- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

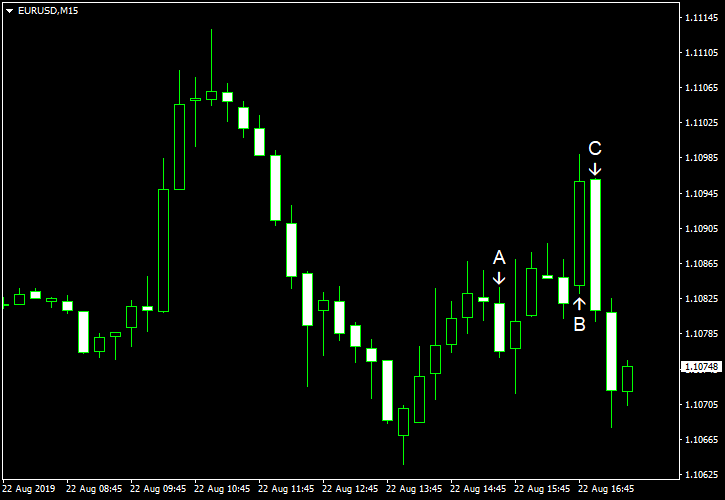

August 22

August 222019

EUR/USD Remains Volatile After Eurozone PMIs, ECB Meeting Minutes

EUR/USD remained volatile today. The currency pair rallied sharply on positive eurozone PMI figures but retreated afterward. The pair attempted to rally once again after the European Central Bank released minutes of its latest monetary policy minutes. But EUR/USD failed to maintain rally once again and is now trading below the opening level. Initial jobless claims were at the seasonally adjusted level of 209k last week, down […]

Read more August 21

August 212019

EUR/USD Volatile After FOMC Minutes, Decides to Go Lower

As to be expected, EUR/USD was volatile immediately after the Federal Open Market Committee released minutes of its latest monetary policy meeting. The currency pair rallied after the release but quickly backed off and is now trading firmly below the opening level. Ultimately, the notes did not provide much new information, and now traders wait for the speech of Fed Chairman Jerome Powell at the Jackson Hole Symposium later this […]

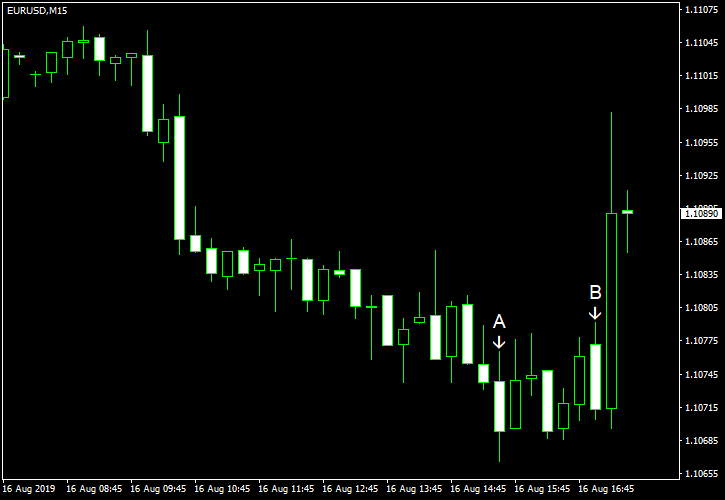

Read more August 16

August 162019

EUR/USD Continues to Decline German Yields Fall

EUR/USD continued to decline today. German 10-year yield fell to a new low of -0.725% today amid signs that the European Central Bank is planning to ease its monetary policy further. Market analysts speculated that it was the main reason for the euro’s weakness. Housing starts were at the seasonally adjusted annual rate of 1.19 million in July, down from 1.24 million in June, versus the median forecast of 1.26 million. […]

Read more August 15

August 152019

EUR/USD Drops After US Retail Sales Beat Expectations

EUR/USD fell on Thursday, declining for the third day in a row. The reason today’s decline were US retail sales that beat expectations. Philadelphia Fed manufacturing index fell from 21.8 in July to 16.8 in June. Still, it was above the consensus forecast of 10.1. (Event A on the chart.) Retail sales climbed by 0.7% in July. Ahead of the report, analysts had predicted the increase to be the same as in June — 0.3%. (Event A on the chart.) NY Empire […]

Read more August 14

August 142019

EUR/USD Declines as USA Postpones Tariffs on Chinese Goods

EUR/USD declined for the second day today after Washington announced yesterday that it will delay implementation on new tariffs on Chinese goods till December. It will be done to relieve pressure on consumers during the Christmas season. US macroeconomic data was decent enough to provide an additional boost to the dollar. Both import and export prices rose 0.2% in July after falling in June. Analysts did not expect any […]

Read more August 12

August 122019

EUR/USD Starts Week with Gains

EUR/USD started the week with gains. Monday’s session was quiet, without major events, and markets were driven largely by persisting concerns about the US-China trade conflict. Treasury budget widened to $119.7 billion in July from $8.5 billion in June, matching forecasts. (Event A on the chart.) On Friday, a report on PPI was released, showing an increase of 0.2% in July, matching market expectations. The index rose 0.1% the month before. (Not shown […]

Read more August 8

August 82019

EUR/USD Declines After Attempting to Rally

EUR/USD attempted to rally but failed and is now trading below the opening level. There were just a couple of reports released in the United States today, none of which were particularly important, therefore US data was not the reason for the volatile moves of the currency pair. Initial jobless claims fell to the seasonally adjusted level of 209k last week from the previous week’s revised level of 217k. Analysts had expected a much […]

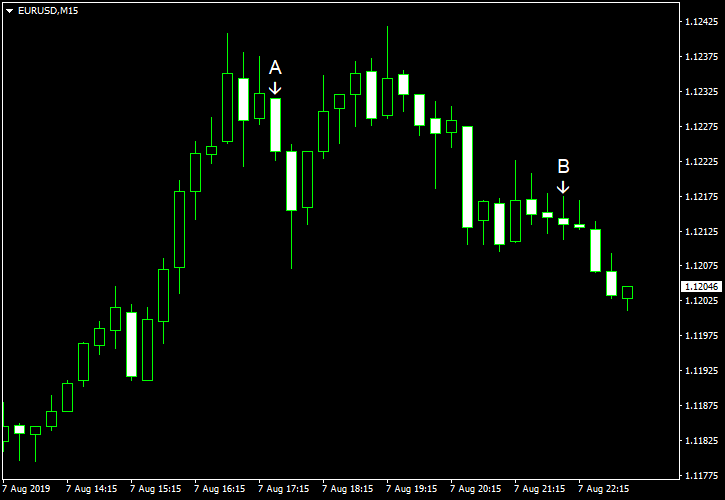

Read more August 7

August 72019

EUR/USD Continues to Get Support from US-China Conflict

EUR/USD rose today as traders were not keen on buying the dollar amid escalating US-China trade tensions. The currency pair has almost lost its gains by now, though. US crude oil inventories increased by 2.4 million barrels last week and were above the five-year average for this time of year. That is instead of falling by 2.9 million barrels as experts had predicted. The stockpiles dropped by 8.5 million barrels […]

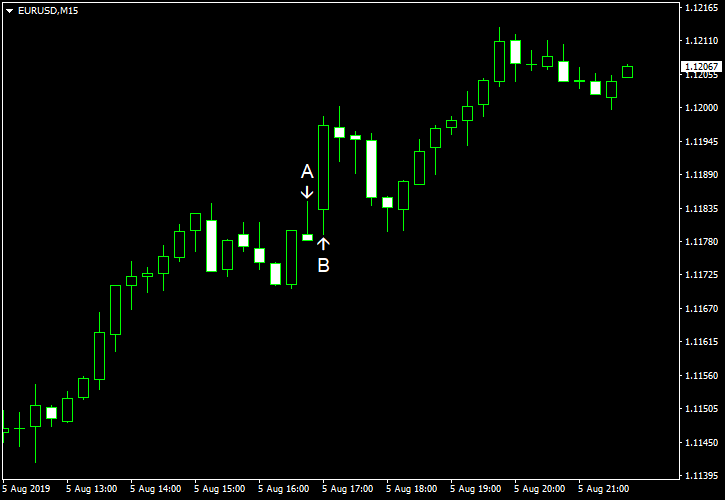

Read more August 5

August 52019

EUR/USD Rallies amid Escalating US-China Trade Tensions

EUR/USD surged today despite risk aversion on the Forex market. Market analysts speculated that the escalating trade tensions between the United States and China, which were causing the risk aversion, was actually the reason for the surge of the currency pair as prospects for a trade war were hurting the greenback. The outlook for another interest rate cut from the Federal Reserve in September was also hurting the US currency. Markit services PMI climbed to 53.0 […]

Read more August 2

August 22019

EUR/USD Rallies After NFP Match Expectations

EUR/USD rallied today after US nonfarm payrolls matched expectations. Market analysts speculated that it is because the slowing employment growth and escalating US-China trade conflict led to speculations that the Federal Reserve will have to cut interest rates again in September. Nonfarm payrolls rose by 164k in July, matching forecasts exactly. June’s increase got a negative revision from 224k to 193k. Unemployment rate remained unchanged […]

Read more