- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

February 12

February 122015

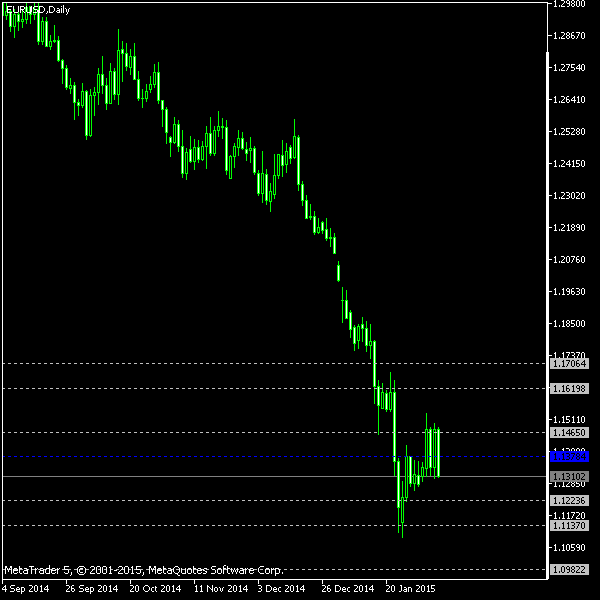

EUR/USD Rises on Back of Dollar Weakness

EUR/USD advanced today, driven by the weakness of the US dollar. The greenback was soft for several reasons, the most important of them being the surge of unemployment claims and the cease-fire agreement between Ukraine and pro-Russian rebels, which made the dollar less attractive in its role of a safe haven. As for news from Europe, they were not particularly good as talks about a new bailout deal for Greece did not bear fruit for now. Retail sales […]

Read more February 8

February 82015

Down-Sloped Double Top on H4 Chart of EUR/USD

On a longer-term chart, this pattern might seem insignificant, but the four-hour chart is clearly showing a double top formation that gives a bearish signal to all TA-minded traders. It peaks the short-term correctional uptrend wave that has lasted since January 26. It is easy to see the additional confirmation for a downward trend restoration in the pair’s failure to set a new higher high after February 3 maximum. You […]

Read more February 8

February 82015

Double Bottom Marks End of USD/CAD Correction

This double bottom pattern is less pronounced than a much similar EUR/USD double top but nevertheless, it terminates as significant correction on the USD/CAD chart and looks valid. Indeed, the formation looks spiky, is rather short, and is quite below the bottom’s resistance line. At the same time, it is symmetrical and demonstrates an important failed lower low. You can see the pattern marked with the yellow lines on the chart […]

Read more February 7

February 72015

Weekly Forex Technical Analysis (Feb 9 — Feb 13)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0982 1.1137 1.1224 1.1378 1.1465 1.1620 1.1706 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.1120 1.1190 1.1361 1.1431 1.1603 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more February 7

February 72015

Forex Brokers Update — February 7th, 2015

Three new brokers have been added to the list of Forex companies on EarnForex.com this week: ExoFX — an FCA-regulted Forex broker with MetaTrader 4 platform, $500 minimum account size, and heavy focus on Forex trading. Leverage can be as high as 1:400; direct market access (DMA) accounts are also available. ExoFX FX Choice — an offshore broker with regulation done by IFSC of Belize. It offers MT4 and MT5 […]

Read more February 6

February 62015

Nonfarm Payrolls Drag EUR/USD Down

Trading was choppy this week as the euro-dollar currency pair was moving one day up and other day down. The Friday’s trading session continued the trend as EUR/USD went down after Thursday’s gains. The reason for the drop was stellar US nonfarm payrolls. Nonfarm payrolls grew by 257k in January, exceeding the consensus analysts’ forecast of 236k. Moreover, the December’s reading was massively revised from 252k to 329k. At the same time, […]

Read more February 5

February 52015

Dollar Falls vs. Euro After Mixed Reports

The dollar rose against the euro during the current trading session initially as the European Central Bank announced that it is not going to accept Greek bonds as collateral anymore. The news sparked speculations that an exit of Greece from the eurozone is not that unlikely. Yet the dollar lost its strength after the initial surge, and mixed economic data from the United States was not helping the US currency either. […]

Read more February 4

February 42015

EUR/USD Moves Lower Even as Employment Growth Slows

EUR/USD went lower during the current trading session even as the ADP employment report was unable to match market expectations. Still, it was accompanied by an upward revision of the previous reading. Moreover, the services sector expanded with accelerating pace, giving an edge to the dollar over the euro. ADP employment growth slipped from the revised 253k in December (241k before the revision) to 213k in January, missing analysts’ estimates that pointed at 224k […]

Read more February 2

February 22015

Dollar Loses Ground to Euro After Disappointing US Data

EUR/USD edged higher during the first trading day of this week as the majority of US macroeconomic reports missed expectations. This led to concerns that nonfarm payrolls released this week will be not as good as analysts predict. Personal income rose 0.3% in December while personal spending fell at the same rate. This is compared to the forecasts of a 0.2% increase and a 0.1% drop respectively. The growth of both income and spending was […]

Read more February 2

February 22015

Other Pegs to Follow Franc’s Example in 2015?

Not many traders believed that the Swiss franc’s peg may end in such an abrupt manner as it really did. It was a huge surprise to the markets, and it has raised some questions about the possibility of other currencies unpegging. Technically, franc’s appreciation cap against the euro was not a peg, but rather a minimum level for EUR/CHF pair, but nevertheless, it was still called peg by many analysts. […]

Read more