- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

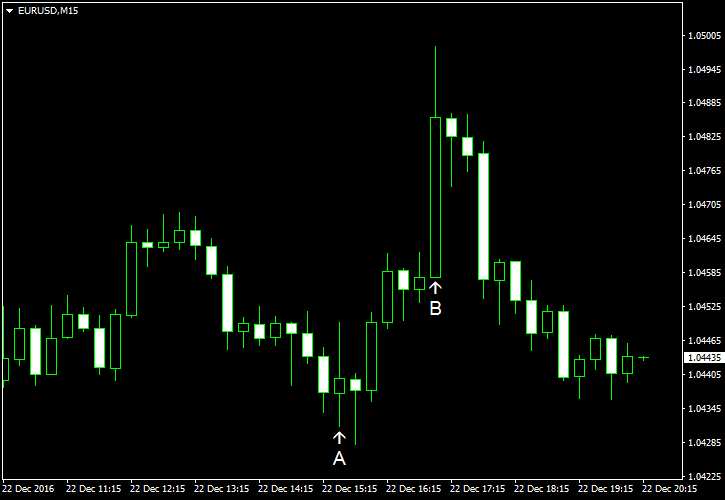

December 22

December 222016

EUR/USD Retreats from Daily High on Thursday

EUR/USD rose for the second day today, though has retreated from the daily high and is moving down right now. Economic data released from the United States over the trading session was disappointing for the most part with few exceptions, most notable the upward revision of US gross domestic product in the final estimate. Analysts do not think that the longer-term uptrend of the US dollar is in danger and explained the current […]

Read more December 21

December 212016

EUR/USD Crawls Higher Despite US Housing Data

Today’s US housing data was good but it did not prevent the dollar from losing to the euro. Analysts explained such behavior by traders’ desire to lock in profits ahead of the year-end. Existing home sales rose to the seasonally adjusted annual rate of 5.61 million in November from a downwardly revised 5.57 million in October (5.60 million before the revision). Experts predicted a decline to 5.52 million. (Event A on the chart.) Crude oil […]

Read more December 19

December 192016

EUR/USD Stable After Halting Decline

EUR/USD was stable on Monday after halting decline and rising for the first time in four days on Friday. US economic data helped the currency pair to stabilize as macroeconomic indicators missed economists’ predictions. Flash Markit services PMI fell from 54.6 in November to 53.4 in December instead of rising to 55.2 as analysts had predicted. (Event A on the chart.) On Friday, a report on housing starts and building permits was released, showing a drop for both indicators. […]

Read more December 15

December 152016

EUR/USD Reaches Record Low in Almost 14 Years

EUR/USD fell today, touching the lowest level since the early January 2003. As of now, the currency pair rebounded from the low but still trades far below the opening level. Yesterday’s Federal Reserve policy announcement continued to feed the dollar’s strength, and with today’s economic reports from the United States being either in line with expectations or better, there is no reason for the greenback to stop its rally. Talks about […]

Read more December 14

December 142016

EUR/USD Tanks After Fed Raises Interest Rates

EUR/USD sank today, erasing intraday gains, after the Federal Open Market Committee hiked interest rates. Such move was widely expected by markets, so no surprise here. What was surprising is the upward revision of the projected path for the federal funds rate, meaning that US policy makers now plan three rate hikes next year instead of two expected previously. As for today’s economic data from […]

Read more December 13

December 132016

EUR/USD Steady Ahead of Fed Announcement

EUR/USD traded close to its opening level today after diving intraday. While the first two trading day of the current week were light in terms of economic data, this will change tomorrow. Not only the Wednesday’s trading session has plenty of economic reports due to release, the Federal Reserve will also announce its policy decision on Wednesday. It is a general consensus that the Fed is going to hike […]

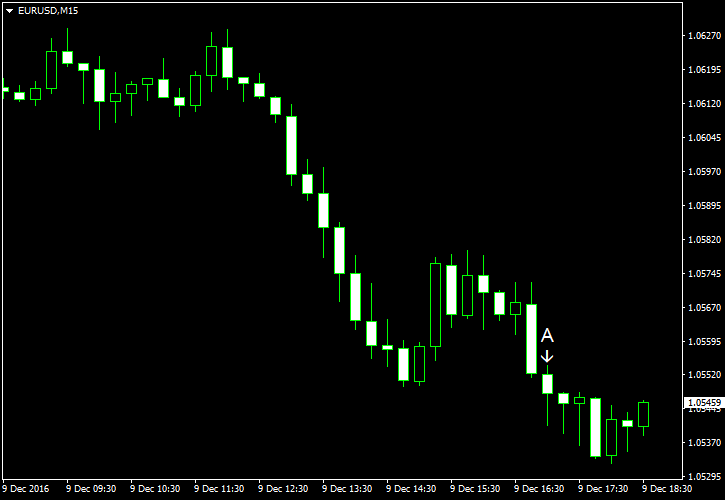

Read more December 9

December 92016

Sell-Off of EUR/USD Continues

Sell-off of EUR/USD that has started yesterday continued today. While the currency pair attempted to halt the decline intraday, it has resumed the downfall by now. Yesterday, the European Central Bank announced changes to its quantitative easing program. The bank trimmed the size of asset purchases but extended the program till the end of the next year. On the whole, the changes led to extension of the QE, not tapering, therefore they had very negative impact […]

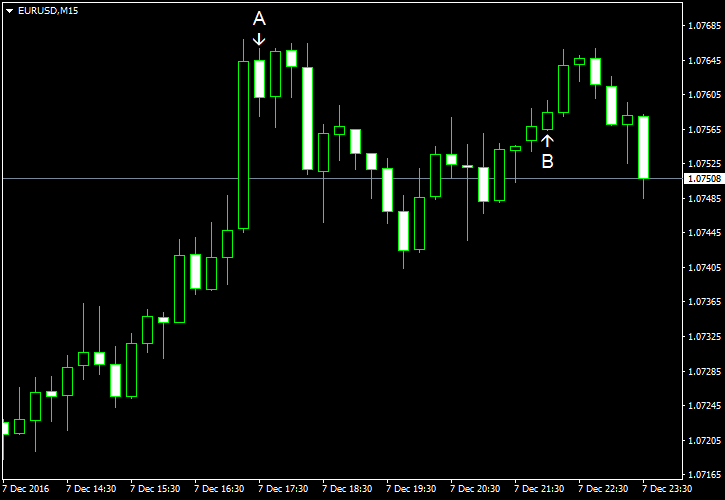

Read more December 7

December 72016

EUR/USD Firm as Markets Prepare for ECB Meeting

EUR/USD was firm today ahead of tomorrow’s meeting of the European Central Bank. Analysts do not expect changes to interest rates, but think that the ECB may extend its quantitative easing beyond the March 2017 threshold. US crude oil inventories dropped 2.4 million barrels last week, exceeding the analysts’ estimate of a 1.4 million drop and the previous week’s fall of 0.9 million. Still, the stockpiles remained at the upper […]

Read more December 6

December 62016

EUR/USD Retreats After Post-Referendum Rally

EUR/USD fell today after yesterday’s rally that followed the Italian referendum. Today’s economic data from the United States was mixed, providing no reason for the currency pair to move either up or down. Meanwhile, traders wait for Thursday’s monetary policy decision from the European Central Bank. No changes to the existing policy and stimulus are expected, but it will be interesting to hear what the bank says about […]

Read more December 5

December 52016

EUR/USD Swings Down Then Up After Italy’s Referendum

The main factor influencing EUR/USD today was the Italian constitutional referendum that has been held on Sunday. Initially, the currency pair reacted very negatively to the outcome of the voting as it ended with rejections of reforms proposed by Italian Prime Minister Matteo Renzi and his resignation. Yet EUR/USD bounced strongly after markets digested the news and decided that it is not the end of the world. As for today’s US economic data, it […]

Read more