- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

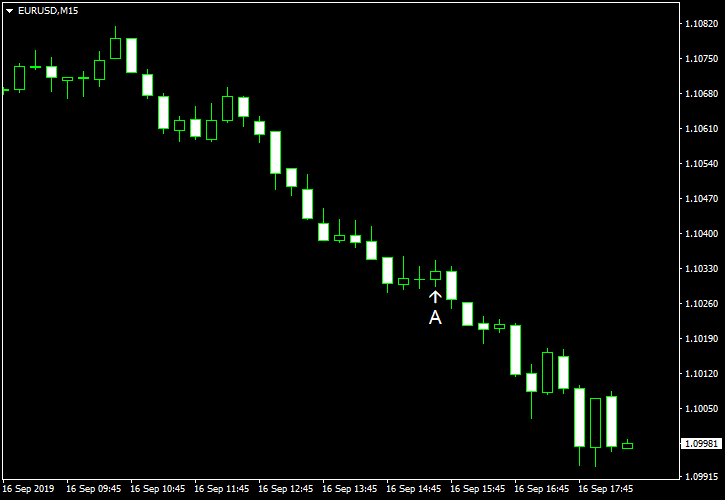

September 16

September 162019

EUR/USD Starts Week with Big Slump

EUR/USD started the week extremely soft, demonstrating a big drop on Monday. Market analysts speculated that the reason for the decline were dovish comments from European Central Bank officials, which suggested the central bank will maintain or even expand its monetary stimulus. Additionally, speculators trimmed bets on interest rate cuts from the Federal Reserve, though they generally still anticipate a cut this week. NY Empire State […]

Read more September 12

September 122019

EUR/USD Volatile After ECB, Decides to Go Higher

EUR/USD was extremely volatile after the monetary policy announcement of the European Central Bank. The currency pair sank initially following the event but quickly bounced, ultimately trading above the opening level. As was widely expected, the ECB cut interest rates and reintroduced quantitative easing. But the size of both the interest rate cut and the asset purchase program was smaller than dovish forecasts were predicting. (Event A on the chart.) CPI rose […]

Read more September 11

September 112019

EUR/USD Declines as Markets Wait for ECB

EUR/USD declined on Wednesday. Market analysts speculated that the decline was a result of anticipation of monetary stimulus from the European Central Bank, which it is expected to announce on Thursday. US macroeconomic data released over the trading session was decent enough to give the dollar additional boost against the euro. PPI rose by 0.1% in August. That is compared with a consensus forecast of no change and an increase of 0.2% registered in the previous […]

Read more September 6

September 62019

EUR/USD Rallies on NFP Miss, Rally Capped by Wage Inflation

EUR/USD rose today after nonfarm payrolls missed expectations and were nowhere near the robust employment growth showed by yesterday’s report from Automatic Data Processing. But gains were limited as wage inflation beat expectations. US nonfarm payrolls rose by 130k in August, whereas analysts were expecting about the same increase as in the previous month — 159k. Unemployment rate remained steady at 3.7%. Average hourly earnings rose by 0.4%, […]

Read more September 5

September 52019

EUR/USD Rises Despite Improving US Employment, Reverses Movement After ISM Services PMI

EUR/USD was rising during Thursday’s trading session despite the positive news about the US-China conflict and strong employment growth in the United States. Only after the services index from the Institute for Supply Management surprised markets by a much-bigger-than-expected jump the currency pair retreated to trade near the opening level as of now. ADP employment rose by 195k in August, exceeding the average forecast of 148k. The July figure got a negative revision from 156k to 142k. […]

Read more September 3

September 32019

EUR/USD Rebounds After US Manufacturing PMI

EUR/USD crashed today but has managed to rebound by now. The currency pair moved sharply higher after the release of US manufacturing indices. The reports were contradicting as the data from Markit showed that the US manufacturing sector was expanding, albeit just barely, while the ISM indicator showed that the sector turned from expansion into contraction. Apparently, markets paid more attention to the negative portion of the data, allowing the euro […]

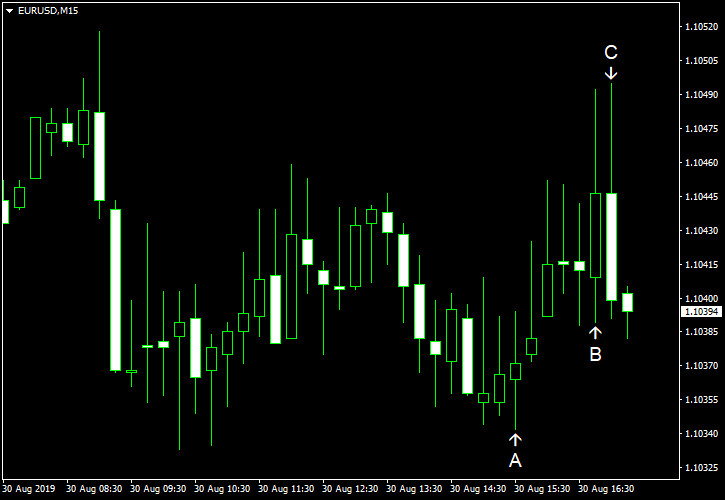

Read more August 30

August 302019

EUR/USD Continues to Fall for Whole Week

EUR/USD continued to fall today. If the currency pair closes below the opening level, that will mean that it was falling for every single day of the week. US macroeconomic indicators released during the trading session were mixed but that did not prevent the dollar from gaining on the euro. Personal income and spending rose in July. Personal income increased by 0.1%, trailing analysts’ projections of a 0.3% increase. The gain […]

Read more August 29

August 292019

EUR/USD Extends Decline After Market Sentiment Improves

EUR/USD declined today for the fourth consecutive trading session. The main piece of news today was the fact that China’s rhetoric softened a bit, signaling that China’s government is willing to negotiate with the United States in order to end the trade war. US GDP rose 2.0% in Q2 2019 according to the preliminary (second) estimate after rising 3.1% in Q1. The figure matched forecasts and was a notch lower than the advance (first) […]

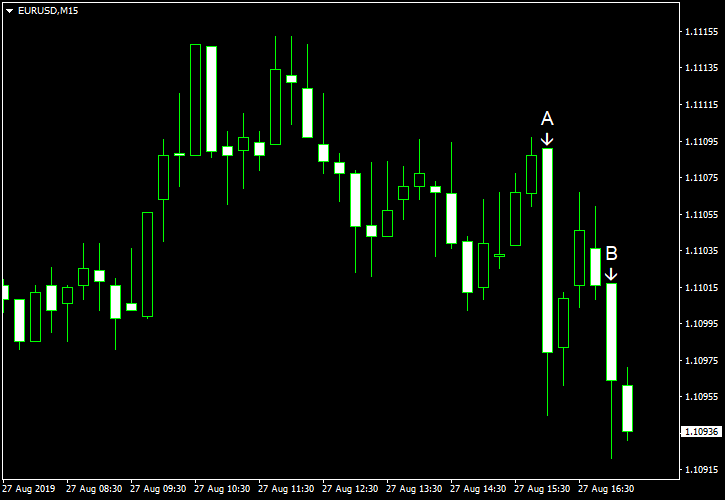

Read more August 27

August 272019

EUR/USD Fails to Profit from Good Fundamentals

EUR/USD attempted to rally today but failed and is now trading below the opening level. Concerns about the US-China trade spat returned to the market, but that did not help the euro to gain on the dollar. The shared 19-nation currency also failed to profit from hopes that Italy will gain a new government caused by the reports that Italy’s Democratic Party and the Five Star Movement are close to reaching a deal. S&P/Case-Shiller […]

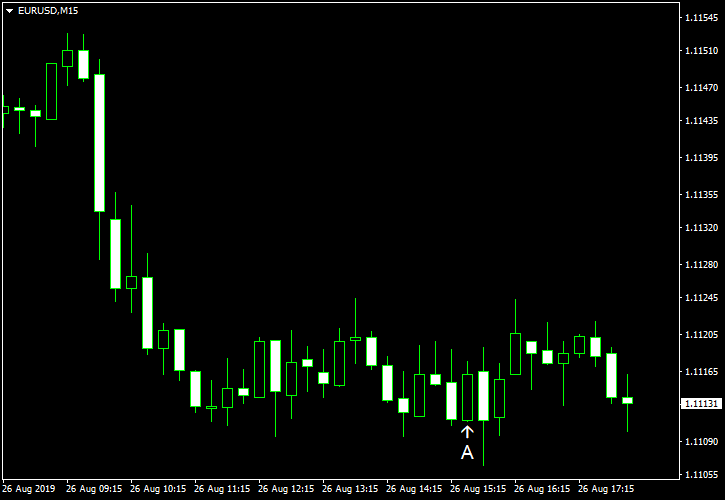

Read more August 26

August 262019

EUR/USD Drops as US-China Tensions Calm Down

EUR/USD fell today as the US-China trade tensions calmed down a bit. While the currency pair climbed on Friday after the trade conflict flared up yet again, the market sentiment improved today as US and China’s officials used more peaceful rhetoric. Durable goods orders climbed 2.1% in July. That is compared to the increase of 1.9% in June and the predicted gains of 1.4%. On Friday, a report on new home sales was released, showing […]

Read more