- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

March 22

March 222017

EUR/USD Bounces After US Existing Home Sales Miss Expectations

EUR/USD was down intraday but has bounced to trade above the opening level as of now. One of reasons for that were US existing home sales that failed to meet market expectations. The US currency was also under pressure from concerns that US President Donald Trump may not have enough power to fulfill his election promises of tax cuts and infrastructure spending. Existing home sales dropped […]

Read more March 17

March 172017

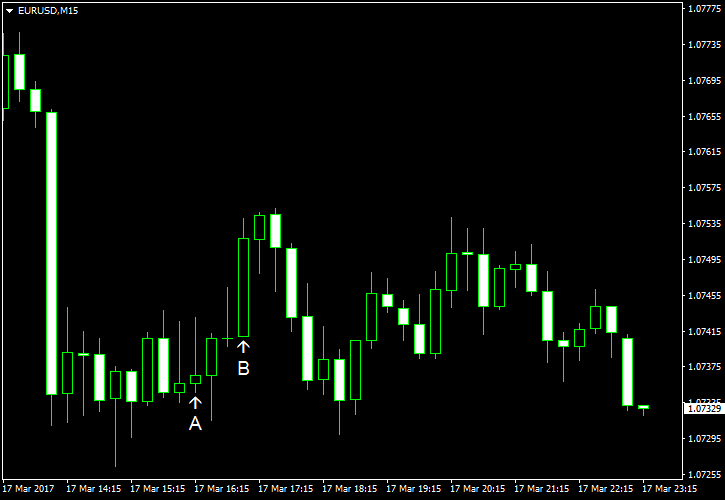

EUR/USD Pauses Rally After Two Days of Gains

EUR/USD fell today after two days of gains even though today’s economic data from the United States was mixed, and other fundamentals also did not provide a reason for the rally to stop. Yet the euro was weak across the board during the Friday’s session, most likely because traders considered the rally excessive and decided to take profits. Industrial production was unchanged in February instead of rising 0.3% as analysts had […]

Read more March 16

March 162017

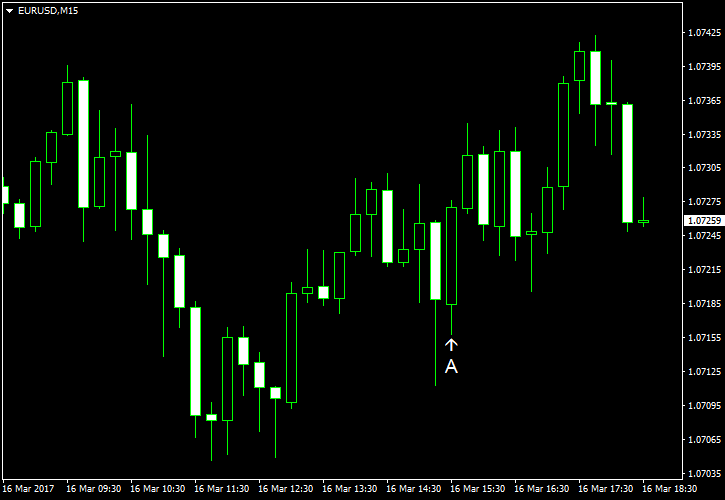

EUR/USD Little Changed After Day of Fed Decision

EUR/USD was little changed today, trading near the highest level in a month and a half, following yesterday’s decision by the Federal Reserve to hike interest rates. Today’s data from the United States was very mixed, giving little guidance to the currency pair. Housing starts were at the seasonally adjusted annual rate of 1.29 million in February, an increase from the January’s rate of 1.25 million. Building permits, on the other hand, logged a decrease from […]

Read more March 15

March 152017

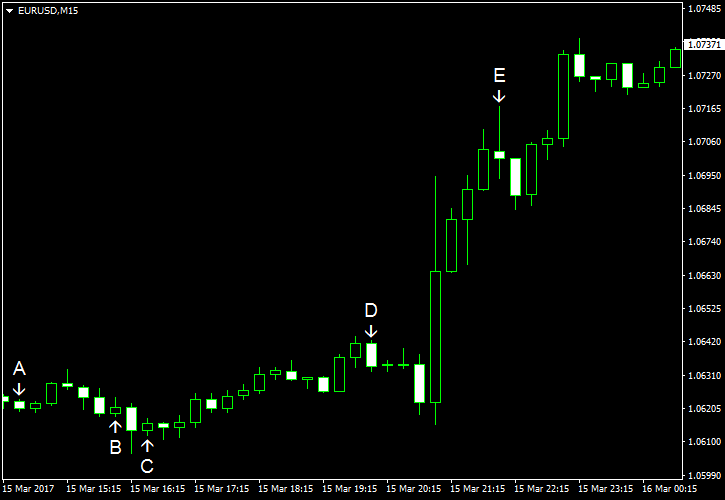

EUR/USD Soars After Fed Hikes Interest Rate

EUR/USD surged more than1% today after the Federal Reserve hiked interest rates. That may seem counter-intuitive to some as currencies tend to rise when their respective central banks raise interest rates, thus the dollar should have rallied versus the euro, not vice versa. Yet such performance was not that puzzling, considering such decision was widely expected by markets. Therefore, many traders employed […]

Read more March 10

March 102017

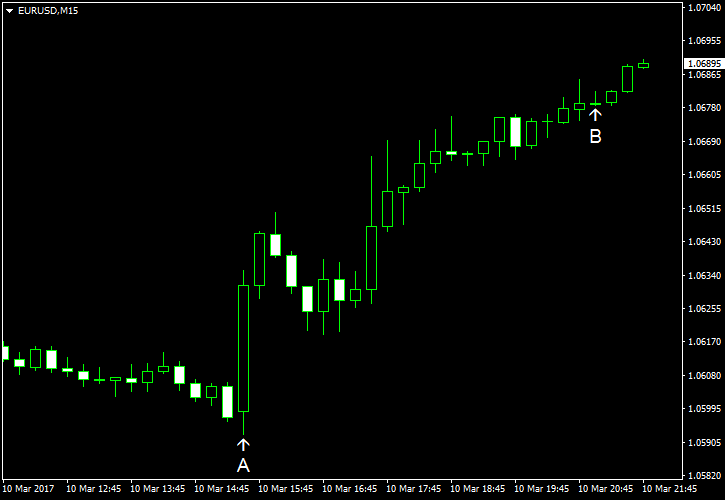

EUR/USD Surges on Talks About Interest Rate Hike from ECB

EUR/USD rallied today, touching the highest level in a month, despite solid growth of US employment. The reason for the currency pair’s gains was the report about discussion among European Central Bank members of possibility of an interest rate hike before the bond-buying program ends. Additionally, US employment data was not entirely positive as wage growth trailed analysts’ predictions. Nonfarm payrolls increased by 235k in February, exceeding analysts’ expectations of 196k. […]

Read more March 9

March 92017

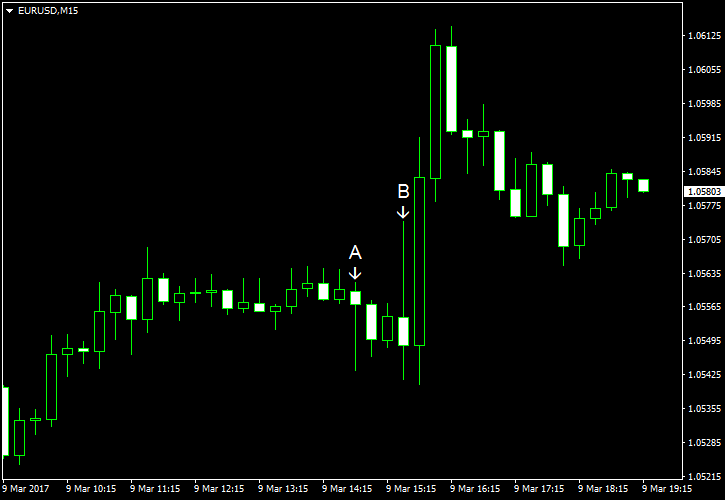

EUR/USD Rallies After ECB Policy Announcement

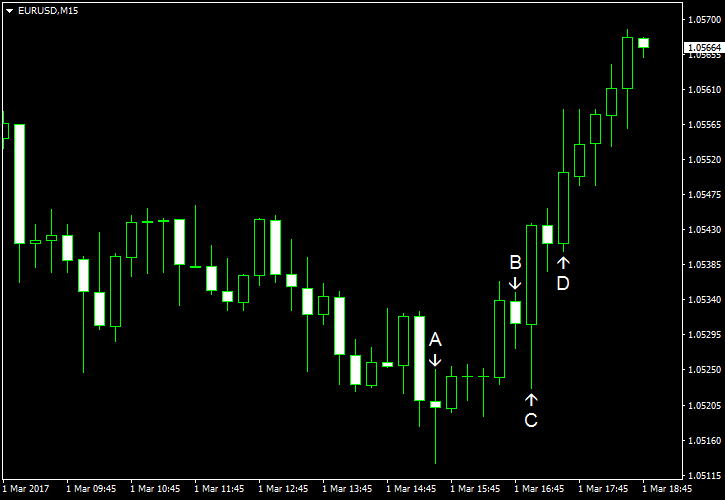

EUR/USD rallied today following the policy announcement from the European Central Bank (event A on the chart) and the press-conference of ECB President Mario Draghi (event B on the chart). It looked like European policy makers were less willing to ease their already extremely accommodative monetary policy further, and that gave boost to the euro. As for today’s data from the United States, it showed no surprises, being close to forecasts. Initial jobless […]

Read more March 8

March 82017

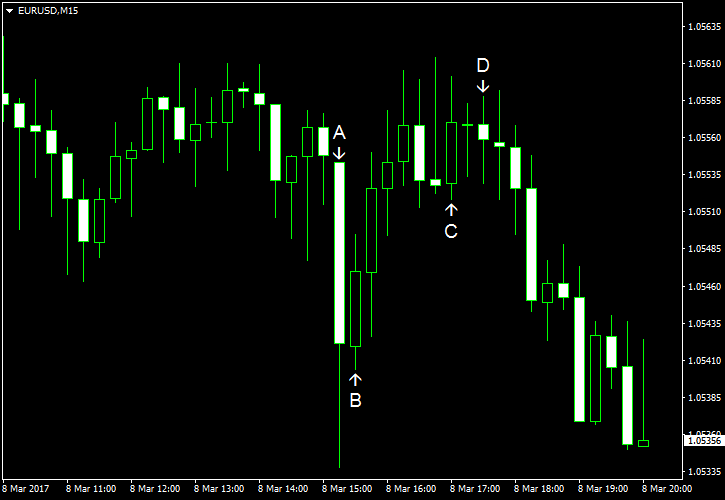

ADP Employment Beats Expectations by Wide Margin, EUR/USD Slides

EUR/USD dropped today, falling for the third day in a row. The main reason for the drop was surprisingly amazing US employment data released by Automatic Data Processing on Wednesday. Other macroeconomic reports released from the United States over the trading session were also favorable. ADP employment gained by as much as 298k in February from January. The huge increase far exceeded the average forecast of 184k. On top of that, the January increase was revised […]

Read more March 7

March 72017

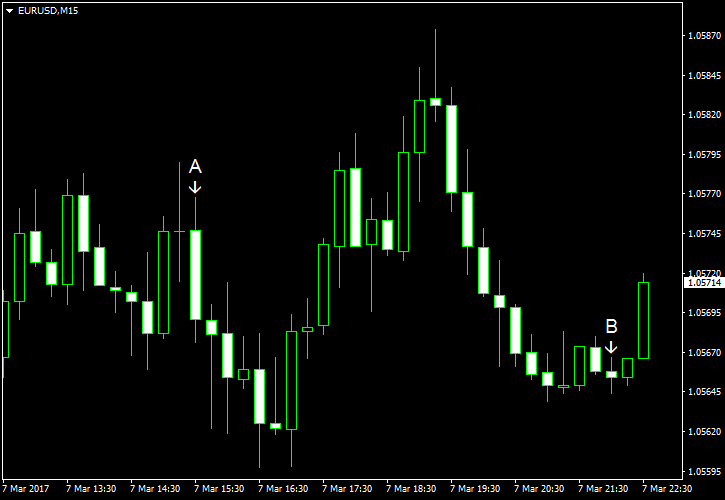

Disappointing US Data Doesn’t Help EUR/USD

Macroeconomic data released from the United States today failed to meet market expectations, but it hardly affected EUR/USD, which fell despite the intraday attempt to bounce. The most likely reasons for the drop were: anticipation of an interest rate hike from the Federal Reserve next week, expectations of decent nonfarm payrolls this week, and renewed concerns about the outcome of the French presidential elections. Trade balance deficit widened to $48.5 billion […]

Read more March 3

March 32017

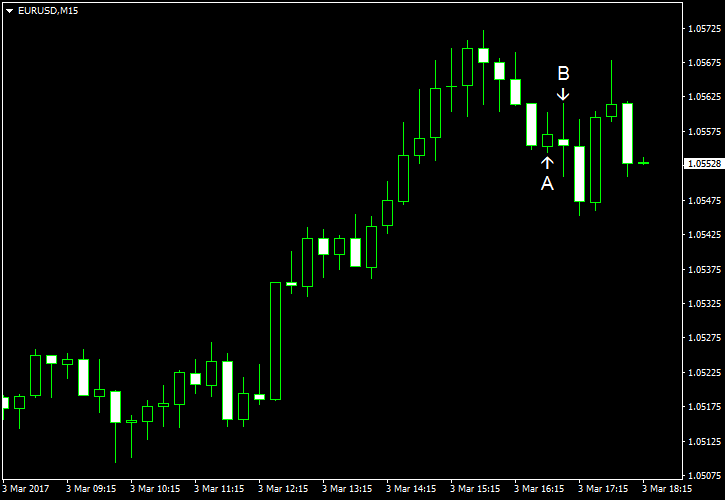

EUR/USD Bounces, Erasing Weekly Loss

EUR/USD bounced today, heading to close flat over the week. During the week, the currency pair reached the lowest level since January 11. The rally of the currency could be explained by profit-taking by dollar bulls (and euro bears) ahead of today’s speech of Federal Reserve head Janet Yellen, which may support the outlook for an interest rate hike from the Fed in March. Markit services PMI dropped from the Januaryâs 14-month high of 55.6 […]

Read more March 1

March 12017

Dollar Gains on Euro After Trump’s Speech, Retreats Later

The dollar gained on the euro on Wednesday after the speech of US President Donald Trump that he delivered to the Congress overnight. Yet the greenback backed off later, losing almost all of its gains by now. US economic data was unable to provide support to the greenback as today’s indicators were rather mixed. Personal income and spending rose in January. Income increased 0.4% after rising 0.3% in December. Spending was up 0.2% […]

Read more