- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

February 28

February 282017

Amazing US Macroeconomic Data Doesn’t Prevent Rally of EUR/USD

EUR/USD rallied today despite a set of amazing macroeconomic indicators (with the exception of gross domestic product) that was released from the United States during the trading session. In fact, the currency pair surged after the surprise increases of the Richmond manufacturing index and the Conference Board consumer confidence. Market analysts explained the dollar’s weakness by uncertainty ahead of the speech US President Donald Trump is going to deliver to the Congress. Traders were concerned […]

Read more February 27

February 272017

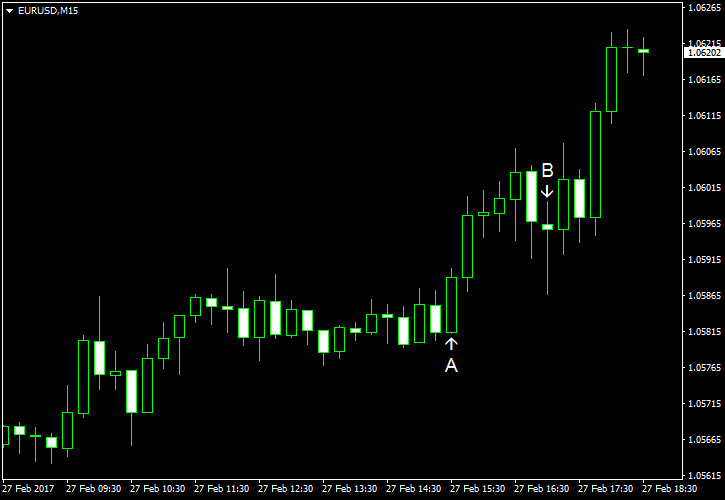

EUR/USD Moves to Upside After Unimpressive US Data

EUR/USD rallied today, boosted by poor economic data released from the United States during the trading session. Pending home sales fell unexpectedly, and core durable goods orders dropped as well (even though the headline figure actually increased). Meanwhile, concerns caused by the French presidential elections eased as polls showed that centrist candidate Emmanuel Macron had a lead over far-rightanti-EU candidate Marine Le Pen. Now, traders […]

Read more February 24

February 242017

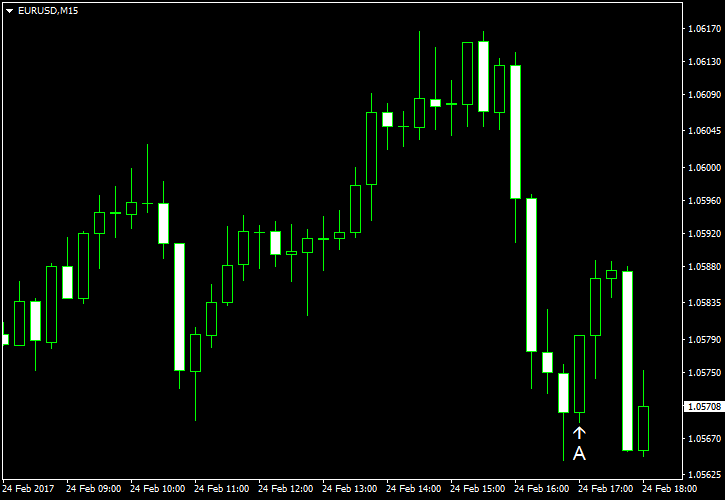

EUR/USD Fails to Rally on Disappointing US Housing Data

EUR/USD rallied today but has lost all its gains by now. The currency pair attempted to rally after the US new home sales missed expectations, but the rally was extremely short-lived. New home sales were at the seasonally adjusted annual rate of 555k in January. The reading was higher than the previous month’s 535k but lower than the average forecast of 575k. Michigan Sentiment Index slipped from 98.5 […]

Read more February 23

February 232017

EUR/USD Rallies as Optimism for Trump’s Tax Reforms Wanes

EUR/USD rallied today for the second day in a row. The current trading session was light on economic data, therefore it was not the reason for the rally. The likely reason was the comments from US Treasury Secretary Steven Mnuchin about the planned tax cuts and other reforms. US President Donald Trump talked about “phenomenal” tax reforms earlier, but markets did not see anything phenomenal in measures described by Mnuchin, […]

Read more February 22

February 222017

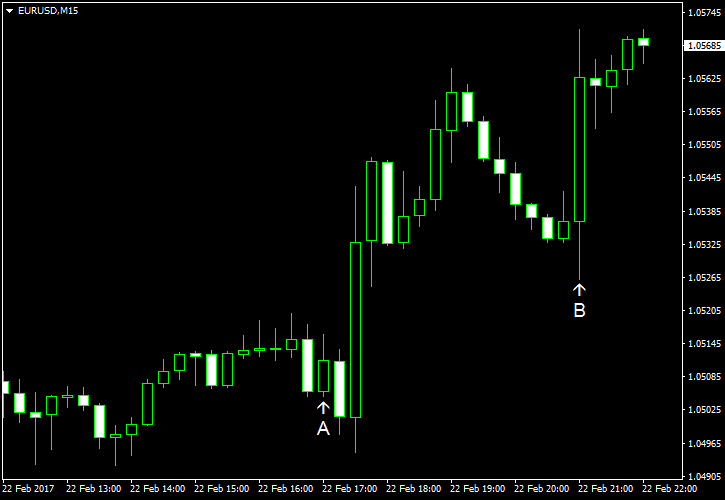

EUR/USD Accelerates Bounce After FOMC Minutes

EUR/USD fell intraday during the Wednesday’s trading session but bounced later due to subsiding concerns about the outcome of the French presidential elections and positive macroeconomic data from the eurozone. The Federal Open Market Committee released hawkish minutes of its January-February policy meeting, yet the currency pair reacted to that in a surprise manner, accelerating its rally rather than slowing. Existing home sales rose to the seasonally adjusted annual rate […]

Read more February 21

February 212017

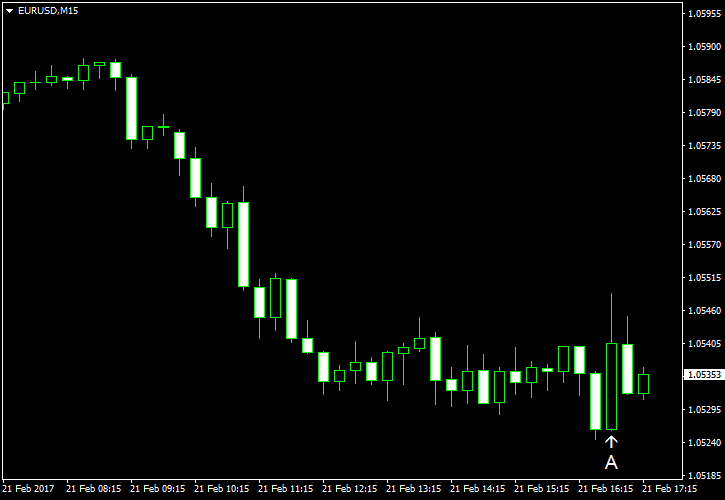

EUR/USD Slides amid Fed Tightening Talks

EUR/USD slipped today amid talks about monetary tightening from the Federal Reserve. Philadelphia Fed President Patrick Harker said today that he “would not take March off the table.” Such comments allowed the dollar to rally even though today’s US economic data was not good at all. Both indicators released by Markit failed to meet market expectations. Flash Markit manufacturing PMI fell from […]

Read more February 16

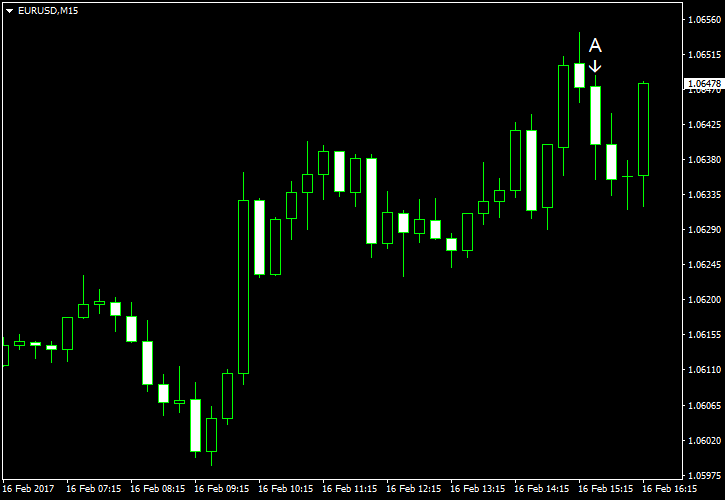

February 162017

Dollar Finds No Solace in Positive Macroeconomic Data

EUR/USD rose for the second consecutive session today even though fundamentals were positive for the US dollar. Economic data released from the United States over the current trading session was very solid for the most part. Additionally, US policy makers, who spoke this week, were rather hawkish. That led to speculations among market analysts that the weakness of the dollar should be short-lived. Housing starts were at the seasonally […]

Read more February 15

February 152017

EUR/USD Bounces as US Data Turns from Positive to Negative

EUR/USD dipped intraday on Wednesday but bounced to trade above the opening level later. Moves of the currency pair had a correlation with US economic data. Initially, reports were rather good, boosting the dollar, but the ones released later failed to meet expectations, sending the greenback lower. CPI demonstrated exactly the same performance as yesterday’s PPI, rising 0.6% in January, two times the forecast gain and the previous month’s increase of 0.3%. […]

Read more February 10

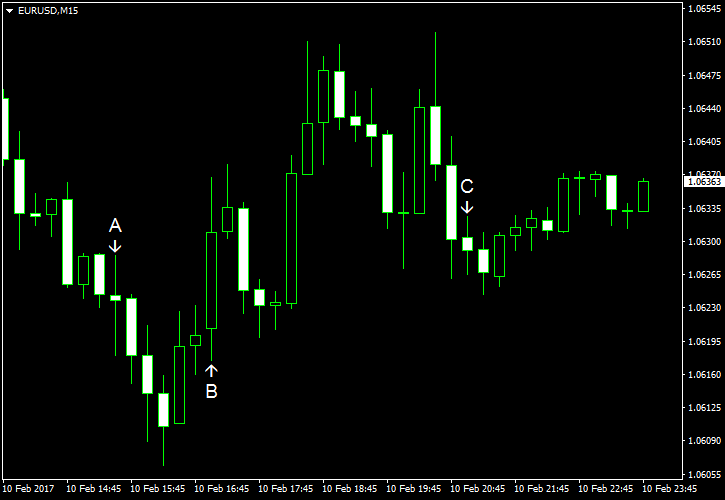

February 102017

EUR/USD Ends Friday Lower

EUR/USD dropped today as hints about a tax reform made by US President Donald Trump continued to support the dollar. The currency pair managed to trim its losses before the settlement as the consumer sentiment reported by the University of Michigan turned out to be far below expectations. Import and export prices rose in January. Import prices increased 0.4%, matching forecasts exactly, after rising 0.5% in December. Export priced edged up 0.1% […]

Read more February 9

February 92017

EUR/USD Drops after Trump Hints at Tax Plans

EUR/USD dropped today after US President Donald Trump said that he will announce a “phenomenal” tax plan in the near future. Investors were hoping that this means tax cuts that he promised in his election campaign as a way to stimulate the economy. Additionally, political uncertainty surrounding France continued to weigh on the currency pair. Initial jobless claims dropped from 246k to 234k last week instead of rising […]

Read more