- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

July 25

July 252017

EUR/USD Loses Gains, Driven Down by US Data

EUR/USD rose today as the two-day meeting of the Federal Reserve started. The currency pair lost its gains, though, as basically all of today’s reports in the United State were good. S&P/Case-Shiller home price index rose 5.7% in May, year-over-year. Analysts expected the same 5.8% rate of growth as in April. Month-on-month, the index was up 0.8%. (Event A on the chart.) Richmond Fed manufacturing index rose to 14 in July from 11 in June (revised […]

Read more July 24

July 242017

EUR/USD Slips, Remains Near Highest Since August 2015

EUR/USD slipped today, though remained near the highest level since August 2015 as the dollar continued to feel the pressure of adverse fundamentals. Among them were the inability of US President Donald Trump to push with his reforms and the investigation into alleged ties of Trump’s election campaign to Russia. As for today’s economic reports in the United States, they were mixed. Markit released flash readings for manufacturing and services PMIs today. Manufacturing PMI […]

Read more July 20

July 202017

EUR/USD at Highest Since August 2015 After ECB Meeting

EUR/USD reached flash highs today, rising to the strongest level since August 2015, after the European Central Bank monetary policy decision (event A on the chart) and the press-conference of ECB President Mario Draghi (event B on the chart). While the central bank kept its policy unchanged, Draghi mentioned that policy makers will discuss adjustments of the bond-buying program in fall. Market participants thought that the discussion may result in quantitative easing […]

Read more July 19

July 192017

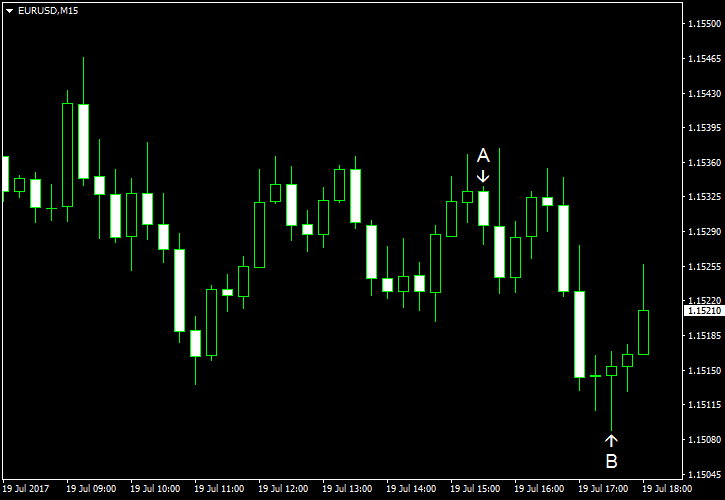

EUR/USD Inches Down Ahead of ECB Policy Announcement

EUR/USD inched down today as traders were waiting for tomorrow’s policy announcement from the European Central Bank. Today’s economic docket was almost empty, but the housing report released in the United States was good, helping the dollar to gain on the euro. Both housing starts and building permits climbed in June, rising above the levels forecast by analysts. Housing starts were at the seasonally adjusted annual rate of 1.22 million last month, […]

Read more July 18

July 182017

EUR/USD Jumps to New Highs

EUR/USD rallied today, touching the level not seen since May 2016, as another effort to repeal the Affordable Care Act failed, leading to increasing concerns that US President Donald Trump will find heavy resistance to his reforms, including tax cuts. That, combined with doubts that the Federal Reserve will be able to proceed with monetary tightening, hurt the dollar. Poor macroeconomic reports did not […]

Read more July 14

July 142017

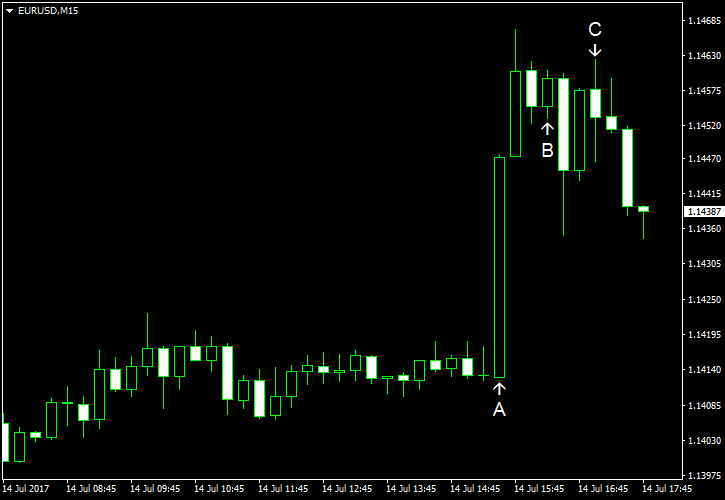

EUR/USD Reverses Losses After Soft Economic Data from USA

EUR/USD gained today, reversing yesterday’s losses, as almost all economic reports released from the United States during the current trading session were bad. In particular, inflation, closely watched by the Federal Reserve, missed expectations. CPI was unchanged in June while economists were counting on at least 0.1% increase. The index was down 0.1% in May. (Event A on the chart.) Retail sales declined 0.2% in June even though analysts also […]

Read more July 13

July 132017

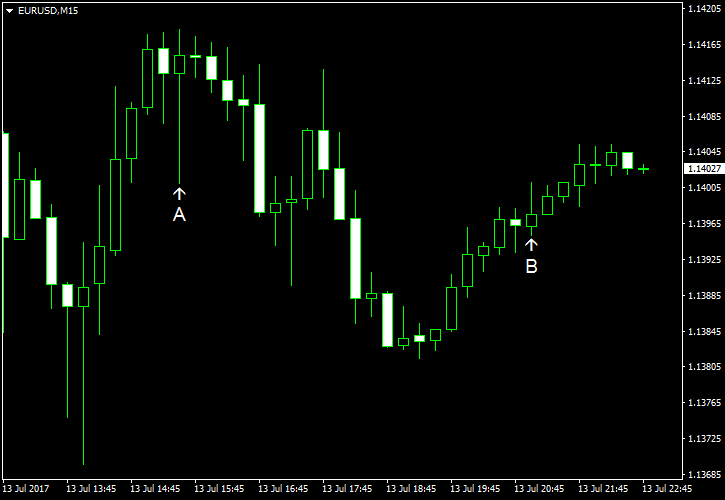

EUR/USD Stable After Mixed US Data

EUR/USD was stable today following mixed economic releases from the United States. Yesterday’s testimony from Federal Reserve Chairwoman Janet Yellen was dovish, but that did not prevent the currency pair from falling during the previous trading session. PPI rose 0.1% in June while experts had anticipated it to stay unchanged, the same as in May. (Event A on the chart.) Initial jobless claims were at the seasonally adjusted […]

Read more July 11

July 112017

EUR/USD Moves Higher During Quiet Trading

EUR/USD went up today. Trading was quiet, with few economic releases. But those that came out favored the euro over the dollar, pushing the currency pair higher. Traders wait for tomorrow’s testimony of Federal Reserve Chair Janet Yellen. Wholesale inventories rose 0.4% in May from April, exceeding analysts’ estimates that showed a 0.3% growth. The stockpiles were down 0.5% in the previous reporting period. (Event […]

Read more July 7

July 72017

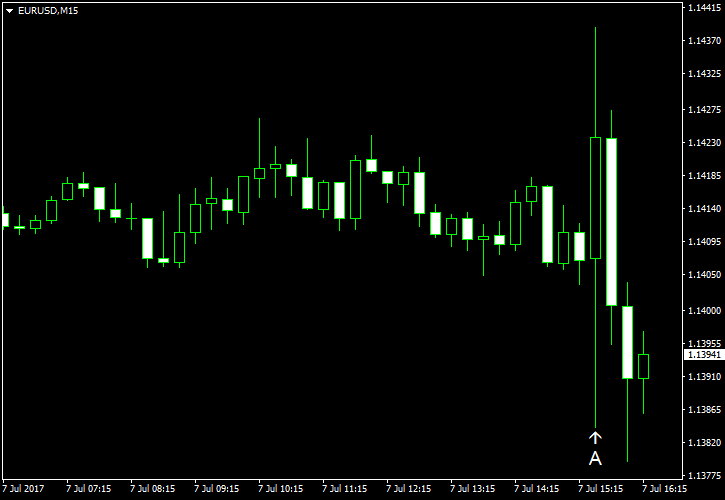

EUR/USD Jumps on NFP, Reverses Gains Immediately

After yesterday’s private employment report missed expectations, economists were concerned that today’s nonfarm payrolls would also be disappointing. Yet that was not the case, at least in terms of employment growth, which turned out to be better than expected. But other parts of the report were not that good, with the unemployment rate demonstrating an unexpected increase and wage inflation stalling. The mixed data led to volatile […]

Read more July 6

July 62017

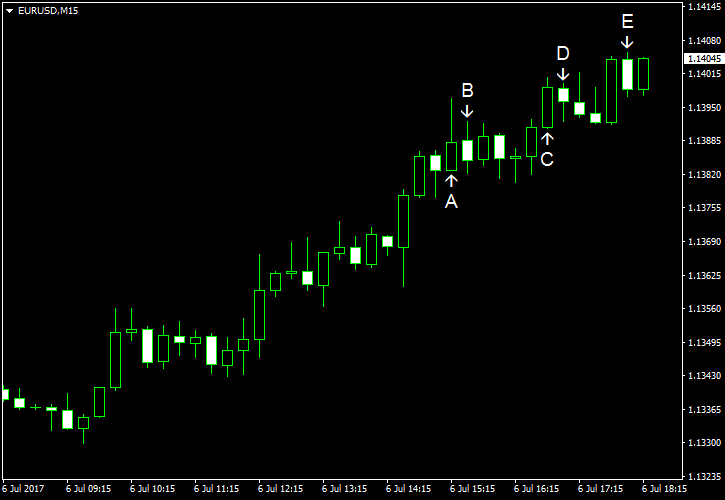

EUR/USD Rallies, Extends Move Up After ADP Employment

EUR/USD was rising today and extended its move up after employment data from Automatic Data Processing missed expectations. The currency pair paused its rise after the US services sector demonstrated strong growth. ADP employment rose by 158k in June, seasonally adjusted, failing to reach the 184k figure promised by analysts. Furthermore, the May growth was revised from 253k to 230k. (Event A on the chart.) Initial jobless claims […]

Read more