- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

May 28

May 282019

EUR/USD Drops on Geopolitical Tensions, Consumer Confidence

EUR/USD declined today as the US dollar got boost from geopolitical tensions, including the Sino-US trade war, and the surprisingly big jump of the US consumer confidence. S&P/Case-Shiller home price index rose 2.7% in March, whereas market participants had expected about the same 3.0% rate of growth as in February. (Event A on the chart.) Consumer confidence climbed to 134.1 in May from 129.2 in April, exceeding the consensus forecast of 130.1. (Event B on the chart.) […]

Read more May 23

May 232019

US & Eurozone Data Poor; EUR/USD Dips, Attempts to Rebound Later

EUR/USD dipped intraday as macroeconomic indicators in the eurozone were disappointing for the large part, with data from France was the only one providing positive surprises. The currency pair is attempting to rebound as US data was not good as well, but so far the EUR/USD still trades below the opening level. Seasonally adjusted initial jobless claims were at 211k last week, almost unchanged from the previous week’s unrevised […]

Read more May 22

May 222019

EUR/USD Fails to Keep Intraday Gains, Retreats Below Opening

Trading was somewhat directionless during the Thursday’s trading session. Moves of EUR/USD reflected that as the pair was moving higher intraday but then reversed its direction and went below the opening level. The EUR/USD pair continued to move lower after the release of FOMC minutes, which suggested that the FOMC does not plan either hike or cut interest rates this year. US crude oil inventories rose by 4.7 […]

Read more May 17

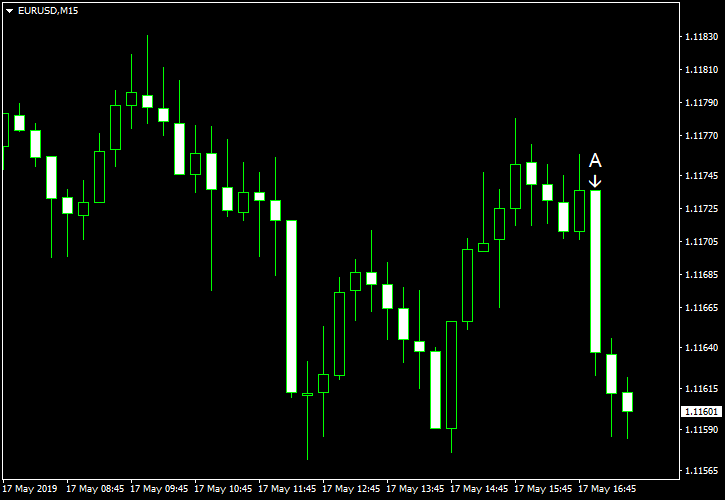

May 172019

EUR/USD Fails to Maintain Rally After US Consumer Sentiment Provides Positive Surprise

EUR/USD attempted to rally intraday but failed to keep gains, especially after the consumer sentiment reported by the University of Michigan demonstrated surprisingly sharp improvement. Leading index rose 0.2% in April, in line with expectations. The March increase got a negative revision from 0.4% to 0.3%. (Event A on the chart.) Michigan Sentiment Index surged to 102.4 in May from 97.2 in April, far above the forecast value of 97.8. That was the highest level […]

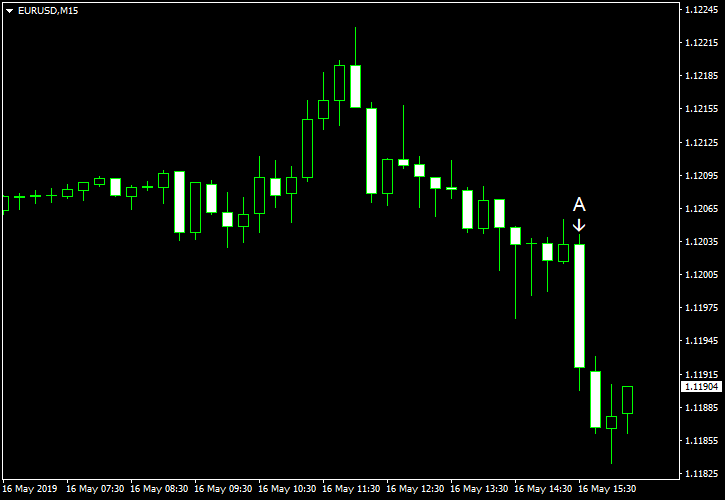

Read more May 16

May 162019

EUR/USD Fails to Maintain Rally

EUR/USD attempted to rally today but failed and is now trading below the opening level. The euro got temporary boost from the news that the United States will delay implementing new tariffs on European cars, but concerns about the upcoming European parliamentary elections and the Italian budget issue pushed the shared 19-nation currency lower. Positive US macroeconomic data also weighed on the currency pair. Housing starts were at the seasonally […]

Read more May 15

May 152019

EUR/USD Settles Flat, Recovering from Intraday Drop

EUR/USD was falling today but jumped sharply at 14:00 GMT. The rally allowed the currency pair to settle flat. There were plenty of macroeconomic reports in the United States today, and most of them were disappointing. Seasonally adjusted retail sales fell 0.2% in April instead of rising at the same rate as analysts had predicted. The sales were up 1.7% in March. (Event A on the chart.) NY Empire State Index climbed from 10.1 […]

Read more May 10

May 102019

EUR/USD Rallies After US Inflation Miss

EUR/USD rallied today, accelerating its rise after US inflation missed forecasts. While the currency trimmed gains by the session’s end, it still closed far above the opening level. US CPI rose 0.3% in April, while analysts had expected the same 0.4% rate of growth as in March. (Event A on the chart.) Treasury budget turned from a deficit of $146.9 billion in March to a surplus of $160.3 billion in April. That was a total […]

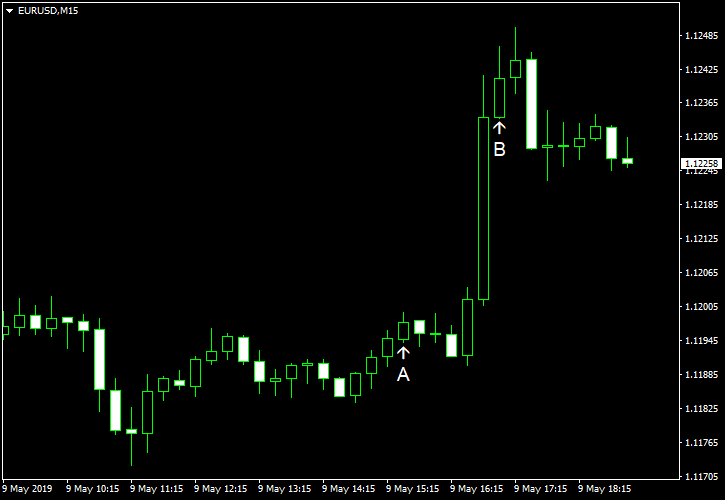

Read more May 9

May 92019

EUR/USD Jumps as Sino-US Trade Talks Continue

EUR/USD rallied today while traders were waiting for the outcome of US-China trade negotiations. US macroeconomic data was decent for the most part, though unemployment claims were disappointing. PPI rose 0.2% in April, in line with expectations, after rising 0.6% in March. (Event A on the chart.) US trade balance deficit widened to $50.0 billion in March from $49.3 billion in February, revised. Analysts had predicted a bigger increase to $51.4 […]

Read more May 8

May 82019

EUR/USD Moves in Range as Sino-US Trade Tensions Escalate

EUR/USD was attempting to rally intraday but retreated and is moving in range currently. The first half of this trading week was light on macroeconomic data in the United States, and traders were focused on escalating trade tensions between the USA and China as it seems that the trade negotiations are collapsing. US crude oil inventories decreased by 4.0 million barrels last week instead of rising by 1.1 million barrels as analysts had […]

Read more May 3

May 32019

EUR/USD Volatile After NFP, Decides to Go Higher After All

EUR/USD was moving gradually lower ahead of US nonfarm payrolls. The currency pair experienced significant volatility immediately after the release of the employment data as it was mixed. While the employment and unemployment figures were much better than was expected, wage inflation missed forecasts. Ultimately, markets preferred to focus on the bad part of the report, and the EUR/USD pair went up. The unexpected drop of the ISM services PMI gave even more […]

Read more