- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

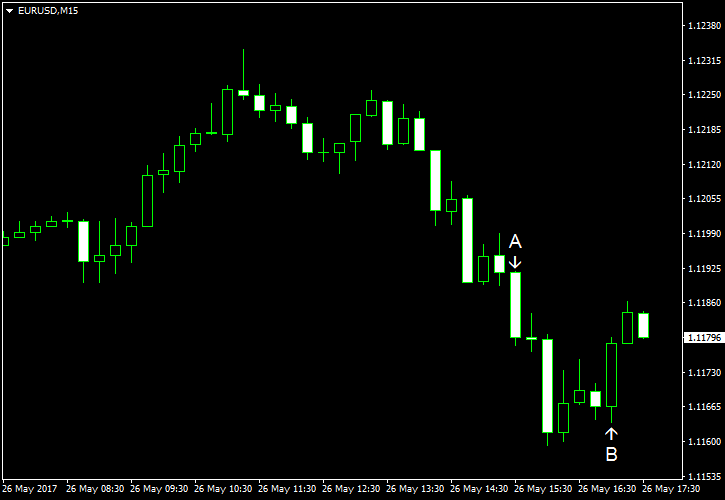

May 26

May 262017

EUR/USD Extends Move Down Following Positive Revision of US GDP

EUR/USD was falling today and extended its decline following the upward revision of US gross domestic product. While the currency pair halted the drop for now, it is too early to tell whether that was just a short pause or a more significant bounce. US GDP rose 1.2% in Q1 2017 according to the second (preliminary) estimate. It was a better reading than 0.9% predicted by analysts and 0.7% showed by the advance […]

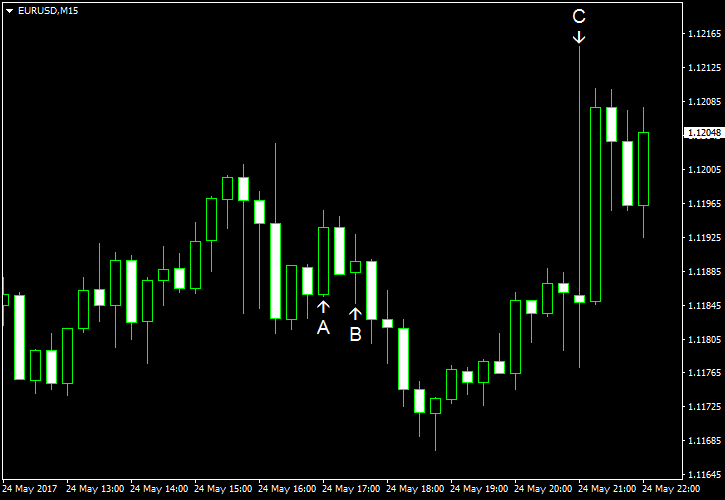

Read more May 24

May 242017

EUR/USD Goes Higher After FOMC Minutes

Today, the Federal Open Market Committee released minutes of its latest policy meeting. While the notes were relatively upbeat, hinting at a possibility of an interest rate hike in June, EUR/USD moved up, rather than down. It seems markets considered the minutes to be not as hawkish as dollar bulls were hoping for. The weakness that the US housing market was demonstrating in the recent reports was also helping the currency pair. […]

Read more May 18

May 182017

EUR/USD Falls After Four Sessions of Gains

EUR/USD declined today following four consecutive sessions of gains as US economic data released over the current session was surprisingly good for the most part. It allowed the dollar to overcome the impact of US politics. Yet the troubles have not ended yet as Reuters reported that people involved in Donald Trump’s campaign had at least 18 undisclosed contacts with Russians during the Presidential election. That added to controversies surrounding […]

Read more May 16

May 162017

EUR/USD at Highest Since November

EUR/USD rallied today, jumping to the highest level since November. There were plenty of reasons for the rally. Allegations of US President Donald Trump revealing intelligence secrets to Russia caused worries and hurt the appeal of the dollar. US housing data failed to meet expectations, damaging the currency further. Meanwhile, both economic and political news from eurozone were favorable to the euro. EUR/USD halted its rally, though, after US industrial production […]

Read more May 15

May 152017

EUR/USD Goes Higher, Weak US Manufacturing Helps Maintain Momentum

EUR/USD was rising today, and soft manufacturing data from the United States helped the currency pair to continue the rally. With that said, EUR/USD started to move sideways after a while, and the worse-than-predicted report about net foreign purchases did not change that. NY Empire State Index slumped from 5.2 to -1.0 in May. That was a completely unexpected turn of events to analysts who were erroneously counting on an increase […]

Read more May 11

May 112017

EUR/USD Again Fails to Rally

EUR/USD attempted to rally today but was unable to keep gains, similar to its performance during the previous trading session. This time, though, the reason for the decline was clearer. The currency pair dropped as US macroeconomic indicators were unexpectedly good, increasing the appeal of the US dollar to investors. PPI rose 0.5% in April. That was a better reading than a 0.2% increase predicted by analysts, let alone the 0.1% drop registered […]

Read more May 10

May 102017

Trump Sacks FBI Director Comey, EUR/USD Retreats

EUR/USD rallied today but has lost gains by now. The currency pair was unable to hold onto gains even though the dollar was under pressure from the shocking news: US President Donald Trump fired FBI Director Comey. The decision was surprising, shocking, and even somewhat suspicious, considering that Comey was investigating the alleged involvement of Russia into the US Presidential election and the Trump’s victory. The dollar slumped […]

Read more May 5

May 52017

EUR/USD Rebounds After Decent Nonfarm Payrolls

US nonfarm payrolls released during the current trading session were rather good, but that did not prevent EUR/USD from climbing after the release. As a result, the currency pair rebounded after the intraday decline, heading to close just above the opening level. Market analysts speculate that traders paid more attention to the upcoming second round of the French Presidential election this weekend. With polls showing high probability […]

Read more May 4

May 42017

EUR/USD Rallies After French Election Debate

EUR/USD rallied after the French election debate between the two candidates for presidency. Analysts considered that market-favoredEmmanuel Macron emerged as a victor, increasing his chances to become a president after the second round of voting this weekend. Economic data from the eurozone was also helping the currency pair, being good for the most part. US macroeconomic indicators were not bad either, but that did not prevent the euro from […]

Read more May 3

May 32017

EUR/USD Down After Fed & Set of Solid US Indicators

EUR/USD dropped today as US economic indicators were rather solid for the most part, with employment rising in line with expectations and the services sector improving much more than experts had anticipated. The currency pair demonstrated an especially sharp drop after the Federal Open Market Committee decided to keep its monetary policy unchanged and issued a statement that was largely neutral but with some hawkish remarks. ADP […]

Read more