- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

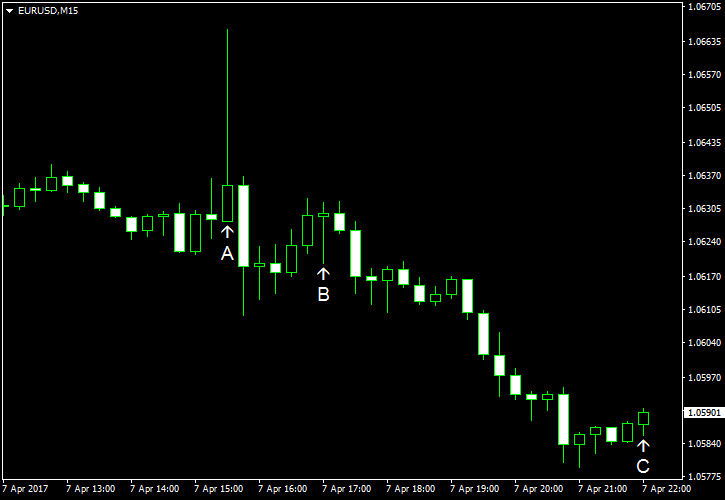

April 7

April 72017

EUR/USD Fails to Keep Gains Despite Sluggish US Employment Growth

US employment demonstrated very underwhelming growth last month. EUR/USD rallied as a result, though surprisingly, the rally was very short-lived. The sluggish employment growth was a nasty surprise considering that the private ADP report released on Wednesday painted a very different picture, showing solid expansion of the labor market. Nonfarm payrolls grew by just 98k in March, a far cry from 174k promised by forecasters. What is more, the February […]

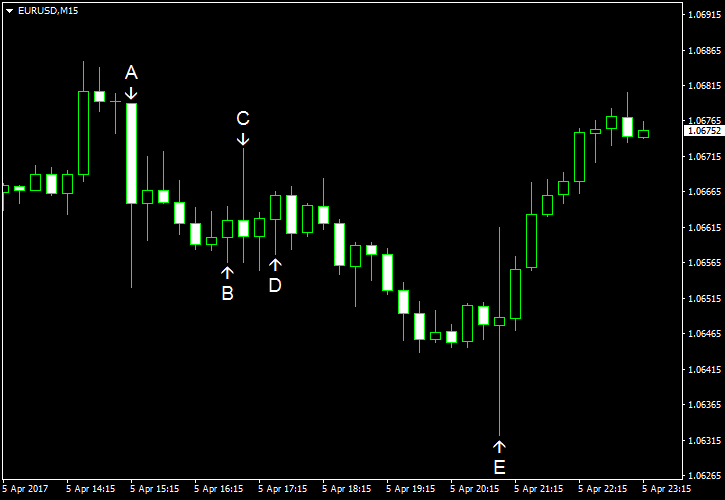

Read more April 5

April 52017

EUR/USD Bounces After FOMC Releases Minutes of Policy Meeting

EUR/USD was falling during the Wednesday’s trading session but halted its decline after the Federal Open Market Committee released minutes of its latest policy meeting. The currency pair swung back and forth wildly immediately after the release but decided to go up in the end. As for other news from the United States, the employment market looked strong while the service sector disappointed. ADP employment grew by 263k on March, much […]

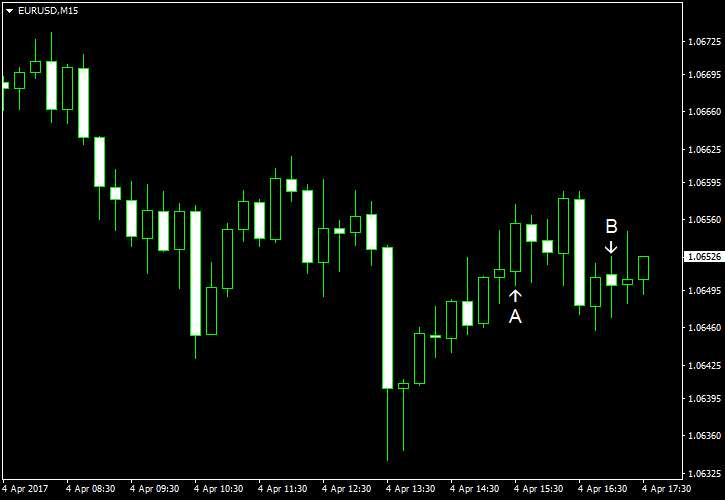

Read more April 4

April 42017

EUR/USD Drops After US Trade Balance & Factory Orders Reports

EUR/USD declined today, falling for the fifth day in six. US macroeconomic reports released during the current session were positive as the trade deficit shrank more than expected while factory orders demonstrated solid growth. The drop was limited, though, as traders were cautious ahead of the meeting between US President Donald Trump and Chinese President Xi Jinping. US trade deficit logged a deficit of $43.6 billion in February, down […]

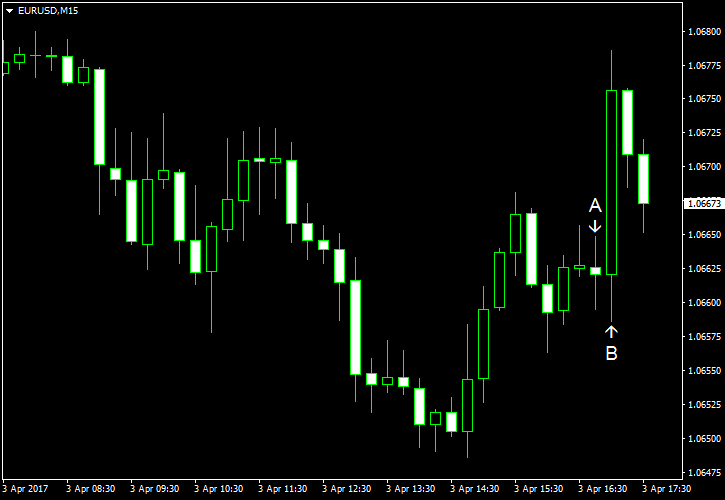

Read more April 3

April 32017

EUR/USD Flat on Monday

EUR/USD was almost flat on Monday even as ECB chief economist Peter Praet signaled in an interview that additional monetary accommodation is unlikely. On top of that, growth of US manufacturing sector slowed last month, but even that did not boost the currency pair considerably. The possible reason for that is concern among investors about the economic and political situation in Europe. Markit manufacturing PMI fell from 54.2 […]

Read more March 31

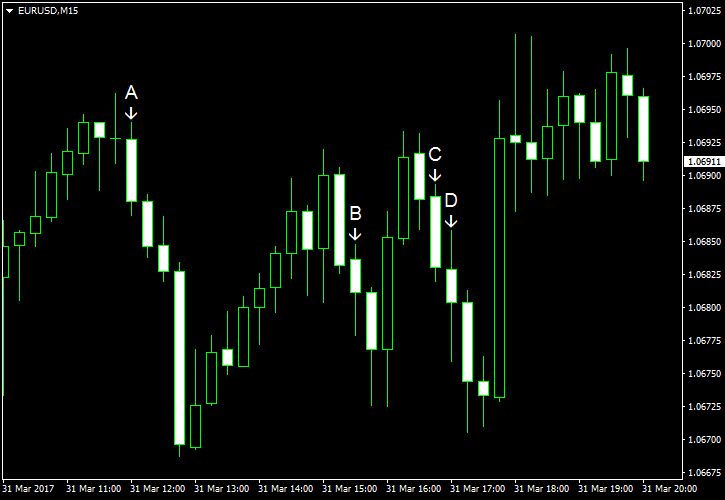

March 312017

EUR/USD Halts Decline Even as Eurozone Inflation Disappoints

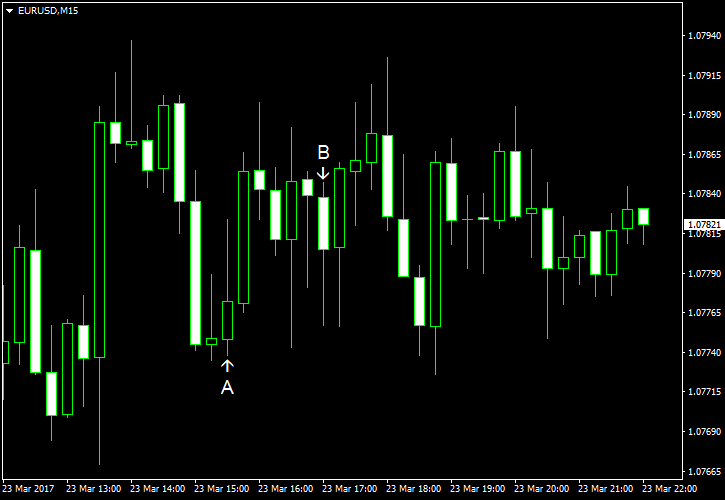

EUR/USD halted its decline today, rising a bit, even though eurozone inflation slowed sharply this month. (Event A on the chart.) The possible reason for the relatively weak performance of the dollar were relatively dovish remarks from Federal Reserve’s voting member William Dudley who said that “thereâs not this huge rush that we have to tighten monetary policy quickly.” Still, the gain of EUR/USD was not big, […]

Read more March 30

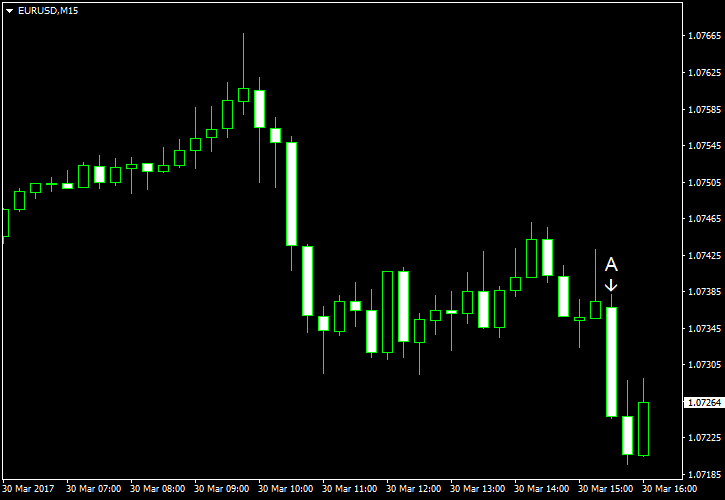

March 302017

EUR/USD Drops After USD GDP & German CPI Reports

EUR/USD dropped today following the release of economic reports from the eurozone and the United States. German inflation slowed this month, missing expectations, according to the preliminary report. Meanwhile, growth of US gross domestic product in the fourth quarter of last year was revised higher in the final estimate. Additionally, the European Central Bank signaled that markets misinterpreted its message in the latest policy statement and expectations of monetary tightening were erroneous. US […]

Read more March 29

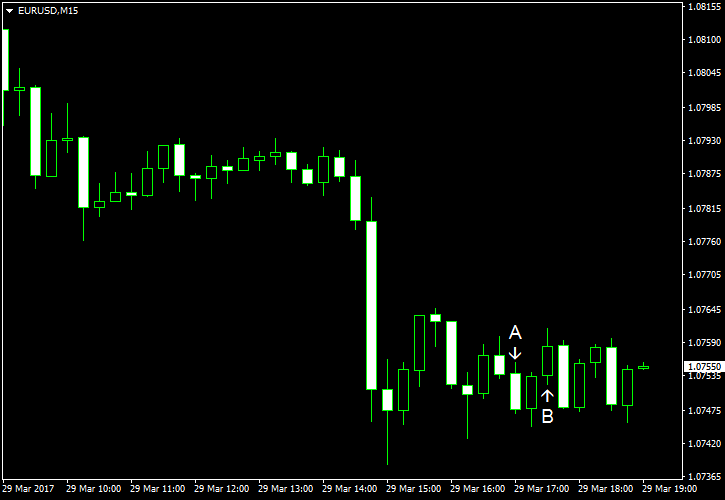

March 292017

EUR/USD Moves Lower as US Pending Home Sales Jump

EUR/USD extended its drop for a second day today as the US economy continued to show signs of robust growth. This time it was a housing market that helped the dollar, showing an unexpectedly big jump of pending home sales. Pending home sales jumped 5.5% in February from January, demonstrating an increase that was more than two times bigger than the forecast growth of 2.3%. The sales were down 2.8% […]

Read more March 28

March 282017

EUR/USD Drops After Huge Leap of US Consumer Confidence

EUR/USD dropped today following the release of a bunch of positive macroeconomic reports from the United States. Of special note was the consumer confidence that demonstrated a huge leap this month. The drop was not big, though, and at present does not look anything more than a correction in a rally that the currency pair has started at the beginning of March. S&P/Case-Shiller home price index rose 5.7% in January, year-over-year, matching forecasts exactly. […]

Read more March 24

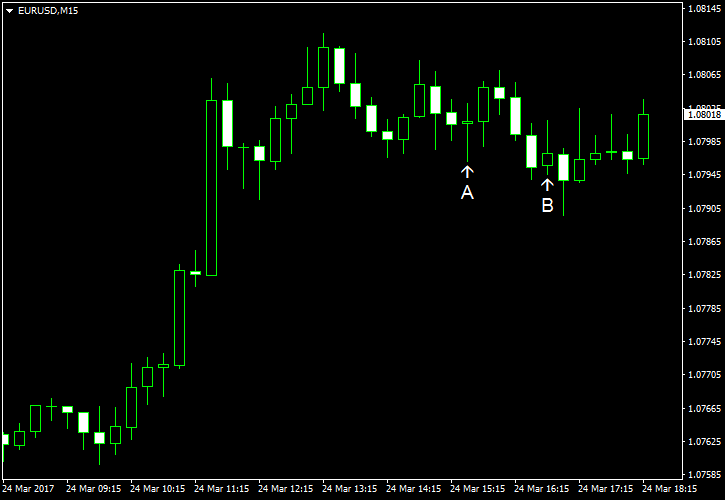

March 242017

EUR/USD Climbs After Release of PMIs from Eurozone

EUR/USD was falling today but bounced after Markit released a bunch of PMI reports for eurozone, all of which exceeded expectations. Meanwhile, PMIs for the United States were disappointing, hurting the US dollar. The greenback was also under pressure because traders were cautious, waiting for the vote on Donald Trump’s healthcare bill. The vote is considered to be a test of Trump’s ability to pass important legislation. Durable goods orders rose […]

Read more March 23

March 232017

EUR/USD Little Changed During Thursday’s Trading

EUR/USD was little changed during Thursday’s trading session as economic data from the United States was mixed and markets were waiting for the vote on the Trumpcare. Initial jobless claims were at the seasonally adjusted level of 258k last week, an increase from the previous week’s revised level of 243k. It was a surprise as market participants were counting on a small drop to 240k. (Event A on the chart.) New home sales were at the seasonally adjusted […]

Read more