- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

November 10

November 102016

EUR/USD Falls as Markets Come to Terms with Trump’s Victory

EUR/USD declined for the second day today as markets came to terms with the fact that Republic nominee Donald Trump won the presidential race. While his victory was considered a negative factor for the dollar earlier, now analysts speculate that his policies look inflationary and are going to encourage the Federal Reserve to continue raising interest rates. Initial jobless claims fell from 265k to 254k last week while experts […]

Read more November 9

November 92016

EUR/USD Sinks After Huge Spike to Two-Month High

This week is light on economic news from the United States, but they would not have any meaningful impact today anyway as markets focused all their attention on the surprise victory of Donald Trump in the US presidential election. Initially, EUR/USD spiked to the upside but retreated below the opening level later as markets digested the news. Now, analysts speculate the Trump’s presidency may be actually positive for the dollar in the longer […]

Read more November 4

November 42016

EUR/USD Below Opening After NFP

EUR/USD traded below the opening level today after the release of nonfarm payrolls. The data was mixed yet again as the headline number demonstrated slower-than-expected employment growth, but other parts of the report were good. Additionally, the trade deficit fell more than was anticipated. The currency pair sank after the report, attempted to bounce immediately afterwards, and was struggling to find a direction since then. Nonfarm payrolls demonstrated growth by 161k […]

Read more November 3

November 32016

EUR/USD Halts Rally After Two Days of Gains

EUR/USD was rising for two sessions but halted its rally today. US economic data was either in line with expectations or worse, giving the dollar no significant advantage. Now, traders focus their attention on tomorrow’s nonfarm payrolls. Yesterday’s ADP employment data was surprisingly poor, leading to concerns that the official data from Bureau of Labor Statistics will be bad too. Initial jobless claims […]

Read more November 2

November 22016

EUR/USD Continues to Rise, FOMC Doesn’t Change Trend

EUR/USD was rising today for the most part of the trading session, though it has started a retreat as of 15:00 GMT. Currently, the currency pair is trying to bounce. The Federal Open Market Committee did not influence moves of the pair much, leaving monetary policy unchanged. The employment report from Automatic Data Processing was unexpectedly bad, allowing EUR/USD to reach the highest level since October 11. ADP employment rose […]

Read more November 1

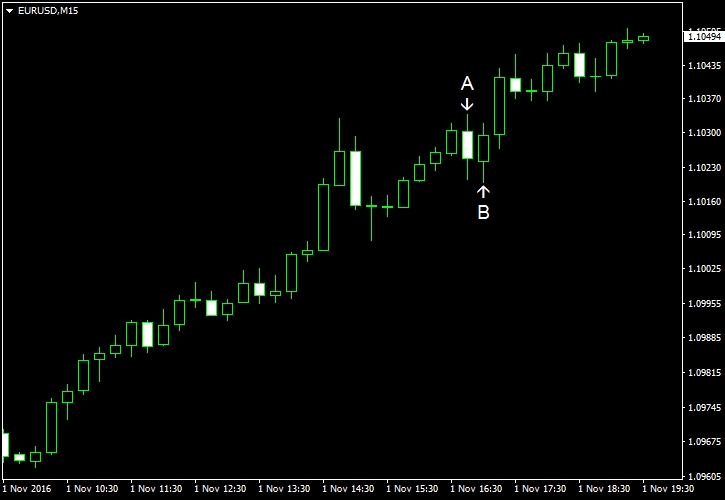

November 12016

EUR/USD Climbs as Outcome of US Elections Clouded

EUR/USD rallied as the victory of Hillary Clinton in the US presidential elections looked less certain after the Federal Bureau of Investigation reopened the probe into Clinton’s emails. While on Monday it seemed like the impact of the news faded, today market analysts use the investigation as an explanation for the dollar’s weakness. As for US economic data, the manufacturing sector looked strong while construction spending showed an unexpected decline. Markit manufacturing PMI climbed from 51.5 […]

Read more October 31

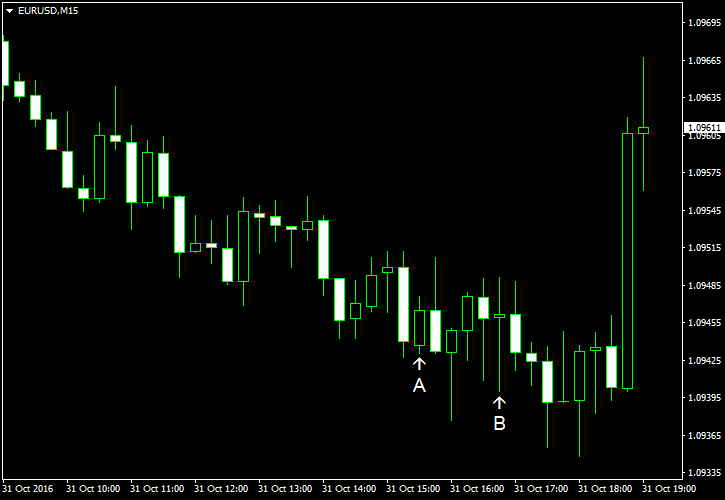

October 312016

Dollar Gains on Euro as Impact of FBI’s Clinton Probe Fades

The dollar ended the week on a negative note as the FBI reopened investigation regarding Hillary Clinton’s emails. Yet market participants digested the news over the weekend and came to conclusion that it will not materially impact Clinton’s chances for victory in the presidential elections. As a result, EUR/USD was moving lower basically throughout the whole trading session. US macroeconomic data did not influence moves of the currency pair much, though currently it […]

Read more October 28

October 282016

EUR/USD Up After US Consumer Sentiment Disappoints, Ignores GDP

The dollar traded mostly flat today, though it fell against some most-traded currencies. So happens, the euro was one of them. The better-than-expected US gross domestic product figure did not halt the rally of EUR/USD for long while the worse-than-expected US consumer sentiment boosted the currency pair. US GDP rose 2.9% in Q3 2016 according to the preliminary figure (the first of the three estimates) after increasing 1.4% in Q2. The analysts’ […]

Read more October 27

October 272016

EUR/USD Rallies Intraday, Falls Below Opening Level Later

EUR/USD attempted to rally during the current trading session but failed to keep upward momentum. As of now, the currency pair is in a sharp decline, falling below the opening level. Economic data released from the United States was mixed today, but that did not deter the dollar from gaining on the euro. Initial jobless claims fell from 261k to 258k last week while analysts had predicted them to stay […]

Read more October 26

October 262016

Dollar Falls vs. Euro, Decline Limited

The dollar fell against the euro today while market participants continued to speculate about chances for an interest rate hike from the Federal Reserve in December. While the general consensus is that the Fed is going to hike rates, that outcome has already been priced in. Any doubts, on the other hand, have potential to hurt the currency badly. Saying that, the greenback’s drop was limited, and the US currency is currently […]

Read more