- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

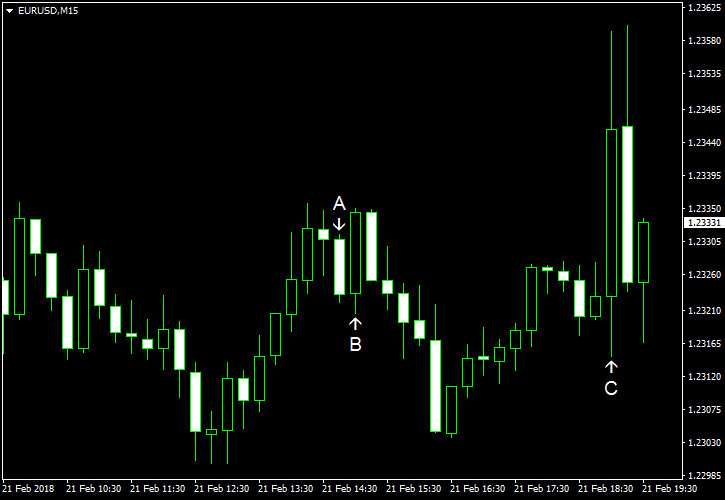

February 21

February 212018

EUR/USD Rebounds Sharply After FOMC Minutes

EUR/USD was moving lower for the most part of the current trading session but jumped sharply following the release of the Federal Open Market Committee policy minutes. That was a bit puzzling, considering that the notes portrayed a favorable picture of the US economy and promised further interest rate increases. Some market analysts speculated that the dollar dropped because the minutes did not promise faster pace of rate hikes. As for other releases […]

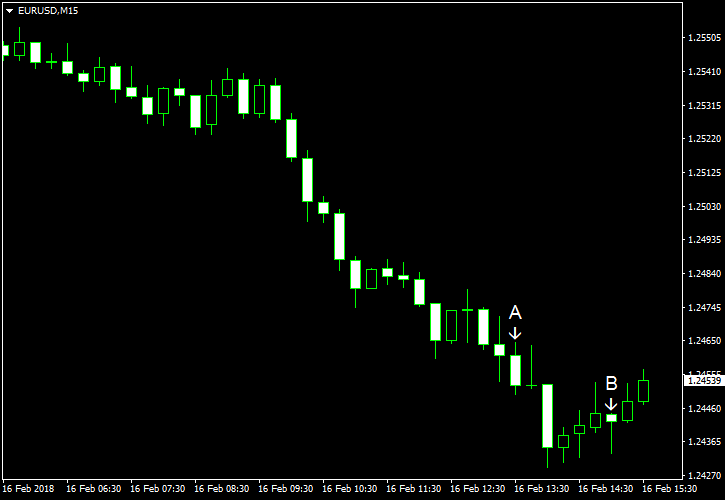

Read more February 16

February 162018

EUR/USD Retreats from Three-Year High

EUR/USD retreated from the highest level in three years. While positive US macroeconomic data released over the Friday’s session added to the downside momentum of the currency pair, most analysts believed that the reason for today’s decline was profit-taking ahead of Monday’s holiday in the United States. That means that the decline is likely to be short-lived. Both housing starts and building permits rose in January. Housing starts were at the seasonally adjusted […]

Read more February 15

February 152018

EUR/USD Extends Rally, Finds No Obstacles from Mixed US Data

EUR/USD extended its rally today after reversing losses caused by the US CPI yesterday. Today’s mixed economic reports in the United States gave the currency pair few reasons to stop its upward movement. PPI rose 0.4% in January, matching expectations, after falling 0.1% in December. (Event A on the chart.) NY Empire State Index fell from 17.7 to 13.1 in February, while experts had promised it to stay unchanged. […]

Read more February 14

February 142018

EUR/USD Drops After US CPI, Reverses Loss Later

EUR/USD crashed after US CPI beat forecasts but quickly reversed losses and is now trading far above the opening level. Retail sales, meanwhile, missed expectations. CPI rose 0.5% in January, accelerating from the growth by 0.1% in December and the beating the median forecast of 0.3%. (Event A on the chart.) Retail sales fell by 0.3% in January, missing the forecast of a 0.2% increase. The December change was revised from an increase by 0.4% to zero […]

Read more February 9

February 92018

EUR/USD Retreats After US Government Reopens

EUR/USD erased its earlier gains today after US politicians approved a deal that allowed the US government to open after a brief shutdown. Thursday and Friday were light on economic data from the United States, therefore it had limited impact on moves of the currency pair. Wholesale sales adjusted for seasonal variations were up 0.4% in December after rising 0.8% in November. Analysts had predicted a smaller increase by 0.2%. […]

Read more February 7

February 72018

EUR/USD Declines Despite German Coalition Deal

EUR/USD declined today even as German Chancellor Angela Merkel managed to secure a deal to form a coalition government. The dollar was extremely strong today even though there not many fundamental reasons for that. US crude oil inventories rose by 1.9 million barrels last week and were in the middle of the average range for this time of year. That is compared to the average forecast of 3.2 million and the previous week’s gain by 6.8 […]

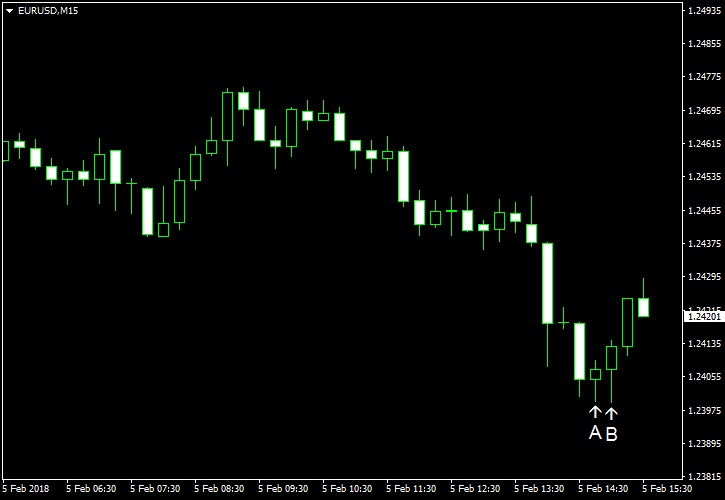

Read more February 5

February 52018

EUR/USD Reverses Earlier Gains, Halts Decline After US Services Sector Data

While EUR/USD was moving up at the start of the current trading session, it halted its rally at 9:15 GMT and started to move down subsequently. The currency pair attempted to rebound following the release of US services sector data, but it had limited success so far. Markit services PMI slid from 53.7 in December to 53.3 in January according to the final estimate. It was unchanged from the preliminary reading and in line […]

Read more February 2

February 22018

EUR/USD Moves Down After NFP Rise Beyond Forecasts

EUR/USD declined today after US nonfarm payrolls rose more than markets participants had been anticipating. Other US economic indicators were good as well. While the currency pair has moved away from the day’s low by now, it is still trading far below the opening level. Nonfarm payrolls increased by 200k in January, exceeding the median forecast of 181k. The December increase was revised from 148k […]

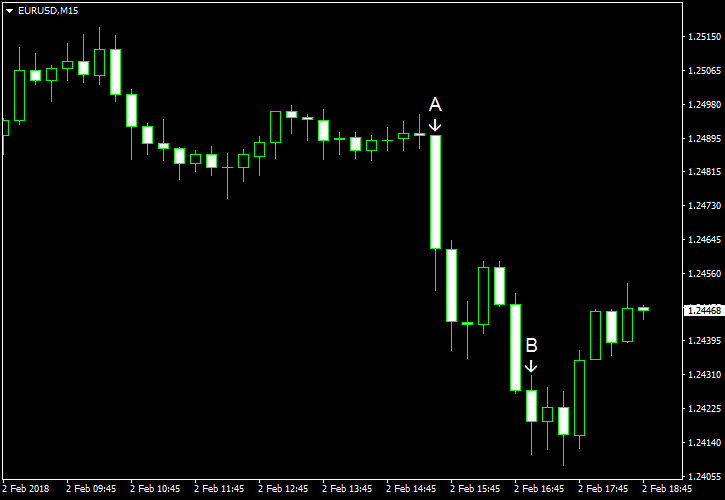

Read more February 1

February 12018

EUR/USD Slides Before FOMC, Remains Almost Flat After Policy Announcement

EUR/USD rallied intraday but retreated ahead of the policy announcement by the Federal Open Market Committee. As was expected, the FOMC did not make any noticeable chances to its policy. Changes to the wording in the statement were minor, though some analysts thought that they made the announcement a bit more hawkish than the previous ones. As for Wednesday’s US economic data, it was generally good. ADP employment rose by 234k in January, […]

Read more February 1

February 12018

EUR/USD Resumes Rally After Pause Caused by FOMC Statement

EUR/USD resumed its rally today after ending the session almost flat yesterday. The dollar bounce caused the FOMC policy statement proved to be short-lived as monetary tightening from the Federal Reserve is already priced in. Meanwhile, speculations that the European Central Bank will join the tightening trend among central banks were helping the euro. As for US data, it was rather good, but that did not […]

Read more