- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

November 8

November 82016

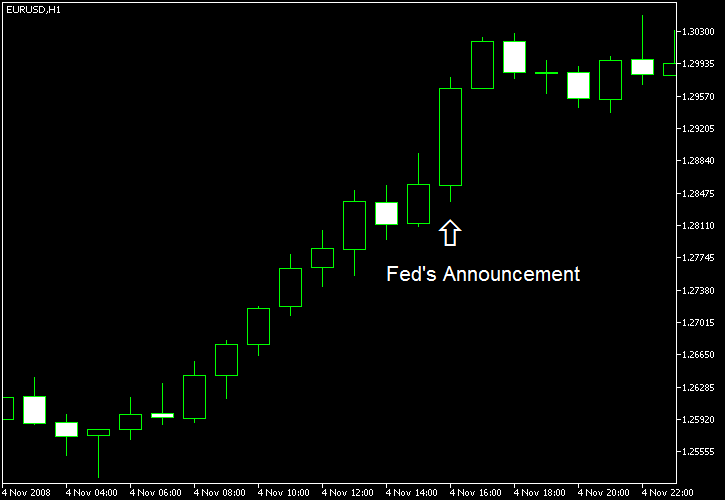

Analyzing EUR/USD on US Presidential Elections Day

EUR/USD daily trading data since January 1971 is readily available from many brokers and demo servers. In theory, this would allow analysis of EUR/USD trading range beginning from the Nixon’s election to his second term on November 7, 1972. In practice, the data we have before 1988 is largely unusable due to poor quality — Open, High, Low, and Close are equal for some days. Also, no […]

Read more November 7

November 72016

Who Wins US Presidential Elections 2016? How Will Currencies React?

We have already covered the US presidential elections and their possible effect on the US dollar in a blog post on February 19. Back then, the elections were still in their primaries stage, but the apparent leaders (Clinton and Trump) have already emerged as the two most likely persons to sit next in the White House. The implications of their presidency for the FX market have also been quite clear, though now they can be […]

Read more2016

Which Part of Your Income Is from Forex Trading?

Every newbie trader dreams of being a full-time Forex trader, with full-time defined as 1–2 hours a day and not having to worry about any financial matters — all being completely compensated by one’s trading performance. The reality usually turns out much harsher. First, becoming a profitable trader is not an easy task in and of itself. Then, it can be tough to move from being a part-time trader to being a full-time […]

Read more October 21

October 212016

One-Hour Trade Insurance from easyMarkets

Three weeks ago, a representative from easyMarkets contacted me to ask if I would be interested to test their new intriguing feature called dealCancellation. They provided me with a free live account with $200 in it to explore this trading tool. This week, I have finally got some time to actually experience it. Basically, dealCancellation is trade insurance. You pay in advance for an opportunity to cancel your […]

Read more October 20

October 202016

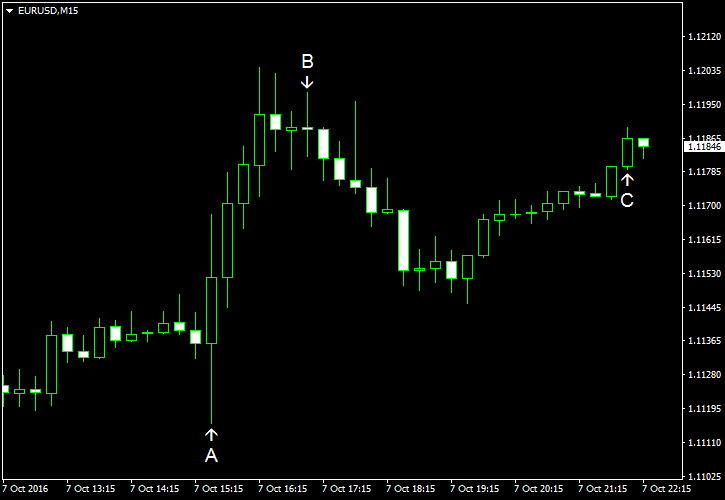

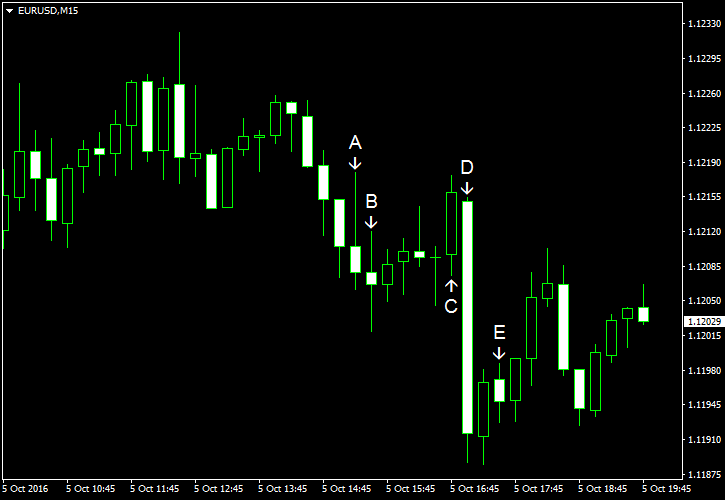

Jobless Data Shakes EUR/USD, Housing Data Lets Dollar Appreciate

EUR/USD posted a significant intraday spike following a disappointing weekly US jobless data report combined with a mixed sentiment indicator. The currency pair rebounded during the next 15 minutes and went into a downtrend for 2 hours more, spurred by the better-than-expected housing data from the United States. Initial jobless claims rose from 247k to 260k during the last week. The growth exceeded the median forecasts of 250k claims. (Event A on the chart.) […]

Read more October 10

October 102016

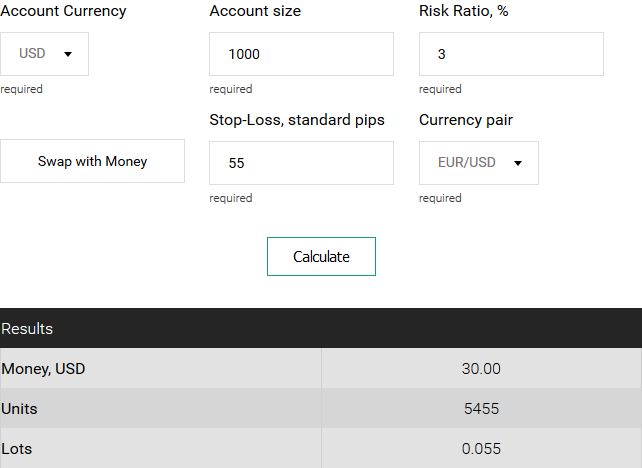

Poll: Which Version of Position Size Calculator Do You Prefer?

According to a poll from 2013, only 16% of this blog’s readers preferred to use the Position Size Calculator for MetaTrader as their choice position sizing tool, while two thirds opted for a simple web version calculator instead. As it has been a month since the graphical panel version of the PSC was released, it is now time to measure the popularity of different calculators again. Online Position Size Calculator is based […]

Read more October 8

October 82016

Weekly Forex Technical Analysis (Oct 10 — Oct 14)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0977 1.1040 1.1117 1.1180 1.1257 1.1320 1.1397 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.1044 1.1123 1.1184 1.1263 1.1323 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more October 7

October 72016

EUR/USD Rallies on Back of Worse-Than-Expected Nonfarm Payrolls

EUR/USD was falling today as traders were counting on solid employment data from the United States. Yet nonfarm payrolls came out below expectations, and the currency pair jumped sharply after the release. It attempted to retreat afterwards but managed to bounce, keeping its gains. Nonfarm payrolls rose 156k in September, failing to reach the predicted growth of 171k. Meanwhile, the previous month’s gain was revised from 151k to 167k. […]

Read more October 7

October 72016

Important Aspects of Trading Gold

The following post is a paid advertisement. The content was provided by the advertiser. If you have taken a look at the trends that have been dominating this year, you may have noticed something quite interesting. In particular, you may have found that gold has been at the top of its game. While it has experienced some fluctuations, it appears to be quite strong, even in the following months. Even […]

Read more October 5

October 52016

EUR/USD Flat After ADP Employment Disappoints

EUR/USD was flat today after the release of economic reports from the United States. Of a particular note was employment data from Automatic Data Processing, which missed expectations. That was not a good sign ahead of Friday’s nonfarm payrolls. Yet the dollar hardly paid heed to the data, continuing to draw strength from expectations of an interest rate hike in December. ADP employment rose 154k in September. The actual increase was […]

Read more