- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

August 1

August 12019

EUR/USD Continues to Fall After FOMC Interest Rate Cut

EUR/USD continued to fall after yesterday’s huge slump caused by the monetary policy decision of the Federal Open Market Committee. While the FOMC cut interest rates, such decision was expected, and markets were disappointed by lack of hints at additional cuts in the future. By now, the currency pair has trimmed its losses, though. Initial jobless claims were at the seasonally adjusted level of 215k last week, up from 207k the week before. […]

Read more July 25

July 252019

EUR/USD Extremely Volatile After ECB Announcement

EUR/USD was extremely volatile today following the monetary policy announcement from the European Central Bank. While the ECB did not change its monetary policy at today’s meeting, the central bank signaled about the possibility of an interest rate cut in the future. That made the currency pair drop initially. But the pair rebounded very quickly as some market participants thought that the statement was not as dovish as was expected. Ultimately, […]

Read more July 24

July 242019

EUR/USD Drops After Weak Eurozone PMIs

EUR/USD dropped after a range of weak PMI prints for the eurozone was released today. Currently, the pair attempts to recover but still trades below the opening level. US PMIs were mixed and housing data missed expectations, allowing the euro to regain some ground versus the dollar. The European Central Bank will make a monetary policy announcement tomorrow. While markets do not count on any changes to the current monetary policy, […]

Read more July 23

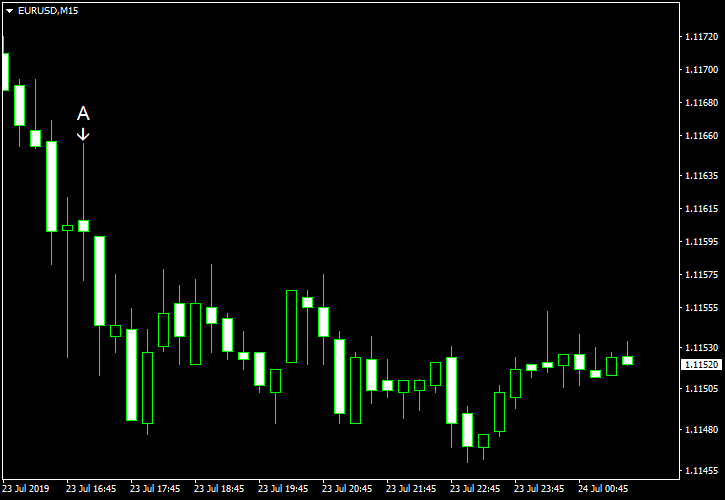

July 232019

EUR/USD Sinks After USA Increase Debt Ceiling

EUR/USD sank on Tuesday. Market analysts explained the drop by the agreement between US President Donald Trump and the Congress to raise the debt ceiling. The trading session was light in terms of US data, and those reports that were released were universally bad. Richmond Fed manufacturing index sank from 2 in June to â12 in July, reaching the lowest reading since January 2013. That was a complete surprise to experts who had […]

Read more July 18

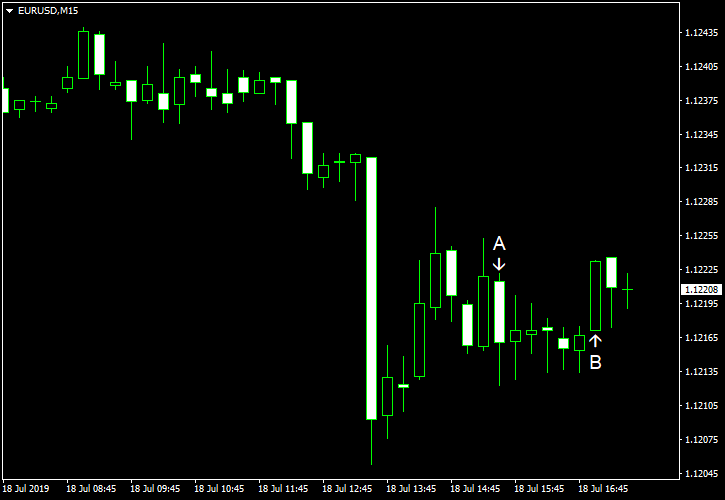

July 182019

EUR/USD Retreats Sharply After Attempting to Rally

EUR/USD rose intraday but fell sharply later. The currency pair was trading in a range afterward. Philadelphia Fed manufacturing index jumped sharply from 0.3 in June to 21.8 in July. Analysts had predicted a much more modest growth to 5.0. (Event A on the chart.) Initial jobless claims were at the seasonally adjusted level of 216k last week, matching forecasts exactly, up from 208k the week before. (Event A on the chart.) Leading […]

Read more July 17

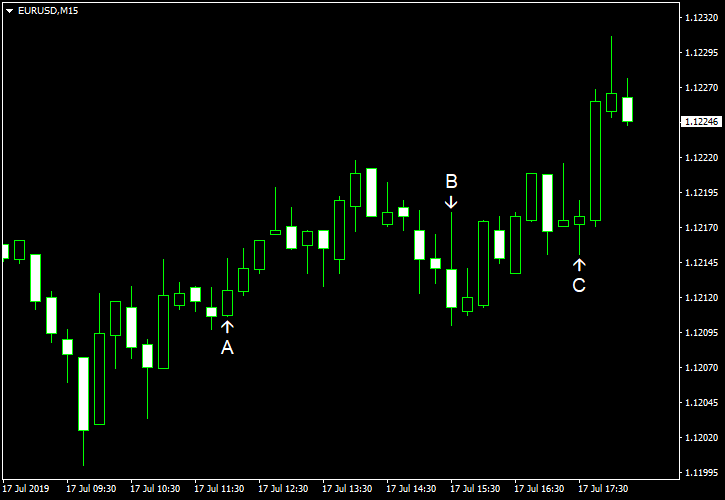

July 172019

EUR/USD Rebounds on Eurozone CPI

EUR/USD dipped intraday but rebounded later today after the release of a better-than-expected eurozone consumer inflation report. (Event A on the chart.) The session was light in terms of US macroeconomic releases. Both housing starts and building permits fell in June. Housing starts were at the seasonally adjusted annual rate of 1.25 million, down from 1.27 million in May. Building permits were at the seasonally adjusted annual rate of 1.22 million, down […]

Read more July 16

July 162019

EUR/USD Sinks After German Economic Sentiment, US Retail Sales

EUR/USD sank today. The currency pair started the decline during the early European trading session and continued to fall after the release of the worsening German economic sentiment (event A on the chart) and better-than-expected US retail sales. Retail sales, both headline and underline, rose 0.4% in June from the previous month, whereas analysts had expected an increase of 0.1%. Both received a negative revision to the increase in May from 0.5% to 0.4%. (Event B on the chart.) […]

Read more July 15

July 152019

EUR/USD Loses Gains, Trades Near Opening Level

EUR/USD rose at the start of Monday’s session but reversed movement at 10:45 GMT and continued to fall after the better-than-expected manufacturing report released in the United States. Currently, the currency pair trades near the opening level. NY Empire State Index rebounded to 4.3 in July from -8.6 in June. Analysts were expecting a more modest gain to 1.6. (Event A on the chart.) On Friday, a report on PPI was released, showing an increase of 0.1% in June, the same […]

Read more July 11

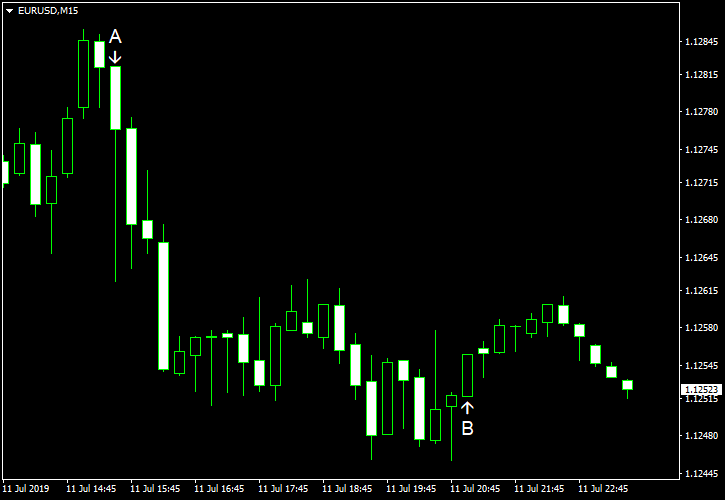

July 112019

EUR/USD Fails to Maintain Rally, Pushed Down by US CPI

EUR/USD was attempting to extend yesterday’s rally today but failed and was trading near the opening level after the US Consumer Price Index beat expectations. With unemployment claims being also better-than-expected, the dollar got enough support to rebound a bit. US CPI rose 0.1% in June, the same as in May, while analysts were expecting no change. (Event A on the chart.) Initial jobless claims were at the seasonally adjusted level […]

Read more July 10

July 102019

EUR/USD Jumps on Powell’s Testimony, FOMC Minutes

EUR/USD rallied sharply today. There were two major reasons for that, though both of them were tied to the outlook for monetary policy of the Federal Reserve. Firstly, comments from Fed Chair Jerome Powell did nothing to contradict the outlook for two interest rate cuts this year. (Event A on the chart.) Secondly, minutes for the latest monetary policy meeting of the Federal Open Market Committee also supported the outlook for easing. As a result, the CME […]

Read more