- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

December 20

December 202018

EUR/USD Volatile As Markets Digest Fed Message

EUR/USD remained volatile following yesterday’s policy announcement from the Federal Reserve. Initially today, the currency pair was rising, but reversed its movement later and started to decline, though it is currently still trading above the opening level. Also yesterday, Italy and the European Union reached an agreement about the Italian budget, adding to bullish factors for the euro. Meanwhile, economic data released in the United States today was mixed, […]

Read more December 19

December 192018

Fed Projections Less Dovish than Expected, EUR/USD Pares Gains

EUR/USD was rising gradually today ahead of the Federal Open Market Committee policy meeting but retreated sharply after the event. While the FOMC hiked its key interest rates, that was already expected and priced in. What really grabbed traders’ attention were the statement and the economic projections, especially for monetary policy. And the fact that they turned out to be not as dovish as markets had expected caused the US […]

Read more December 17

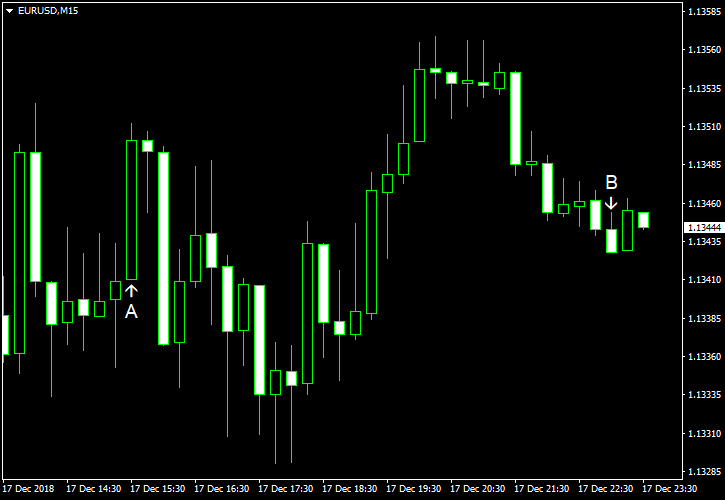

December 172018

EUR/USD Rallies Ahead of Wednesday’s FOMC Policy Decision

EUR/USD rallied today as the US dollar was soft ahead of the monetary policy announcement from the Federal Open Market Committee on Wednesday. The outlook for the greenback remained largely bullish, though. NY Empire State Index slumped from 23.3 in November to 10.9 in December, whereas analysts had expected a much higher figure of 20.1. (Event A on the chart.) Net foreign purchases were at $31.1 billion in October, up from $30.8 billion in September. […]

Read more December 14

December 142018

EUR/USD Tanks, Hurt by Weak Economic Data in Eurozone & China

EUR/USD tanked today after economic reports released in the eurozone and China during the trading session turned out to be worse than market participants anticipated, putting the Forex market into a risk-off mode. Meanwhile, US retail sales were slightly above expectations, helping the dollar a bit, though the deviation from forecasts was minimal, and therefore not enough to give the currency any significant boost. Retail sales rose 0.2% […]

Read more December 13

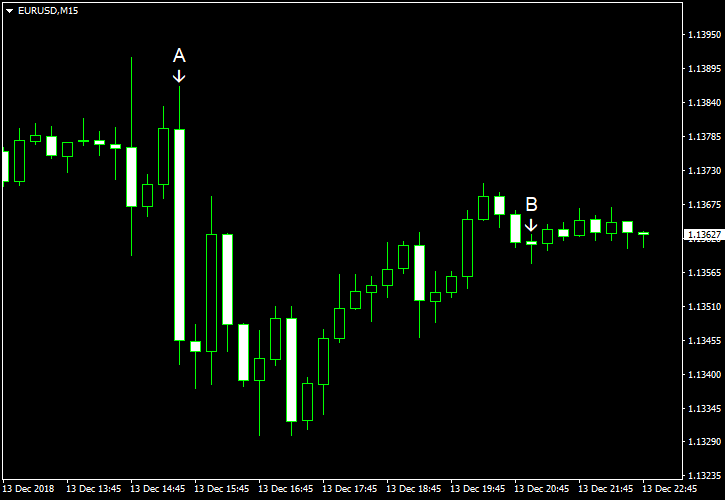

December 132018

EUR/USD Volatile due to ECB Policy Announcement

EUR/USD was extremely volatile today, rising ahead of the policy announcement from the European Central Bank, falling sharply after the release, but rebounding to almost flat by the end of the Thursday’s session. ECB President Mario Draghi announced an end to the quantitative easing program but made dovish remarks, sending the currency pair down. US macroeconomic data was mixed today, but with absence of any major releases, it had […]

Read more December 12

December 122018

EUR/USD Climbs as US Inflation Stagnates

EUR/USD rallied today after data showed that US inflation stalled last month. The general positive market sentiment also helped the currency pair. CPI showed no change in November, exactly as analysts had predicted. The index was up 0.3% in October. (Event A on the chart.) US crude oil inventories fell by 1.2 million barrels last week, less than analysts had predicted (3.0 million barrels) and logged […]

Read more December 7

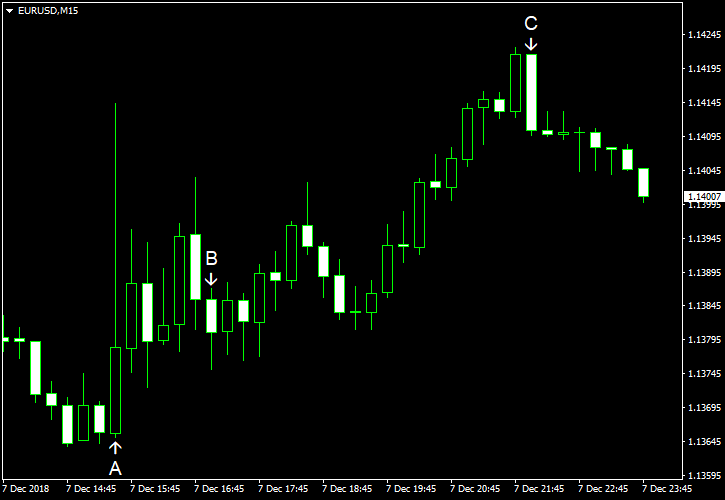

December 72018

EUR/USD Climbs After NFP, Reverses Gains by Session’s Close

EUR/USD was volatile after US nonfarm payrolls missed expectations. Initially, the currency pair surged but trimmed gains immediately. Nevertheless, it continued to move higher afterwards. Yet by the very end of trading, the EUR/USD moved sharply down, almost erasing the day’s gains. Nonfarm payrolls rose by just 155k in November, far below the forecast value of 198k. Furthermore, the October’s increase got a negative revision from 250k to 237k. […]

Read more December 6

December 62018

EUR/USD Rallies, Supported by US Employment Data Miss

EUR/USD rallied today. The rally accelerated after the release of US employment data, which missed expectations. The market sentiment was negative following the news about the arrest of Huawei CFO Meng Wanzhou, but that did not help the dollar to rebound. ADP employment rose by 179k in November, down from 225k in October and missing the analysts’ average projection of 195k. (Event A on the chart.) Nonfarm productivity rose 2.3% in Q3 2018 from […]

Read more December 3

December 32018

EUR/USD Stable After Volatile Moves on US-China Truce News

EUR/USD was moving up and down after the news that United States and China achieved a temporary truce in the trade war. Currently, the currency pair trades flat. US macroeconomic data, which was mixed, was overshadowed by the news about ceasefire. Markit manufacturing PMI was at 55.3 in November according to the final estimate, slightly down from the October’s reading of 55.7. The actual figure was near analysts’ forecasts and the preliminary estimate […]

Read more November 29

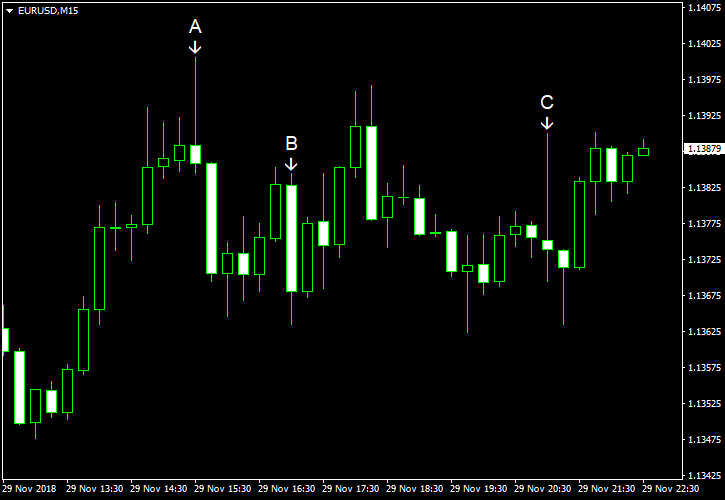

November 292018

EUR/USD Stable, Shows Muted Reaction to FOMC Minutes

EUR/USD was mostly stable today. The currency pair attempted to rally after the minutes of the latest Federal Open Market Committee meeting. Yet the attempt failed, and the EUR/USD pair retreated almost immediately. Personal income and spending rose in October more than was expected, 0.5% and 0.6% respectively. That is compared to the consensus forecast of 0.4% for both indicators and the 0.2% increase registered in September (unchanged from the initial estimate for income, revised […]

Read more