- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

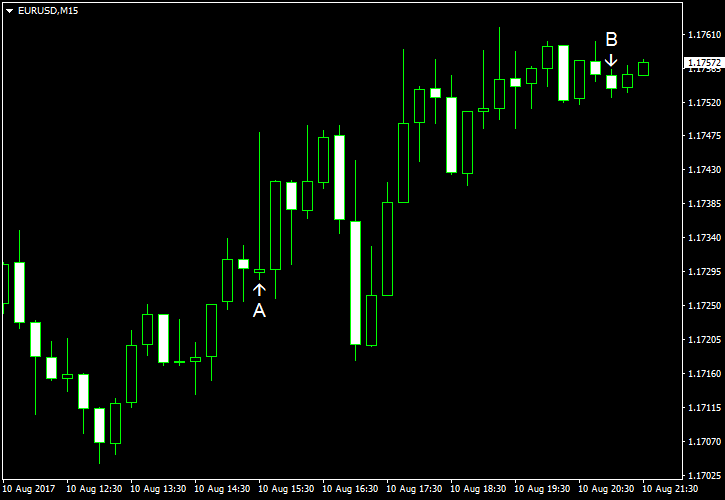

August 10

August 102017

Poor US Fundamentals Drive USD Down, Lower Deficit Does Not Help

The trading was mostly negative for the greenback today. EUR/USD rally continued after worse-than-expected macroeconomic reports have been released in the United States during the most active part of the trading session. Budget deficit data released later during the day did not affect the currency pair much. Initial jobless claims were at 244k last week compared to 241k recorded a week earlier and 240k median forecast. (Event A on the chart.) US […]

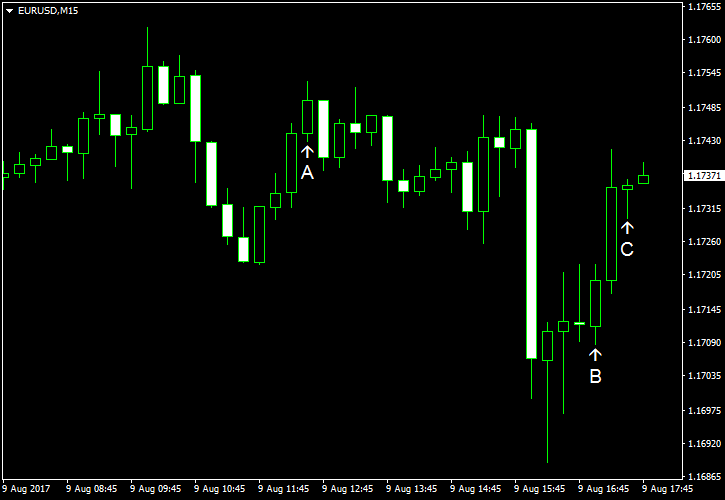

Read more August 9

August 92017

EUR/USD Volatile on Mixed US Data

EUR/USD traded up and down during the current session as the markets have been moved by mixed macroeconomic data. However, currently, the US dollar is trading a bit stronger versus the euro compared to the daily open level. US nonfarm productivity added 0.9% in the second quarter of this year as opposed to 0.1% seen in the first quarter (revised up from no change). Traders expected a 0.7% increase for this indicator. (Event A on the chart.) […]

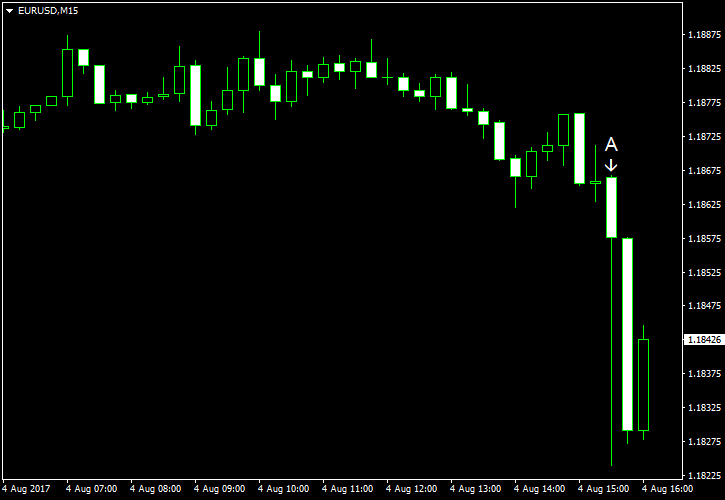

Read more August 4

August 42017

NFP Surprise Positively, EUR/USD Edges Down

EUR/USD was trading sideways ahead of US nonfarm payrolls but slid after the release of the employment report. Employment growth was better than expected, while other indicators looked solid as well, though economists were concerned that wage inflation basically is not moving anywhere. Nonfarm payrolls rose 209k in July, exceeding the median forecast of 182k. Furthermore, the already substantial June increase of 222k was revised […]

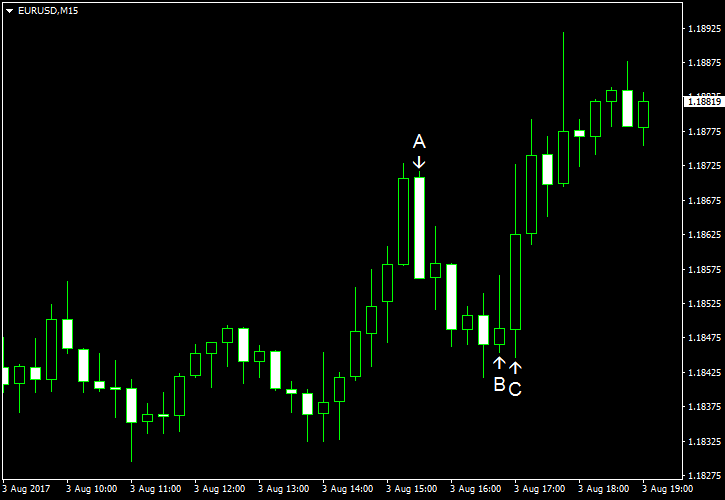

Read more August 3

August 32017

EUR/USD Falls as ISM Services PMI Trails Forecasts

EUR/USD rose today as the report about the US services industry released by the Institute for Supply Management today turned out to be worse than was predicted. Other reports were good, but that did not prevent the currency pair from rallying, though the rally was limited. Initial jobless claims fell from 245k to 240k last week, close to the forecast figure of 242k. (Event A on the chart.) Markit services PMI […]

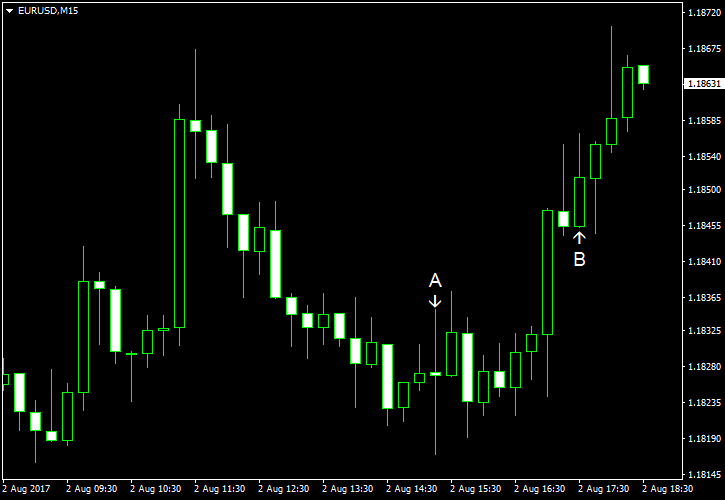

Read more August 2

August 22017

EUR/USD at New Highs as US Employment Misses Expectations

EUR/USD rallied to news highs today as US employment data trailed forecasts, adding to concerns that the economic situation does not warrant additional monetary tightening from the Federal Reserve. The really important piece of data, though, will be Friday’s nonfarm payrolls, which does not always correlate with the private ADP data. ADP employment rose by 178k in July, missing the analysts’ average estimate of 187k. On a positive note, […]

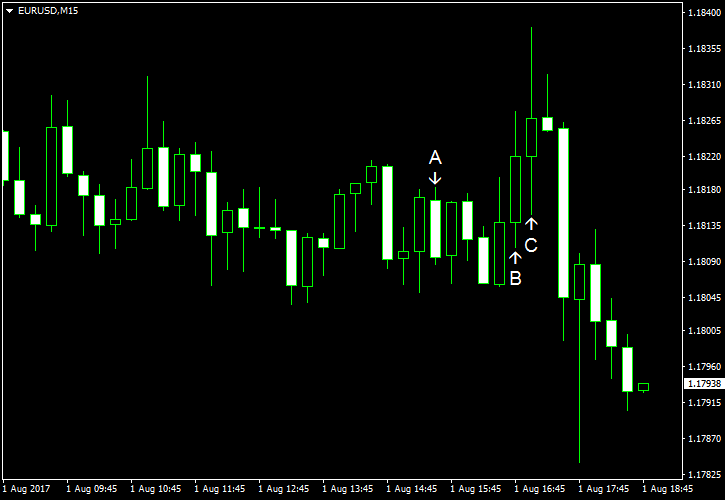

Read more August 1

August 12017

EUR/USD Retreats, Stays Close to Multi-Year Highs

EUR/USD was gradually moving down today and logged a sharp drop just recently. Yet the currency pair remained near the multi-year highs, and so far the decline looks like just consolidation ahead of Friday’s employment data. As for today’s data in the United States, macroeconomic indicators were largely within expectations, construction spending being a notable exception with its unexpected drop. Personal income was unchanged in June, meaning that […]

Read more July 31

July 312017

EUR/USD Rallies to New High

EUR/USD rallied to a new high today, reaching the strongest level since January 2015. Basically all economic reports released in the eurozone during the current trading session were good, reinforcing the view that the European Central Bank will be more hawkish going forward. Meanwhile, data released in the United States was mixed, adding to doubts that the Federal Reserve will continue aggressive monetary tightening. Chicago PMI dropped […]

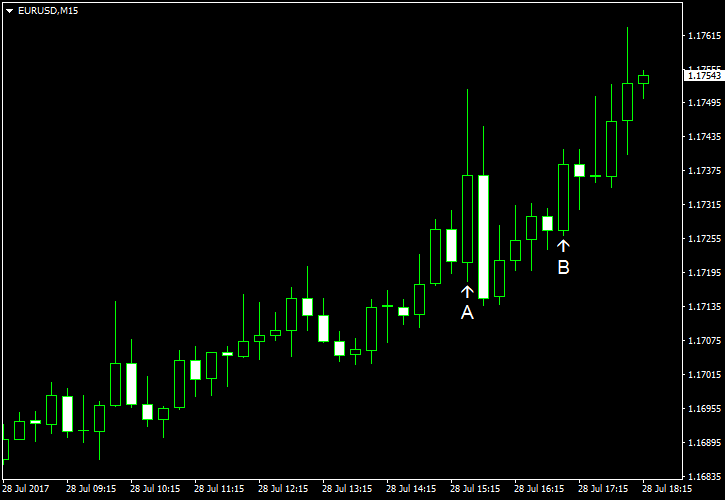

Read more July 28

July 282017

EUR/USD Attempts to Resume Rally

EUR/USD rose today, attempting to resume its rally after yesterday’s drop. While today’s US GDP report looked good, some inflation readings were disappointing. And that is coming after just recently the Federal Reserve voiced concern about sluggish inflation. Additionally, another failure to repeal Obamacare added to worries about political turmoil in the United States. Meanwhile, eurozone economic data was good, helping the euro […]

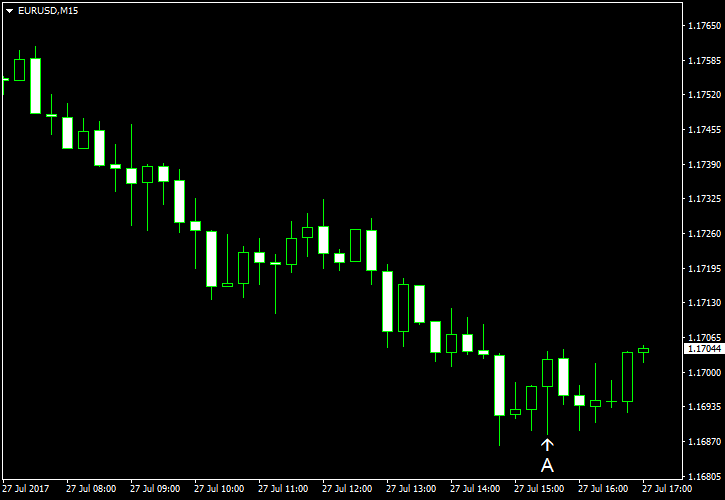

Read more July 27

July 272017

EUR/USD Backs Off from Multi-Year High

EUR/USD retreated today following yesterday’s rally but not before reaching the highest level since January 2015. Now, traders wait for US gross domestic product due to release tomorrow. The big increase of durable goods orders reported today gave hope to dollar bulls that GDP may be better than forecasts promised. Initial jobless claims rose from 234k to 244k last week. The average forecast […]

Read more July 26

July 262017

EUR/USD Jumps to Highest Since 2015 After FOMC

EUR/USD rallied today, jumping to the highest level since January 2015, after the Federal Open Market Committee concluded its two-day meeting. The Committee did not deliver any big surprise, and market participants felt that the policy statement was not hawkish enough for the dollar to reverse its bearish momentum. New home sales were at the seasonally adjusted annual rate of 610k in June, below the median forecast of 615k. The May […]

Read more