US economic data, it was rather solid today, without any big surprises. ADP employment rose by 173k in May, in line […]

Read more June 1

June 12016

EUR/USD Rallies, Struggles to Move Even Higher

EUR/USD was rising today and as of now is struggling to move even higher. US data released over the trading session was mixed, with manufacturing indicators being pretty good while construction spending being far worse than forecasts. Seasonally adjusted Markit manufacturing PMI fell just marginally from 50.8 in April to 50.7 in May according to the final version of the report. Experts had predicted the index to remain at its […]

Read more May 31

May 312016

EUR/USD Falls Sharply to Session Opening

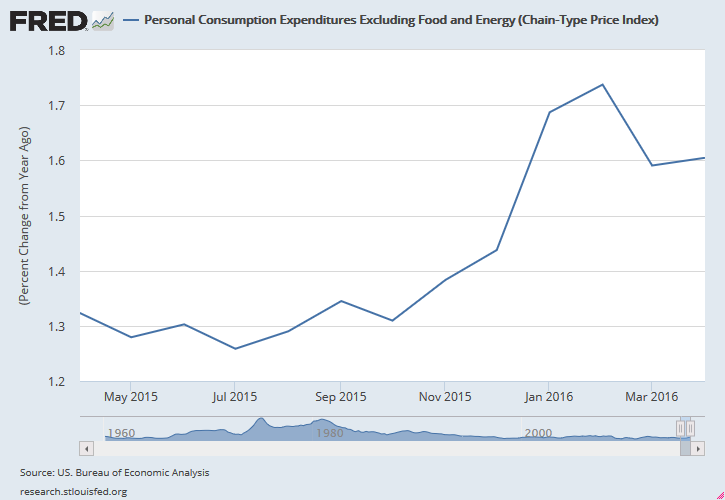

EUR/USD was moving up for the most part of the current trading session but has fallen sharply recently and is trading near the opening level as of now. It is a puzzling behavior considering that the couple of reports released from the United States prior to the drop were disappointing. Personal income and spending rose in April. Income was up 0.4%, the same as in March and matching expectations. Spending increased 1.0%, compared to the forecast of 0.7% […]

Read more May 30

May 302016

Forex Brokers Update — May 30th, 2016

No new companies have been added last week, but quite a few of the listed brokers have been updated: RoboForex and ActivTrades now support MT5 hedging accounts. Forex Club removed the Azerbaijani version of its website. Alpari has lowered the minimum account size for MT5 ECN accounts from $500 to $1 (actually, to zero, but you cannot trade anything with no funds at all.) Axiory added […]

Read more May 29

May 292016

New Calculator — Celebrating EarnForex Blog’s 10th Anniversary

Today is a special day for EarnForex Blog — it turns ten. My first post here was not something readers could use to help them trade better. This time, to celebrate the blog’s 10 years of service, I offer a gift to everyone — a new online calculator: Percentage Gain/Loss and Recovery. It is a small tool that simplifies the calculations of percentage gain and loss values based on the size of your past and current funds. […]

Read more May 18

May 182016

EUR/USD Breaks Down After FOMC Minutes

EUR/USD was moving sideways for two days but started to break down today. The decline intensified sharply after the minutes of the latest Federal Reserve meeting proved to be sufficiently hawkish to revive speculations about an interest rate hike in June. Crude oil inventories rose 1.3 million barrels last week, staying at the historic high level for this time of year. Analysts completely missed with their forecasts of a drop by 3.1 […]

Read more