- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

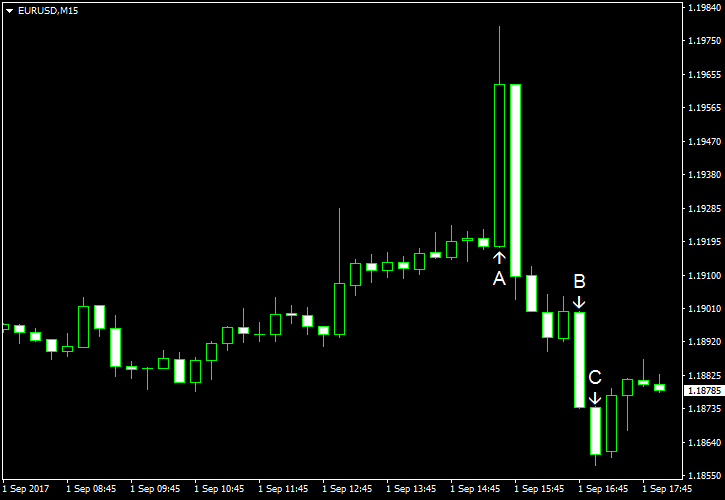

September 1

September 12017

EUR/USD Quickly Reverses Gains Caused by Poor NFP

US nonfarm payrolls released today missed expectations. That caught market participants off-guard as they were counting on robust employment data following the very good private ADP report released earlier this week. Yet another surprise came in the form of reaction to the news demonstrated by EUR/USD. While the currency pair surged following the report, as it could be expected, it lost the gains very quickly and for whatever reason fell […]

Read more August 31

August 312017

EUR/USD Falls, Rebounds Later

EUR/USD dropped intraday during the current trading session after the report that the European Central Bank is concerned with the strength of the euro. Nevertheless, the currency has rebounded by now. As for US economic data, it was mixed, without any big surprises. Initial jobless claims were at the seasonally adjusted rate of 236k last week. It was almost the same as the previous week’s revised level of 235k and the predicted reading of 237k. […]

Read more August 30

August 302017

EUR/USD Declines After Amazing US Data

The dollar rallied versus the euro today after two major economic reports released in the United States turned out to be surprisingly good. Meanwhile, US stockpiles of crude oil continued to shrink even as Hurricane Harvey caused many refineries to halt, limiting consumption of US oil. ADP employment climbed by 237k in August, outpacing the previous month’s growth of 201k (revised up from 178k). The median forecast promised an increase by just […]

Read more August 29

August 292017

EUR/USD at Highest in More Than Two Years

EUR/USD touched the highest level since the very beginning of 2015. The reason for that was the launch of a ballistic missile by North Korea. The missile flew over Japan and dropped in the Pacific waters. Many experts speculated that it was a test by the rogue nation of its capability of reaching the United States. The resulting risk aversion hurt the US dollar. The unexpected surge of the US consumer confidence alleviated the pressure on the greenback to some degree, but the currency […]

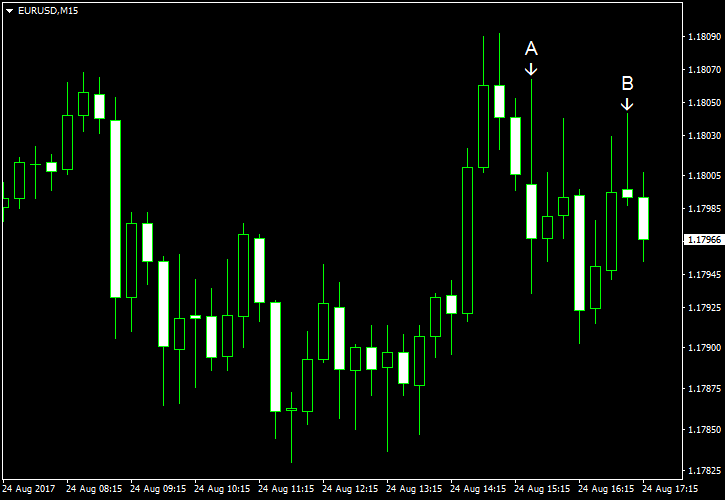

Read more August 24

August 242017

EUR/USD Steady Ahead of Jackson Hole

EUR/USD was steady today as trading was quiet ahead of the Jackson Hole Symposium. While the meeting starts today, markets’ attention was focused on Friday. That was because Federal Reserve Chair Janet Yellen and European Central Bank Mario Draghi will speak tomorrow. As for today’s economic data in the United States, it was a bit disappointing, with existing home sales falling instead of rising. But that had […]

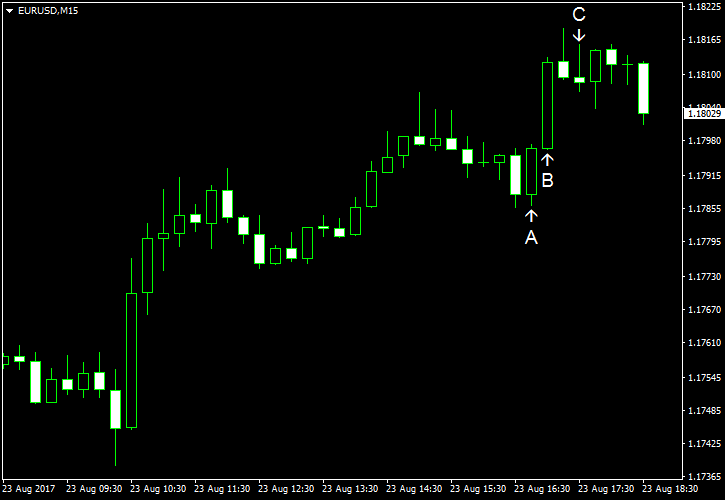

Read more August 23

August 232017

EUR/USD Reverses Movement Yet Again

EUR/USD reversed its movement yet again, basically changing its direction every day of this week. The currency pair gained today as the dollar was hurt by the comments of the US President Donald Trump. Economic reports released in the United States during the current session also contributed the drop of the greenback, being disappointing for the most part (with the notable exception of the services indicator). Flash Markit manufacturing PMI dropped from 53.3 in July […]

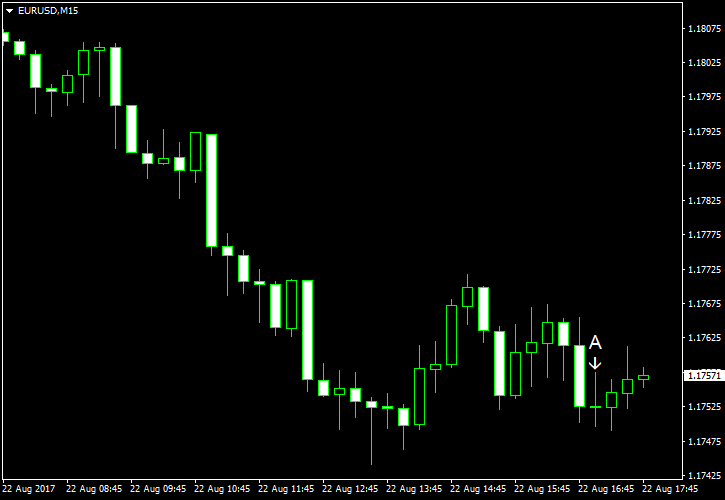

Read more August 22

August 222017

EUR/USD Down During Quiet Trading as Dollar Recovers

The US dollar was rebounding against its rivals today. That led to the drop of EUR/USD currency pair, which basically erased yesterday’s gains. The disappointing eurozone economic sentiment was not helping the matter either. Meanwhile, US manufacturing was surprisingly robust this month, bolstering the greenback further. Overall, though, trading was quiet as traders were lying in wait for the Jackson Hole Symposium later this week. Richmond […]

Read more August 17

August 172017

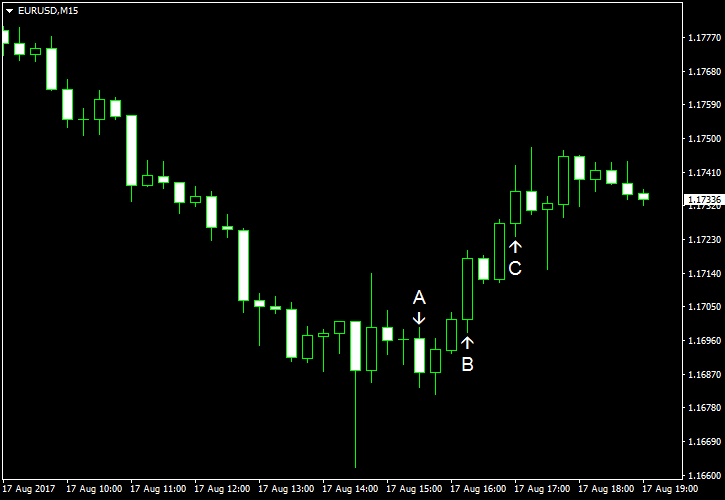

EUR/USD Declines Through the Day, Recovers After US Fundamentals

The euro was in a downtrend versus the US dollar for the first half of the trading session today. It stalled after the New York session opening and entered a recovery uptrend as the US industrial production report disappointed the USD bulls. Initial jobless claims fell from 244k to 232k during the week ending August 12. The value came out better than the 240k forecast for the figure. (Event A on the chart.) Philadelphia Fed manufacturing index continued […]

Read more August 16

August 162017

EUR/USD Falls Before US Data, Soars on FOMC Minutes

EUR/USD had fallen today even before any meaningful economic data was released anywhere in Europe or the United States. It continued to fall even as the US reports came out without any good surprises for the dollar bulls. However, the currency pair rallied later following the release of the July FOMC meeting minutes. Both housing starts and building permits deteriorated in July, falling to 1.16 and 1.22 million units respectively (annualized, […]

Read more August 15

August 152017

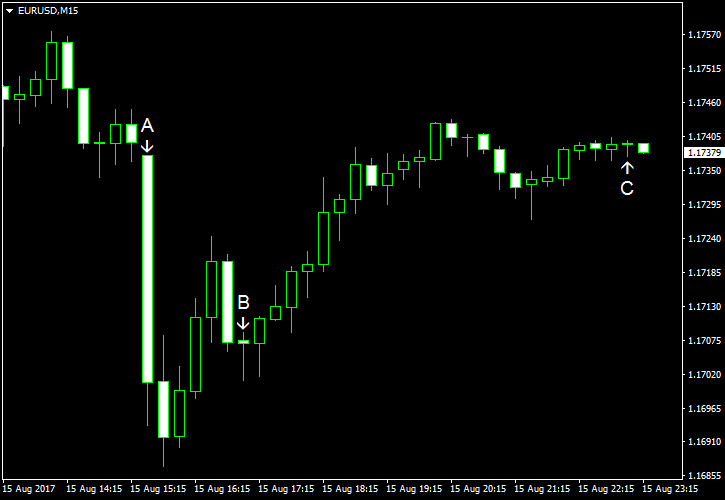

EUR/USD Recovers Despite Good US Data

After having fallen upon the release of the first batch of the US macroeconomic indicators, EUR/USD was rather quick to recover despite the lack of some meaning fundamental drivers. The currency pair then stalled not too far from the daily open level. US export and import prices rose by 0.4% and 0.1% respectively in July. The growth of the export prices exceeded the median forecast while the import prices changed according to it. A month earlier, […]

Read more