- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

July 5

July 52019

EUR/USD Falls Sharply After NFP Beats Expectations

EUR/USD was moving gradually lower today but accelerated the decline sharply after the release of nonfarm payrolls. Unlike the private report from Automatic Data Processing, the official employment data was far better than expectations. It is important to note, though, that other parts of the report, namely the unemployment rate and wage inflation, were disappointing. US nonfarm payrolls rose by 224k in June, exceeding market expectations of an increase […]

Read more July 3

July 32019

EUR/USD Flat After ADP Employment Misses Expectations

EUR/USD was volatile today, swinging back and forth between gains and losses. Currently, the EUR/USD pair trades near the opening level. The most notable piece of data released in the United States today was the employment report from Automatic Data Processing, which missed market expectations. Most other releases were bad as well, hurting the US dollar. ADP employment rose by 102k in June, failing to reach the market consensus of a 140k […]

Read more July 1

July 12019

EUR/USD Tumbles After USA & China Reach Trade Truce

The US dollar was firm today after the reports that the United States and China managed to achieve a truce, agreeing not to escalate the trade war further. That led to hopes that the US economy will face less pressure, and as a result the Federal Reserve will have fewer reasons to cut interest rates. Reacting to the news, EUR/USD dropped on Monday’s trading session. While the currency pair has trimmed some of its losses […]

Read more June 28

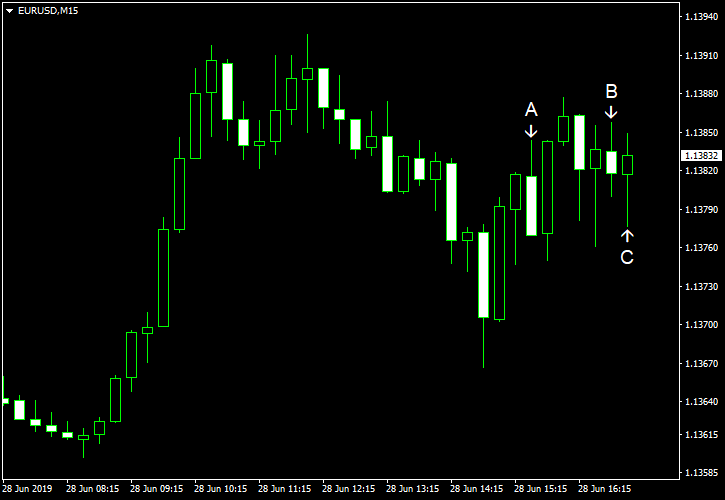

June 282019

EUR/USD Gains as Eurozone Inflation Accelerates

EUR/USD gained today. Market analysts speculated that the reason for the rally were inflation figures released in the eurozone today, most of which exceeded expectations and showed accelerating inflation. Meanwhile, US core PCE inflation remained stable, and other macroeconomic indicators were mixed. Both personal income and spending rose in May. Personal income rose 0.5%, the same as in April and exceeding the average forecast of an increase by 0.3%. Personal spending increased 0.4%, […]

Read more June 27

June 272019

EUR/USD Flat as Traders Wait for G20 Summit Outcome

EUR/USD dropped initially today but has rebounded since then to trade near the opening level. Traders were reluctant to open new positions before the outcome of the US-China negotiations at the G20 summit becomes clear. US macroeconomic data released today was mixed, with decent reports on economic growth and the housing market but a surprisingly big increase of unemployment claims. US GDP rose 3.1% in Q1 2019 according to the third […]

Read more June 26

June 262019

EUR/USD Moves Sideways on Wednesday

EUR/USD was moving sideways today amid somewhat directionless trading. On one hand, the market sentiment was lifted by comments from Treasury Secretary Steven Mnuchin that suggested the United States and China are close to reaching a trade deal. On the other, the dollar got boost from comments of Fed officials yesterday. St. Louis Federal Reserve Bank President James Bullard dismissed the idea of a 50 basis point interest rate […]

Read more June 25

June 252019

EUR/USD Declines Despite Poor US Macroeconomic Data

EUR/USD declined today, though trimmed losses by the end of the trading session. The currency pair fell even as most US macroeconomic indicators released on Tuesday were disappointing. S&P/Case-Shiller home price index rose 2.5% in April, year-over-year, in line with expectations. The index was up 2.6% the month before. Month-on-month, the indicator rose 0.8%. (Event A on the chart.) Richmond Fed manufacturing index fell from 7 in May to 3 in June instead […]

Read more June 21

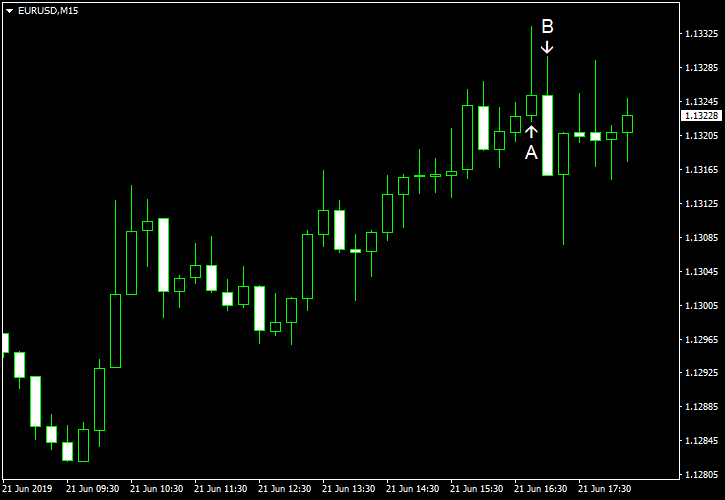

June 212019

EUR/USD Rallies on Markit PMIs

EUR/USD rallied today, rising for the third consecutive trading session. While the dovishness of the Federal Reserve continued to support the currency pair, PMIs released by Markit today were also helping. Most indicators for the eurozone exceeded expectations, while the US indicators missed forecasts. The better-than-expected US housing data halted the rally but did not make the EUR/USD pair back off. Both Markit manufacturing PMI and Markit services PMI fell […]

Read more June 20

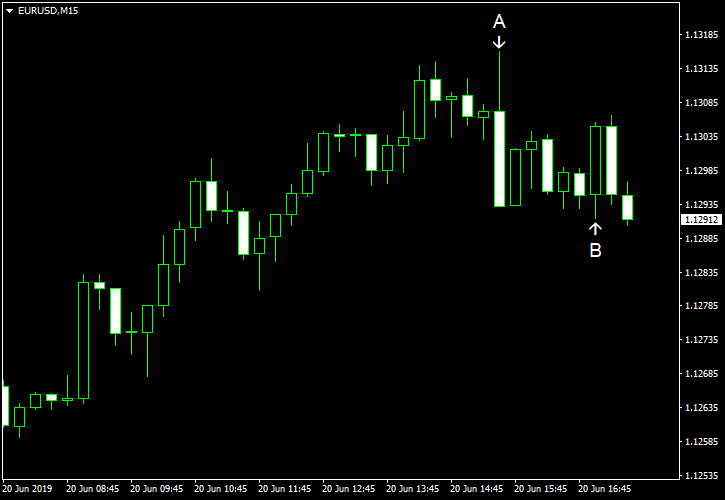

June 202019

EUR/USD Extends Rally on Dovish Fed, Poor US Data

EUR/USD extended yesterday’s rally today as the US dollar remained extremely weak due to unexpectedly strong dovishness of the Federal Reserve. US macroeconomic data was not helping the greenback either as almost all indicators released today failed to meet expectations. Philadelphia Fed manufacturing index dropped from 16.6 in May to 0.3 in June, far below the forecast level of 10.6. (Event A on the chart.) Current account balance deficit narrowed to $130.4 […]

Read more June 19

June 192019

EUR/USD Soars as FOMC Patient No More

EUR/USD rose sharply today after the monetary policy announcement from the Federal Open Market Committee. While the FOMC did not change its policy at today’s meeting, the fact that the statement dropped the word “patient” led to speculations that an interest rate cut may happen as soon as the next meeting in July. Furthermore, the projections revealed that about half of the FOMC members anticipate a cut by the end of the year. US crude oil […]

Read more