- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

May 2

May 22019

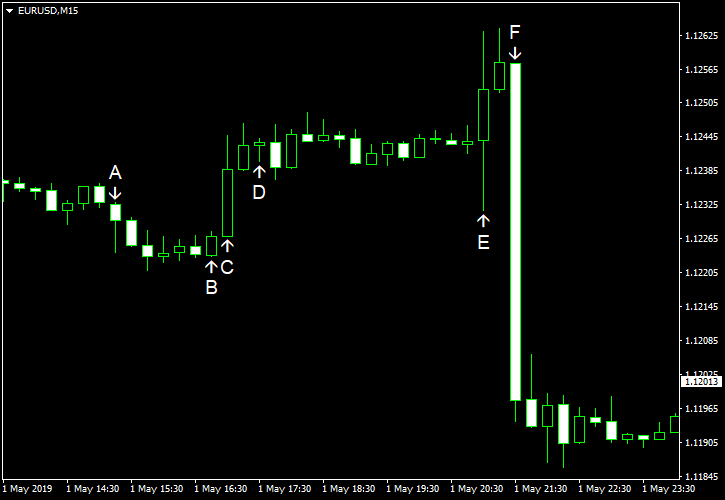

EUR/USD Extends Decline

EUR/USD extended yesterday’s decline today. There were several macroeconomic released in the United States but none of them were particularly important. Markets were focused mostly on tomorrow’s nonfarm payrolls. Nonfarm productivity climbed by 3.6% in Q1 2019. That is compared to the median forecast of a 0.9% increase and the 1.9% gain registered in Q4 2018. (Event A on the chart.) Seasonally adjusted initial jobless claims were at 230k last week, unchanged […]

Read more May 1

May 12019

EUR/USD Loses Day’s Gains After Powell Cools Interest Rate Cut Bets

EUR/USD was rising on Wednesday, largely ignoring positive employment data, after manufacturing indices missed expectations. The currency pair attempted to extend rally after the Federal Open Market Committee left interest rates unchanged, but plunged after Jerome Powell, Chairman of the Federal Reserve, stated in the press conference that he sees no case to change rates in either direction in the foreseeable future. (Event F on the chart.) ADP employment […]

Read more April 30

April 302019

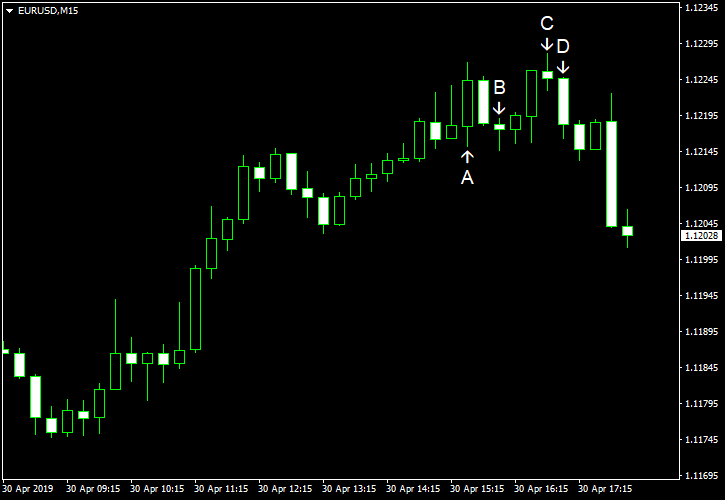

EUR/USD Rallies After Data from Eurozone

EUR/USD rallied today, rising for the third consecutive trading session. Markets welcomed macroeconomic data released in the eurozone today, even though not all indicators were good. US economic data was mixed as well. S&P/Case-Shiller home price index rose 3.0% in February on an annual basis. That is compared to the forecast increase of 3.7% and the January growth by 3.5%. On a monthly basis, the index rose 0.2%. (Event A on the chart.) Chicago PMI […]

Read more April 26

April 262019

EUR/USD Sharply Rebounds After Dropping on US GDP

US gross domestic product rose last quarter more than was expected. Initially, EUR/USD dropped sharply on the news but rebounded very quickly and continued to move higher. Analysts speculated that it is because, while the headline GDP figure looked very good, underline details seemed rather weak and were not painting a favorable picture of the US economy. US GDP rose 3.2% in Q1 2019 according […]

Read more April 25

April 252019

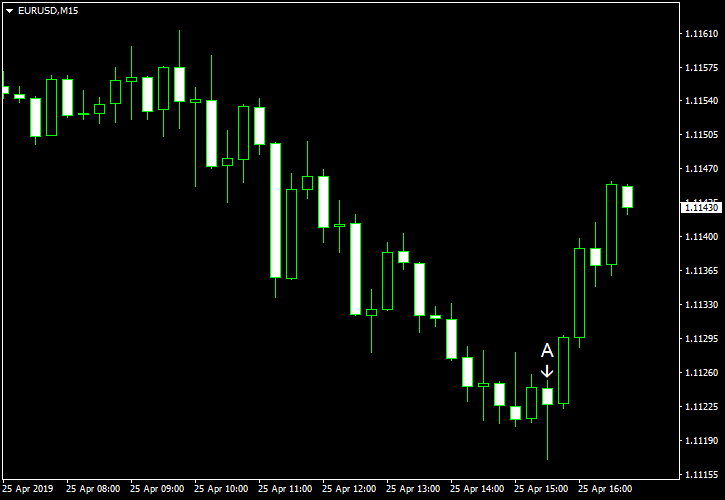

EUR/USD Bounces After Dropping to Almost 2-Year Low

EUR/USD continued to fall today, reaching the lowest level in almost two years, though by now the currency pair has bounced from the day’s lows. Traders preferred the dollar to the euro due to the divergence between monetary policy and economic health of the United States and the eurozone. Durable goods orders climbed 2.7% in March, far exceeding the increase by 0.7% predicted by analysts. The previous month’s decline got a positive revision from 1.6% to 1.1%. (Event […]

Read more April 23

April 232019

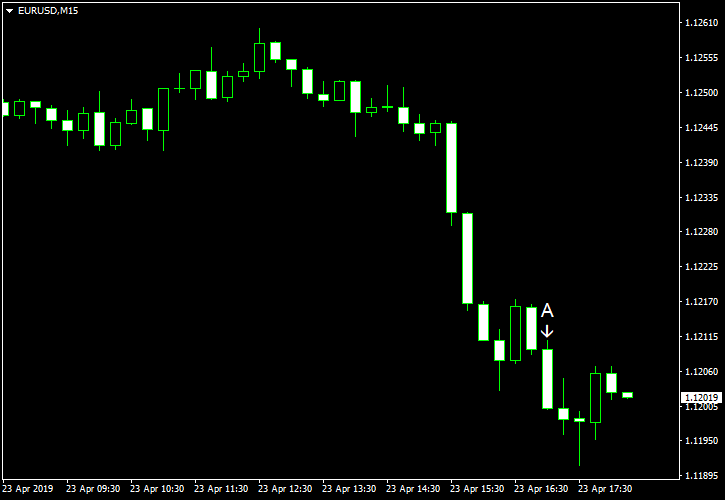

EUR/USD Crashes for No Apparent Reason

EUR/USD tumbled today despite there were no major events to explain the slump. Market analysts provided various possible reasons for the crash, including expectations of good earning reports for the first quarter from US companies and the divergence between monetary policy of the Federal Reserve and the European Central Bank. Whatever the reason, the currency pair erased gains of the previous two trading sessions and was trading at lows not seen since the beginning of the month. […]

Read more April 22

April 222019

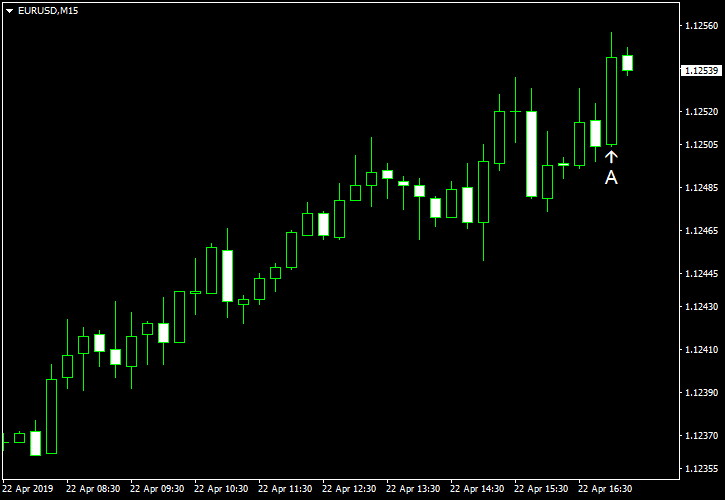

EUR/USD Rises in Post-Holiday Light Trading

Markets opened after the Easter holiday, but there were few events to move them. The only macroeconomic indicator released in the United States today missed expectations, and it may be partially responsible for today’s rally of EUR/USD. Existing home sales were at the seasonally adjusted annual rate of 5.21 million in March, missing market expectations of 5.31 million. Furthermore, the February figure got a negative revision from 5.51 million to 5.48 […]

Read more April 18

April 182019

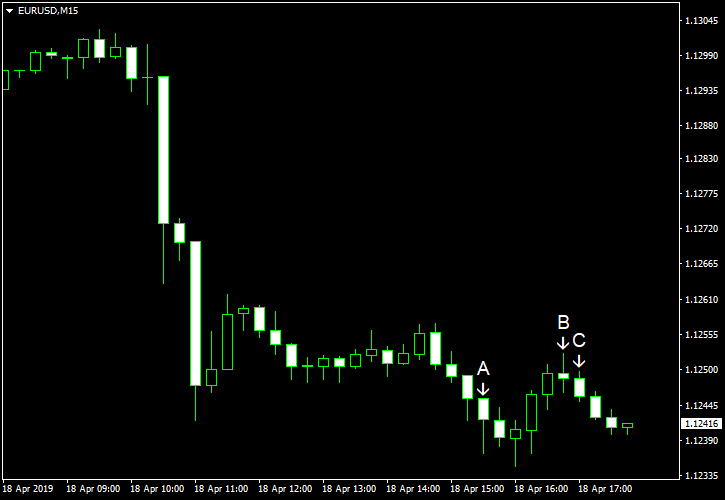

EUR/USD Sinks After European PMIs

EUR/USD sank today following the releases of European Purchasing Managers’ Indices by Markit. While they were not completely negative, showing a mix of good and bad results, the currency pair did not respond well to the reports. US PMIs, on the other hand, were unquestionably disappointing, but that did not help the pair. Retail sales rose 1.6% in March from the previous month after falling 0.2% in February. Analysts had […]

Read more April 17

April 172019

EUR/USD Rallies Intraday, Trims Gains Later

EUR/USD rallied intraday but has trimmed its gains later. US macroeconomic data beat expectations, adding to the downside momentum of the currency pair. US trade balance deficit shrank to $49.4 billion in February, down from $51.1 billion in January. That is instead of rising to $53.5 billion as analysts had predicted. (Event A on the chart.) Wholesales inventories rose 0.2% in February. That is compared to a 0.4% increase predicted by analysts […]

Read more April 15

April 152019

EUR/USD Settles Flat After Rising Earlier

EUR/USD rallied on Monday but lost its gains later and settled near the opening level. Trading was relatively quiet, with absence of any major events. NY Empire State Index climbed to 10.1 in April from 3.7 in March. Analysts had predicted a smaller increase to 8.1. (Event A on the chart.) Net foreign purchases were at $51.9 billion in February. That is compared to the predicted figure of -$18.2 billion and the January reading […]

Read more