- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

June 17

June 172019

EUR/USD Rallies on Monday, Ends Session Trimming Gains

EUR/USD rallied on Monday, though trimmed gains by the end of the trading session. Analysts pointed at the slump of the Empire State Manufacturing Index as one of the possible reasons for the rally, but the currency pair actually halted its upward movement after the release. NY Empire State Index tumbled from 17.8 in May to -8.6 in June. That was a total surprise to analysts, who had expected a much smaller decrease to 12.1. (Event A on the chart.) Net […]

Read more June 14

June 142019

EUR/USD Sinks After US Retail Sales, Industrial Production

EUR/USD sank today even as US retail sales missed expectations. But the miss was small and the core components came out within expectations. Furthermore, both the headline and underline figures for the preceding month got a positive revision. And on top of that, industrial production beat forecasts. The positive data eased concerns that the US economy is experiencing slowdown. Retail sales rose 0.5% in May from April. That was below […]

Read more June 13

June 132019

EUR/USD Flat Below 1.13

EUR/USD attempted to rally today but failed and is now trading about flat below the psychologically important 1.13 level. There were no particularly important macroeconomic releases today, either in the United States or in the eurozone. Tomorrow, US retail sales will draw the most attention, being considered a relatively major release. Import prices dropped 0.3% in May, matching forecasts exactly, after increasing 0.1% in the previous month. Export […]

Read more June 12

June 122019

EUR/USD Sinks Despite Slowing US Consumer Inflation

EUR/USD was falling during the Wednesday’s trading session. The currency pair made a short-lived attempt to rally on the back of slowing US inflation but quickly resumed its decline. CPI rose 0.1% in May, in line with expectations, after rising 0.3% in April. (Event A on the chart.) US crude oil inventories increased by 2.2 million barrels last week instead of falling by 1.0 million barrels as analysts had predicted. The stockpiles swelled […]

Read more June 7

June 72019

EUR/USD Surges After Nonfarm Payrolls Provide Huge Disappointment

EUR/USD surged today after US nonfarm payrolls came out and turned out to be hugely disappointing. Employment growth was far below expectations and wage inflation missed forecasts as well. Only the unemployment rate matched predictions. US nonfarm payrolls rose by 75k in May versus 177k predicted by experts. Furthermore, the April increase got a negative revision from 263k to 224k. Unemployment rate remained unchanged at 3.6%, as was […]

Read more June 6

June 62019

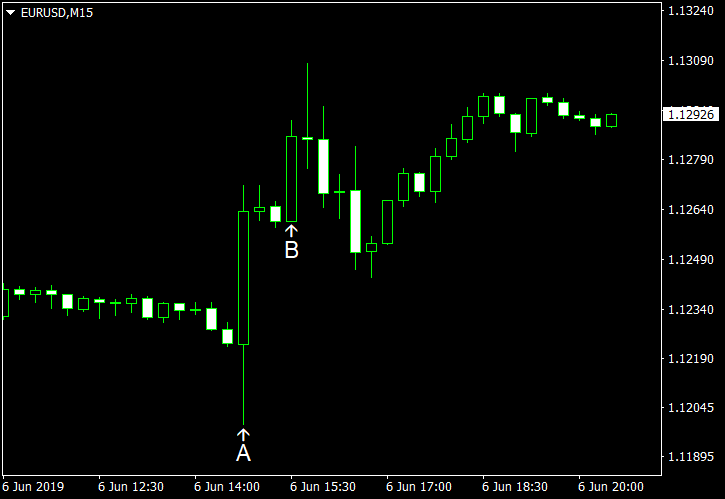

EUR/USD Surges After ECB Monetary Policy Meeting

EUR/USD was somewhat volatile after today’s monetary policy meeting of the European Central Bank but ultimately decided to go higher. (Event A on the chart.) ECB President Mario Draghi signaled that the central bank does not plan interest rate hikes until at least mid-2020, but markets decided that his stance was not that dovish. (Event B on the chart.) As for US macroeconomic data, it was largely […]

Read more June 5

June 52019

EUR/USD Retreats After Surging on Atrocious ADP Report

EUR/USD surged intraday as ADP employment report was surprisingly atrocious, showing barely any growth. Service industry data was confusing, as reports from Markit and Institute for Supply Management showed completely different results. The currency pair has retreated by now, though, trading below the opening level. ADP employment rose by meager 27k in May from April. That is nowhere near the forecast increase of 185k, let alone […]

Read more June 3

June 32019

EUR/USD Gains as US Manufacturing Growth Slows

EUR/USD rallied today as all of US macroeconomic indicators released during the trading session were disappointing. That includes the manufacturing indices, which dropped, though remained in the expansionary territory. Speculations that the Federal Reserve may cut interest rates also bolstered the currency pair. Seasonally adjusted Markit manufacturing PMI dropped to 50.5 in May from 52.6 in April according to the final estimate. That is compared to the preliminary estimate of 50.6 […]

Read more May 31

May 312019

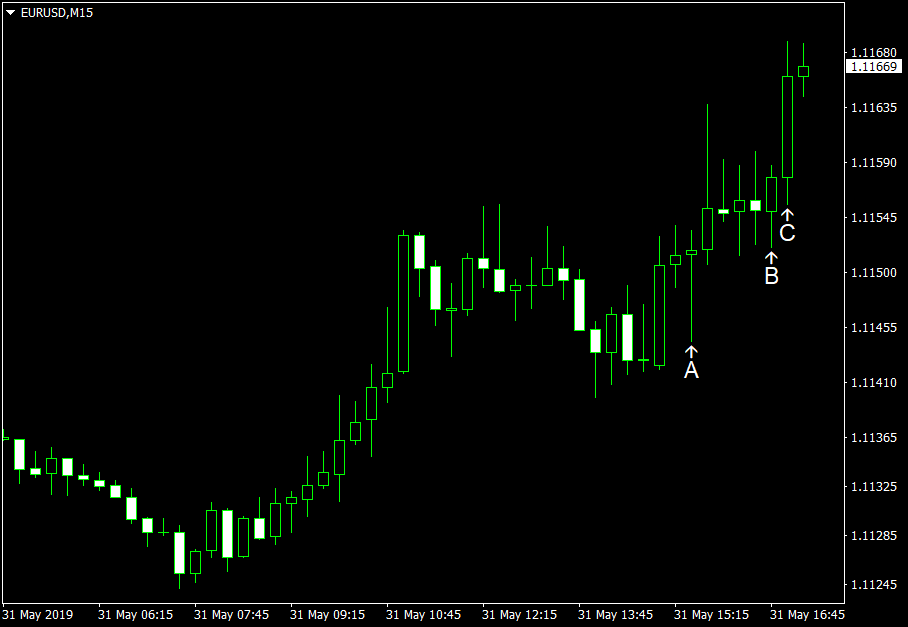

EUR/USD Gains Despite Risk Aversion, Poor Eurozone Data

EUR/USD gained today as the euro was strong against other most-trade currencies despite markets being dominated by risk aversion. Traders were generally favoring safer currencies after US President Donald Trump talked about tariffs on imports from Mexico. It is surprising to see the euro strong in such environment. What makes it even more puzzling is today’s macroeconomic reports in the eurozone, all of which were […]

Read more May 30

May 302019

EUR/USD Recovers After Dipping Intraday

EUR/USD declined during today’s trading session but has bounced by now. Markets have largely priced in the trade war between the United States and China, and the market sentiment stabilized. US macroeconomic indicators were within expectations for the most part, with the notable exception of pending home sales. US GDP rose 3.1% in Q1 2019 according to the preliminary (second) estimate, matching expectations. That is compared to the advance reading of a 3.2% […]

Read more